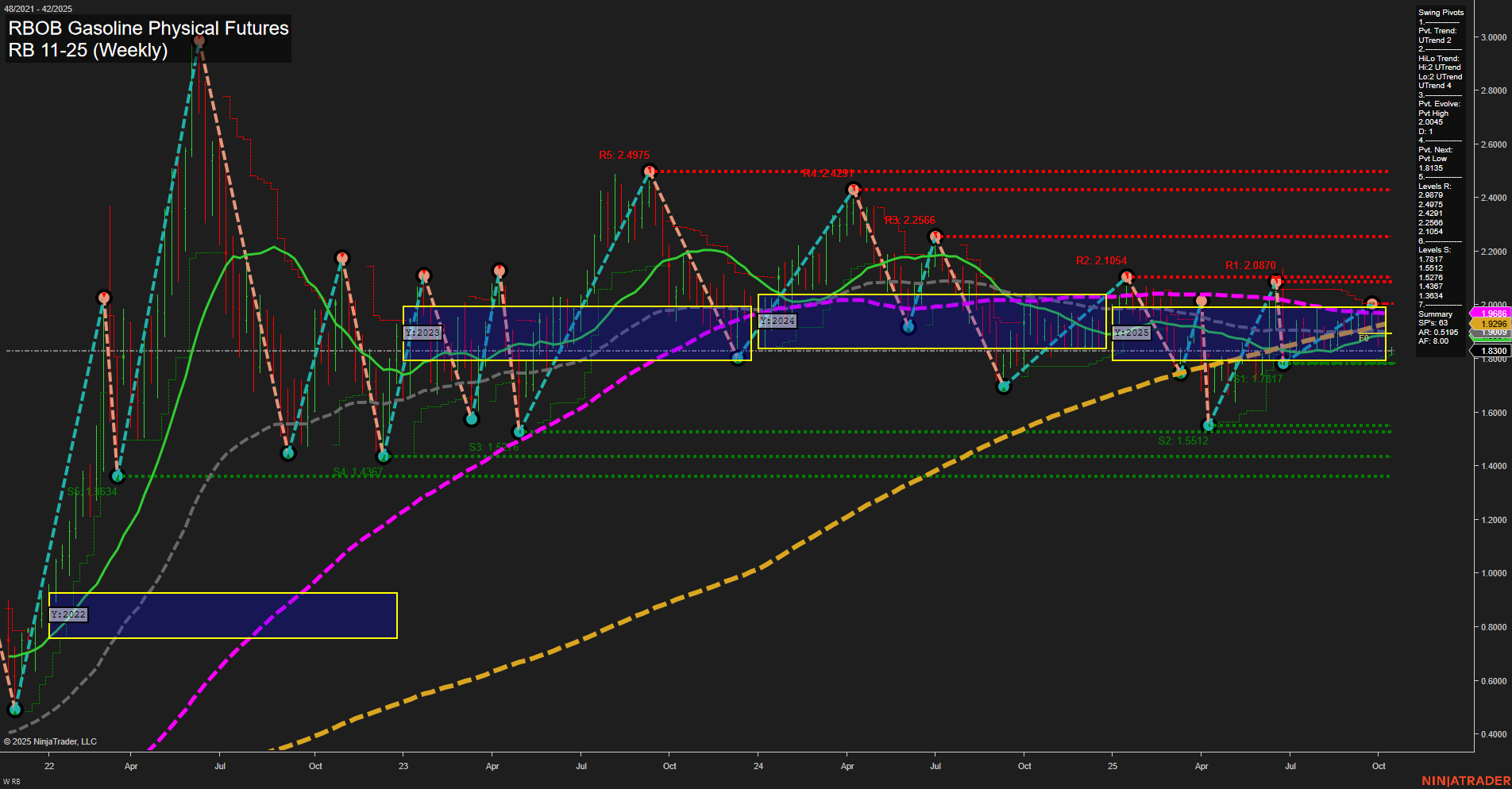

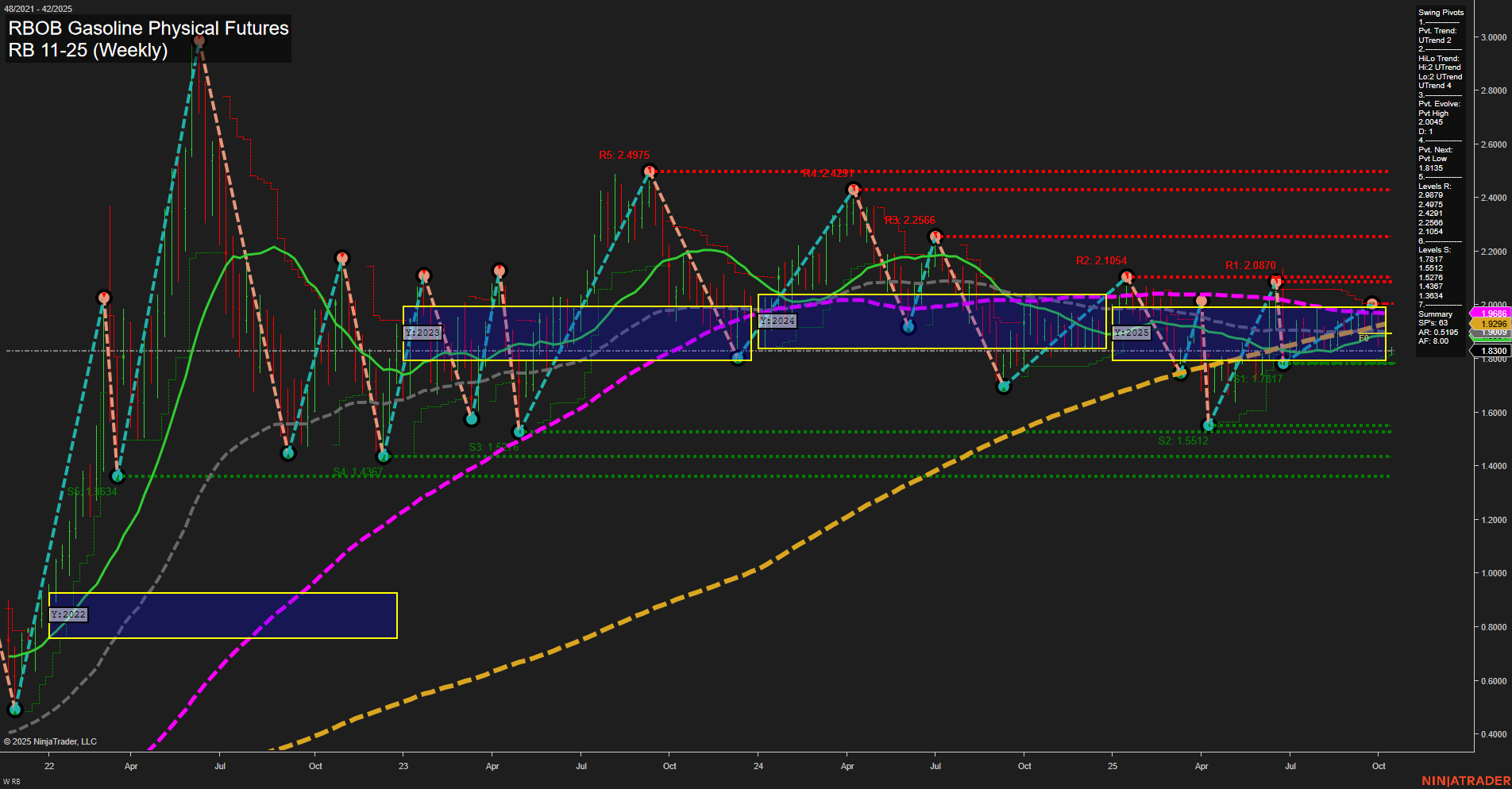

RB RBOB Gasoline Physical Futures Weekly Chart Analysis: 2025-Oct-12 18:10 CT

Price Action

- Last: 1.9296,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 20%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -45%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -7%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 2.0870,

- 4. Pvt. Next: Pvt low 1.8171,

- 5. Levels R: 2.4975, 2.4297, 2.2566, 2.1054, 2.0870,

- 6. Levels S: 1.8171, 1.6512, 1.4367, 1.3447, 1.2334.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.9296 Up Trend,

- (Intermediate-Term) 10 Week: 1.9296 Up Trend,

- (Long-Term) 20 Week: 1.9296 Up Trend,

- (Long-Term) 55 Week: 1.9195 Down Trend,

- (Long-Term) 100 Week: 1.8015 Up Trend,

- (Long-Term) 200 Week: 1.8300 Up Trend.

Recent Trade Signals

- 10 Oct 2025: Short RB 11-25 @ 1.8756 Signals.USAR-MSFG

- 09 Oct 2025: Short RB 11-25 @ 1.8781 Signals.USAR.TR120

- 06 Oct 2025: Long RB 11-25 @ 1.8802 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

The RBOB Gasoline futures market is currently showing a mixed technical landscape. Short-term momentum is positive, with price action above the weekly session fib grid (WSFG) center and a clear uptrend in both the swing pivot and moving averages for the 5, 10, and 20-week periods. However, intermediate and long-term fib grid trends (MSFG and YSFG) remain down, with price below their respective NTZ centers, indicating underlying weakness or consolidation on higher timeframes. The most recent swing pivot high at 2.0870 and support at 1.8171 define the current trading range, with resistance levels stacked above and multiple support levels below. Recent trade signals have been mixed, with both short and long entries triggered in the past week, reflecting the choppy and range-bound nature of the market. Overall, the short-term outlook is bullish, but the intermediate and long-term trends are neutral, suggesting a market in transition, potentially awaiting a catalyst for a decisive breakout or breakdown. Volatility remains moderate, and price is consolidating near key moving averages, which could act as dynamic support or resistance in the coming weeks.

Chart Analysis ATS AI Generated: 2025-10-12 18:11 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.