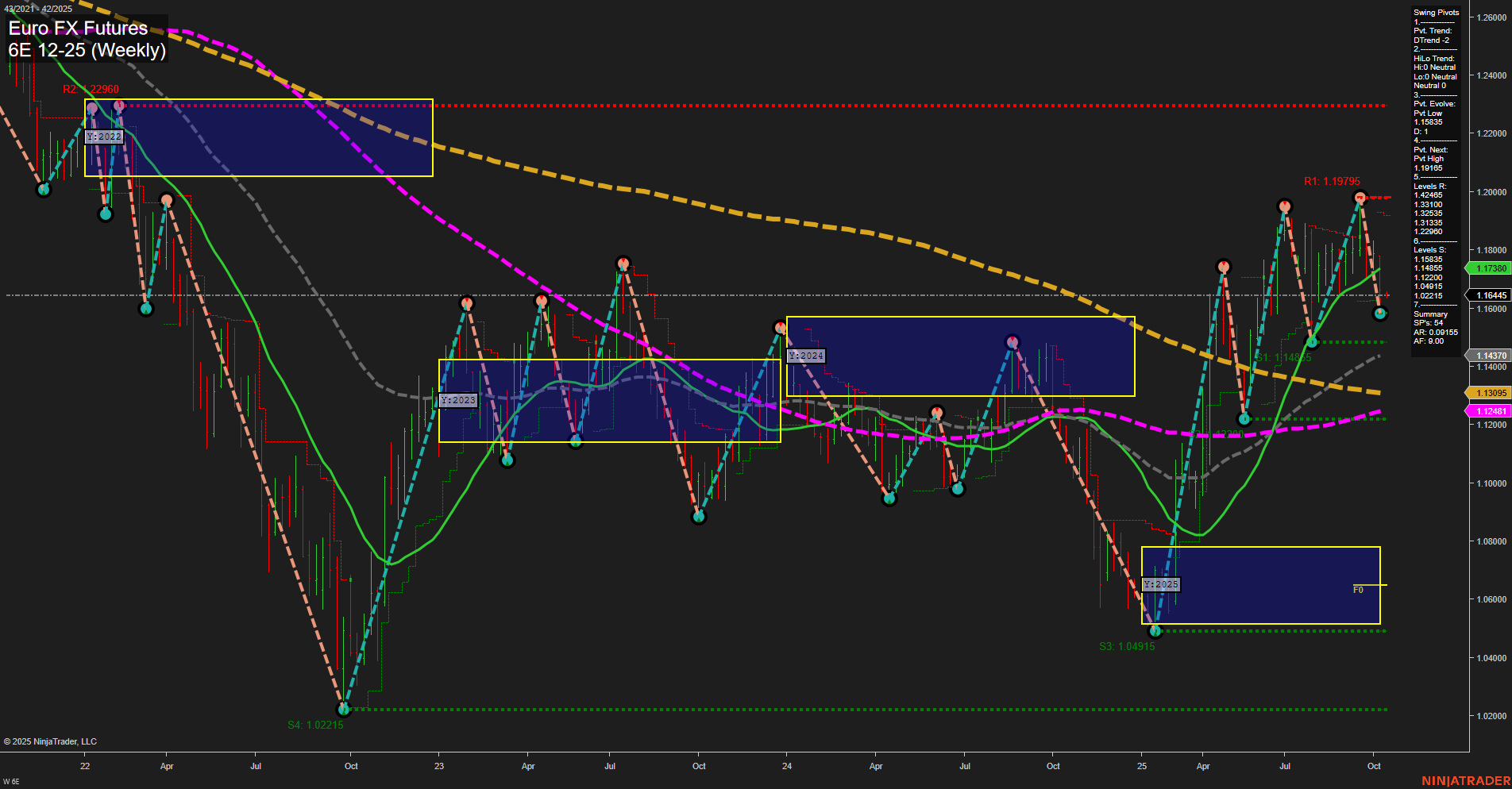

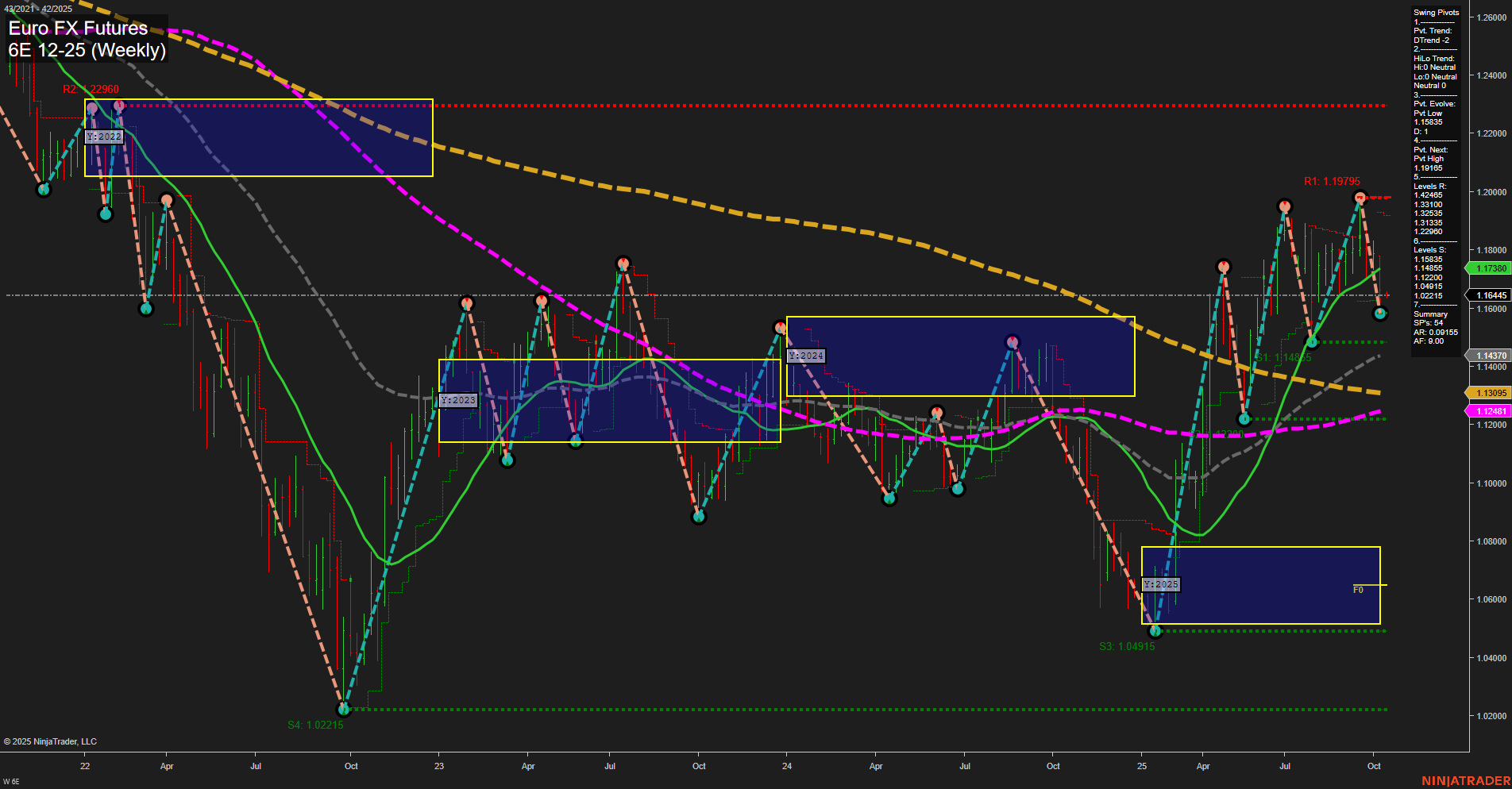

6E Euro FX Futures Weekly Chart Analysis: 2025-Oct-12 18:01 CT

Price Action

- Last: 1.17380,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -12%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -40%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 78%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.16445,

- 4. Pvt. Next: Pvt high 1.19165,

- 5. Levels R: 1.19165, 1.19795, 1.22960,

- 6. Levels S: 1.16445, 1.14945, 1.13095, 1.12481, 1.10215, 1.04915, 1.02215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.17380 Down Trend,

- (Intermediate-Term) 10 Week: 1.16445 Down Trend,

- (Long-Term) 20 Week: 1.14370 Up Trend,

- (Long-Term) 55 Week: 1.13095 Up Trend,

- (Long-Term) 100 Week: 1.12481 Up Trend,

- (Long-Term) 200 Week: 1.14047 Down Trend.

Recent Trade Signals

- 07 Oct 2025: Short 6E 12-25 @ 1.17375 Signals.USAR-MSFG

- 06 Oct 2025: Short 6E 12-25 @ 1.1709 Signals.USAR.TR120

- 06 Oct 2025: Short 6E 12-25 @ 1.17665 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition. Short- and intermediate-term trends are bearish, as confirmed by the WSFG and MSFG both trending down with price below their respective NTZ/F0% levels. Recent swing pivots and trade signals also reinforce a downside bias in the near term, with the most recent pivots evolving lower and resistance levels overhead. However, the long-term YSFG trend remains up, with price still above the yearly NTZ/F0% and long-term moving averages (20, 55, 100 week) trending higher, suggesting underlying bullish structure. The 200-week MA, however, is still in a downtrend, indicating some longer-term overhead pressure. The market is currently testing support around 1.16445, with further downside potential toward 1.14945 and 1.13095 if selling persists. Resistance is clustered near 1.19165 and above. Overall, the chart reflects a corrective pullback within a larger bullish yearly context, with short-term momentum favoring sellers but long-term structure still supportive of higher prices if key supports hold.

Chart Analysis ATS AI Generated: 2025-10-12 18:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.