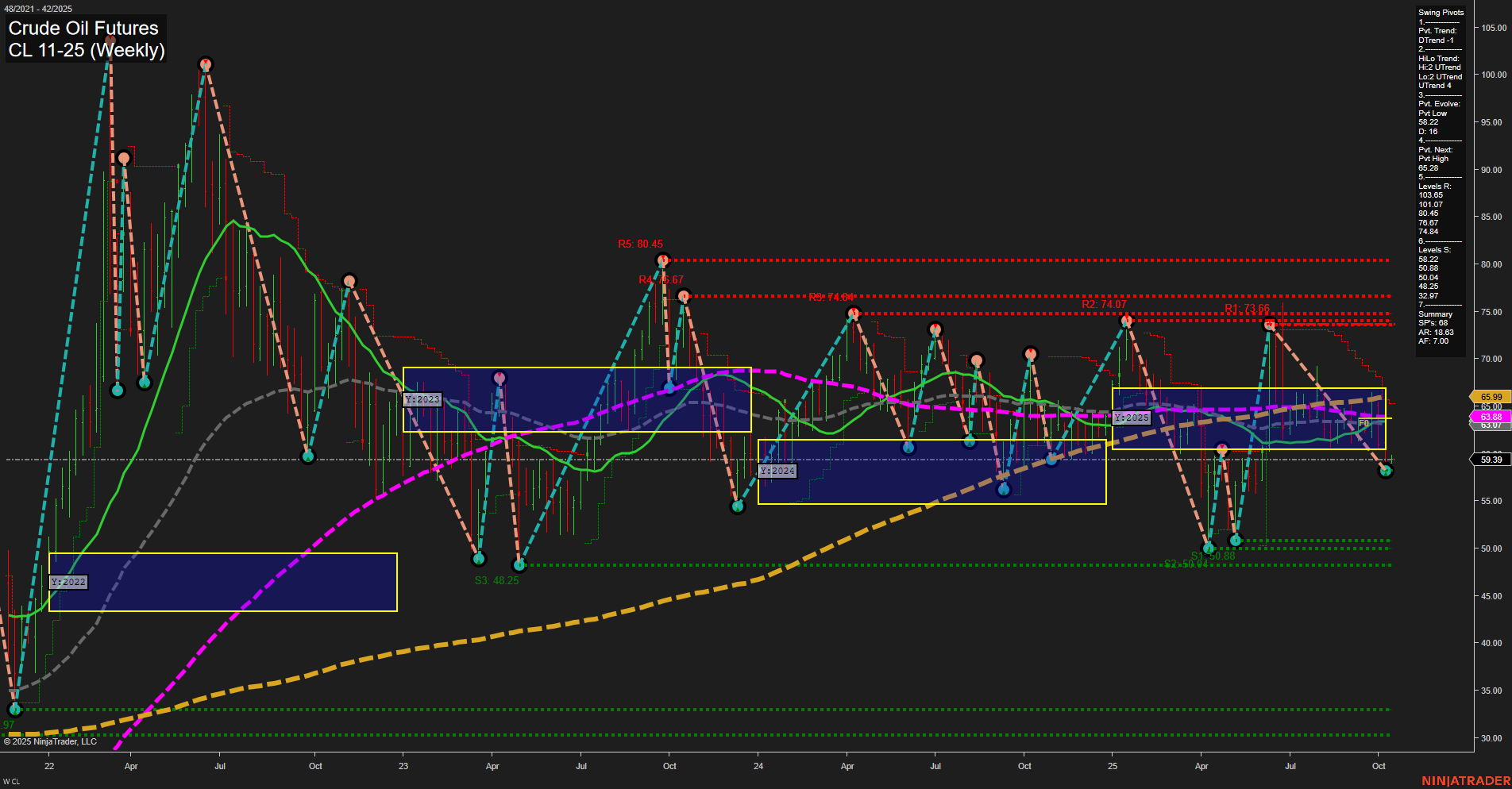

Crude oil futures are exhibiting a clear bearish structure across all timeframes. The most recent price action shows medium-sized bars with slow momentum, indicating a lack of strong directional conviction but a persistent downward bias. The Weekly Session Fib Grid (WSFG) trend is up, but price is only modestly above the short-term NTZ, suggesting a weak bounce within a broader downtrend. Both the Monthly (MSFG) and Yearly (YSFG) Session Fib Grids show price below their respective NTZs, confirming intermediate and long-term downward trends. Swing pivot analysis highlights a short-term downtrend, while the intermediate-term HiLo trend remains up, hinting at possible countertrend rallies, but the prevailing direction is still lower. Resistance levels are stacked well above current price, with significant support in the high 40s and low 50s. All benchmark moving averages from 5 to 200 weeks are trending down, reinforcing the dominant bearish sentiment. Recent trade signals have all triggered short entries, aligning with the overall technical picture. The market appears to be in a corrective or consolidation phase within a larger downtrend, with lower highs and lower lows dominating the chart. Volatility remains moderate, and there is no evidence of a strong reversal or breakout at this stage. The technical landscape suggests continued pressure on crude oil prices, with any rallies likely to encounter resistance at the previously established swing highs and moving averages.