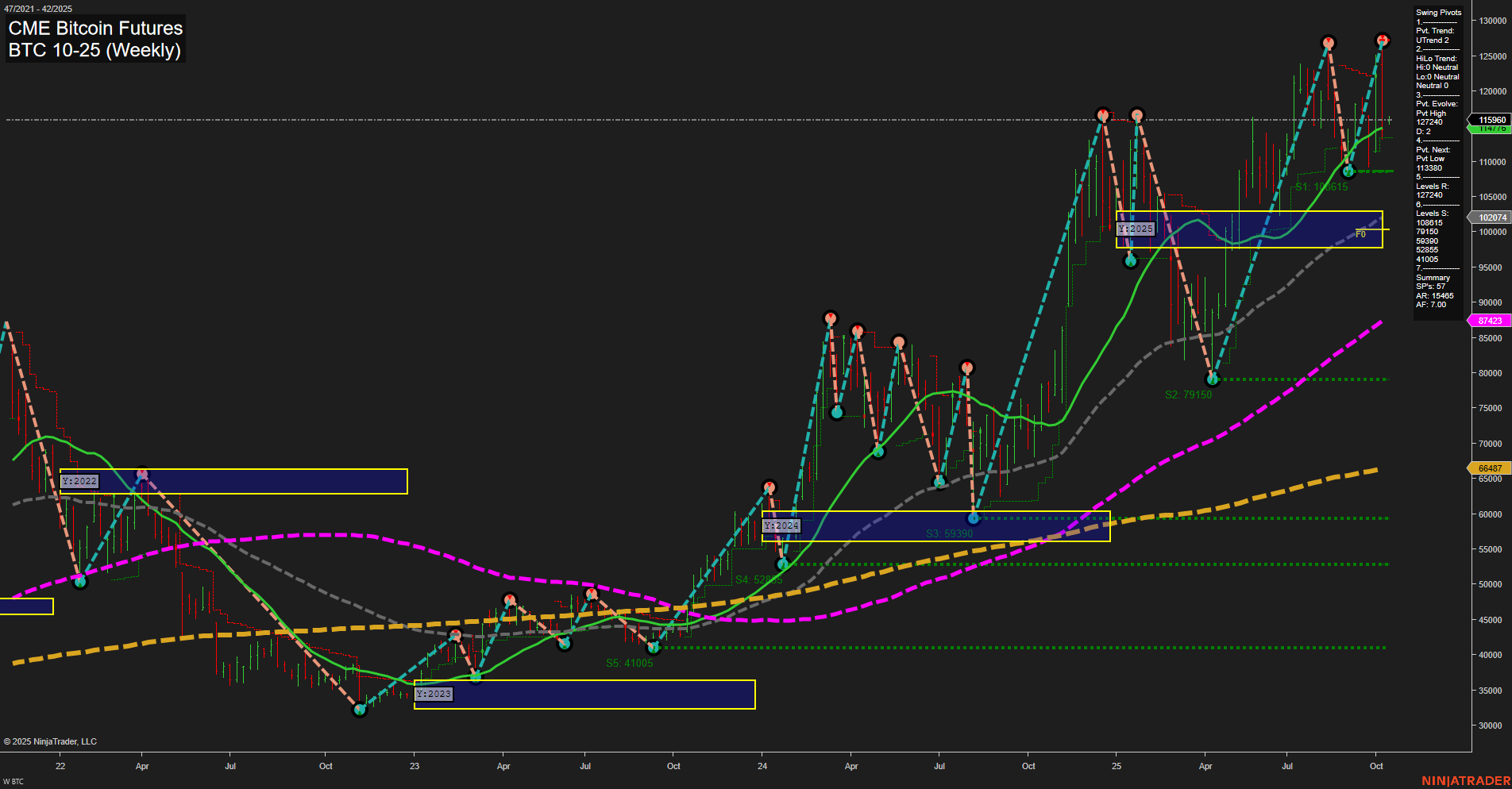

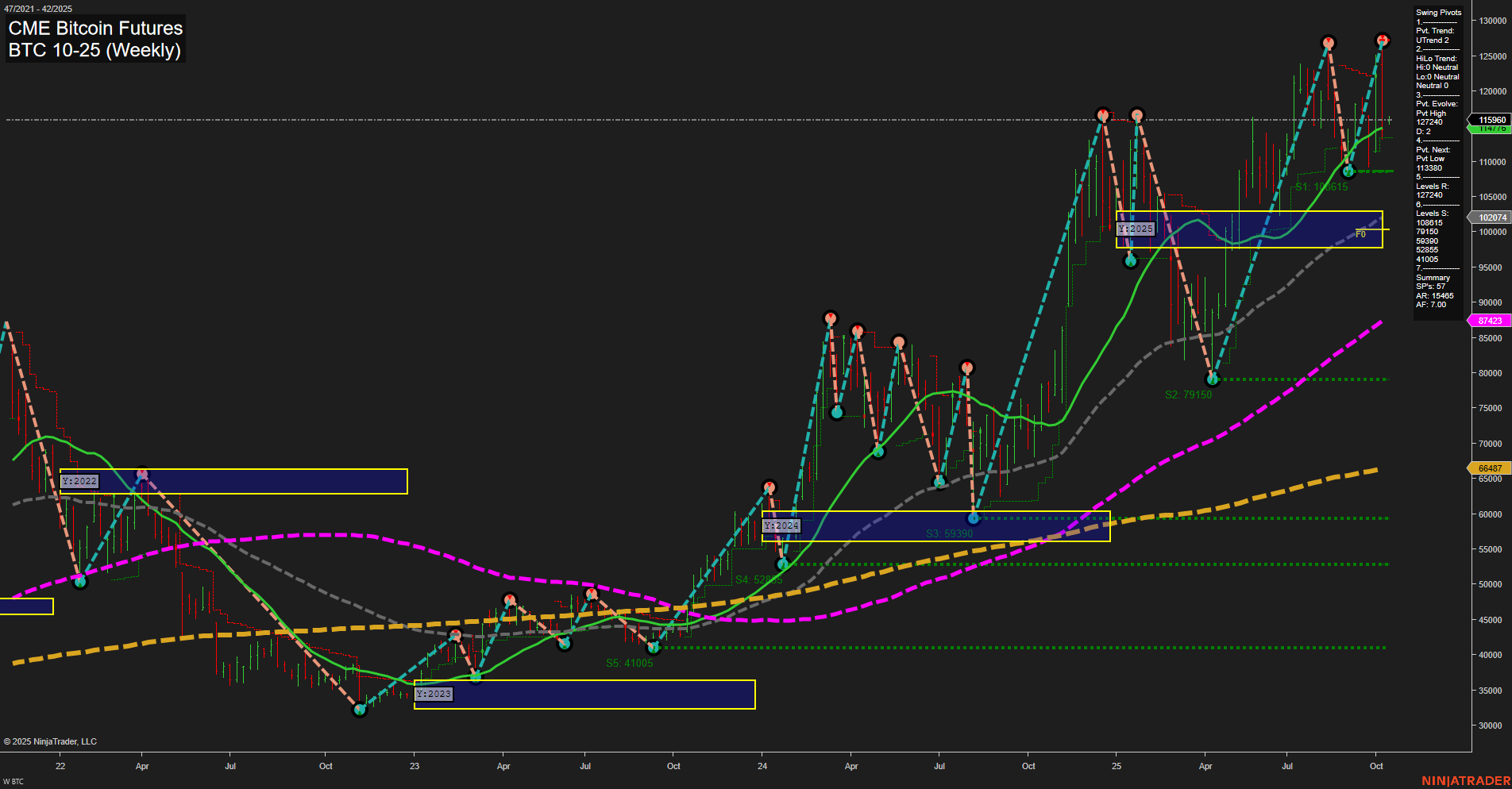

BTC CME Bitcoin Futures Weekly Chart Analysis: 2025-Oct-12 18:03 CT

Price Action

- Last: 115960,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 5%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 58%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend 2,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt High 121240,

- 4. Pvt. Next: Pvt Low 113380,

- 5. Levels R: 121240, 115960,

- 6. Levels S: 109815, 95300, 79150, 53990, 41005.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 113615 Up Trend,

- (Intermediate-Term) 10 Week: 102074 Up Trend,

- (Long-Term) 20 Week: 97423 Up Trend,

- (Long-Term) 55 Week: 66487 Up Trend,

- (Long-Term) 100 Week: 66487 Up Trend,

- (Long-Term) 200 Week: 66487 Up Trend.

Recent Trade Signals

- 08 Oct 2025: Long BTC 10-25 @ 124875 Signals.USAR-WSFG

- 07 Oct 2025: Short BTC 10-25 @ 121990 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The BTC CME Bitcoin Futures weekly chart shows a strong bullish structure in both the short- and long-term perspectives, with price action characterized by large bars and fast momentum. The price is trading well above all major moving averages, which are all trending upward, confirming the underlying strength. The Weekly, Monthly, and Yearly Session Fib Grids all indicate an upward trend, with price holding above their respective NTZ/F0% levels, reinforcing the bullish bias.

Swing pivots highlight an ongoing uptrend in the short term, with the most recent pivot high at 121240 acting as resistance and the next pivot low at 113380 as a key support. Intermediate-term HiLo trend is neutral, suggesting some consolidation or pause in the trend at this timeframe. Multiple support levels are well below current price, indicating a strong base has been established.

Recent trade signals show both long and short entries, reflecting active swing trading around key levels, but the overall structure remains bullish. The chart suggests a market in a strong uptrend with occasional pullbacks, typical of a trending environment with high volatility and momentum.

Chart Analysis ATS AI Generated: 2025-10-12 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.