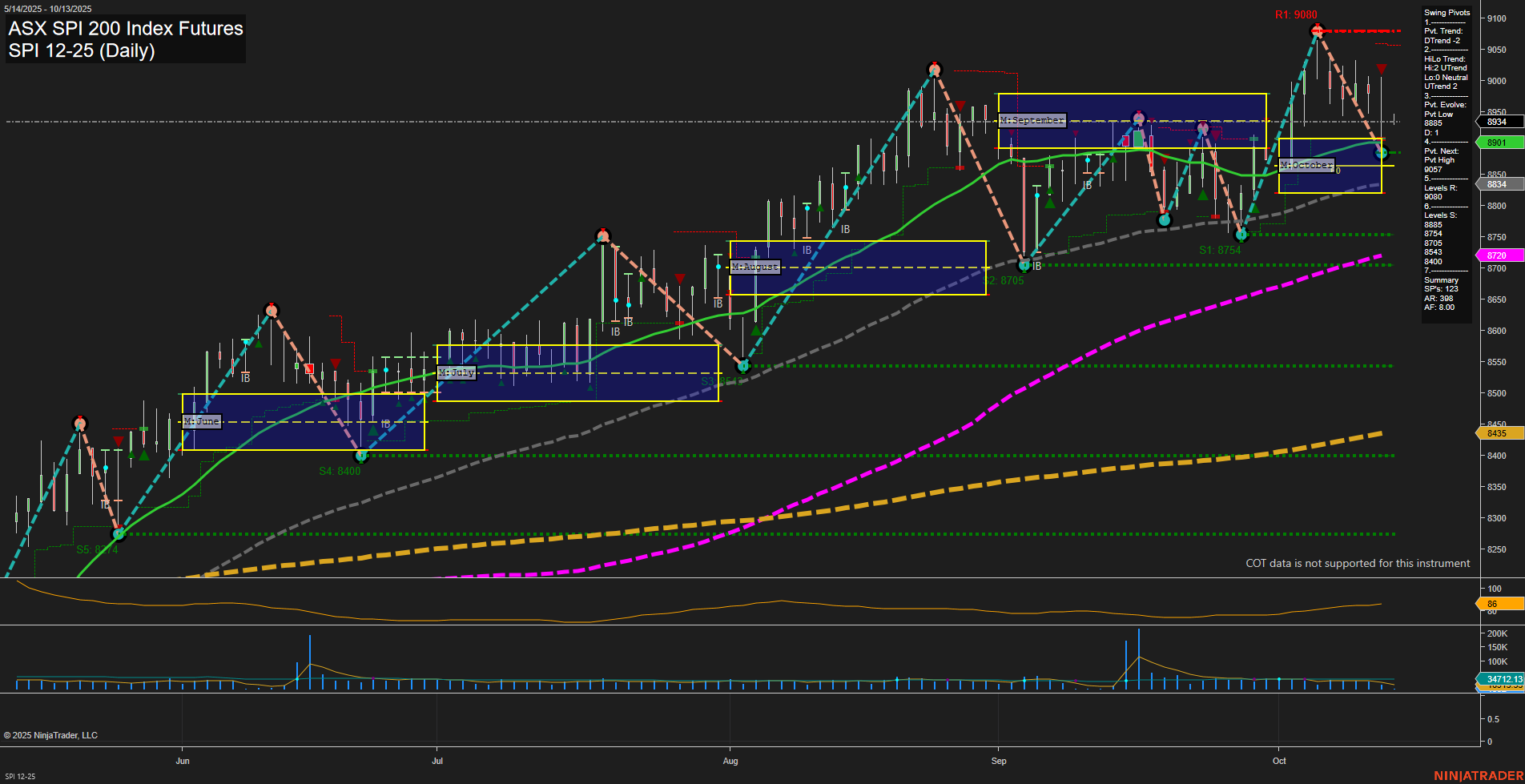

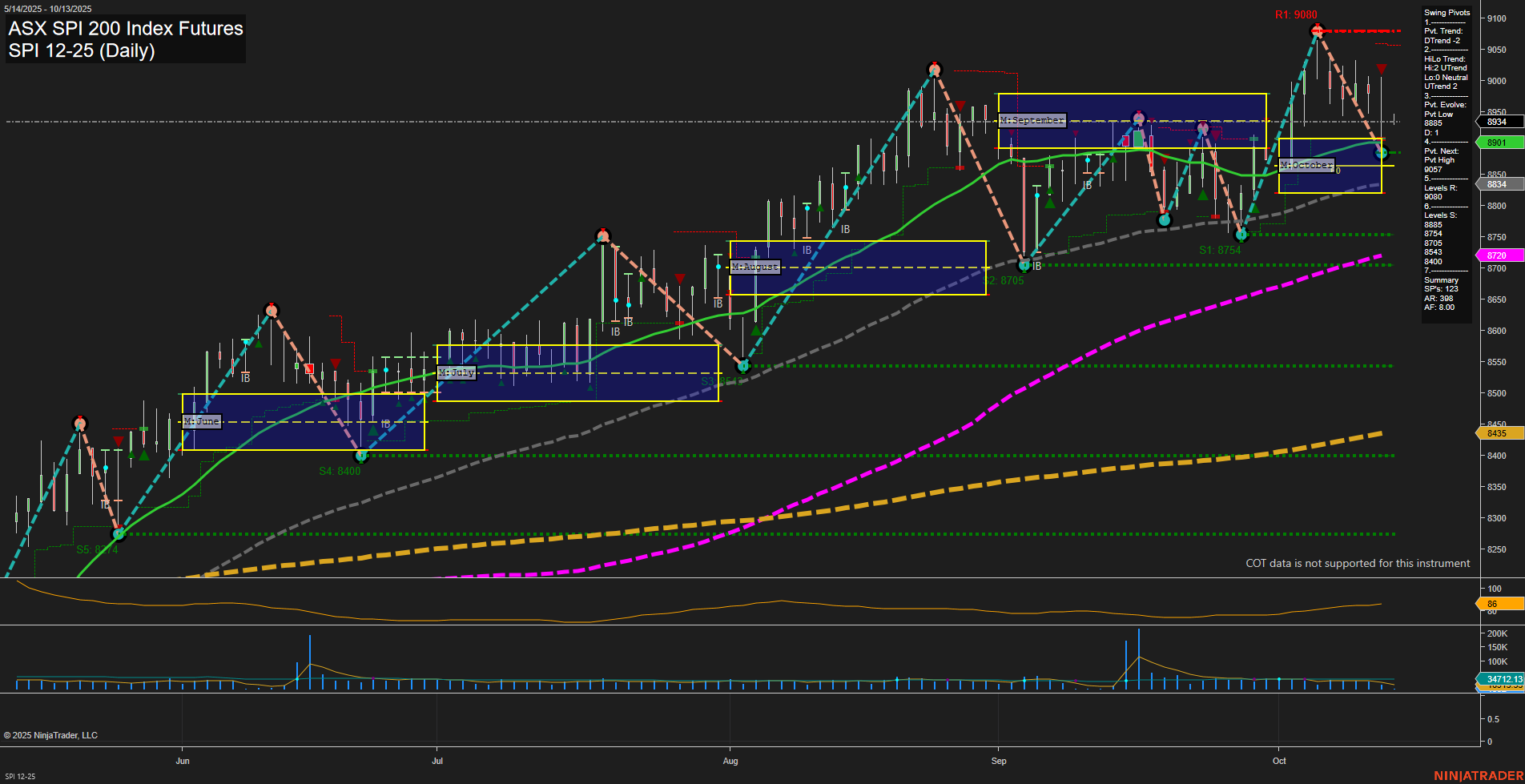

SPI ASX SPI 200 Index Futures Daily Chart Analysis: 2025-Oct-12 18:12 CT

Price Action

- Last: 8934,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 9080,

- 4. Pvt. Next: Pvt low 8754,

- 5. Levels R: 9080, 8934,

- 6. Levels S: 8754, 8705, 8605, 8400, 8144.

Daily Benchmarks

- (Short-Term) 5 Day: 8931 Down Trend,

- (Short-Term) 10 Day: 8957 Down Trend,

- (Intermediate-Term) 20 Day: 8991 Down Trend,

- (Intermediate-Term) 55 Day: 8720 Up Trend,

- (Long-Term) 100 Day: 8750 Up Trend,

- (Long-Term) 200 Day: 8435 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The SPI 200 Index Futures daily chart currently reflects a market in transition. Price action has recently shifted to a short-term downtrend, as indicated by the swing pivot DTrend and the alignment of the 5, 10, and 20-day moving averages all trending lower. The last price is sitting just below the 20-day MA, reinforcing short-term bearishness. However, the intermediate-term HiLo Trend remains in an uptrend, and the 55, 100, and 200-day moving averages are all still rising, suggesting that the broader trend structure is intact and supportive. Key resistance is at the recent swing high of 9080, with immediate support at 8754 and further levels below. Volatility is moderate, and volume remains healthy. The market appears to be in a corrective phase within a larger uptrend, with price consolidating after a strong rally and testing support zones. This environment is typical of a pullback or retracement within a bullish cycle, where short-term weakness is counterbalanced by longer-term strength. No clear breakout or breakdown is evident, and the overall structure suggests a wait-and-see approach as the market digests recent gains.

Chart Analysis ATS AI Generated: 2025-10-12 18:12 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.