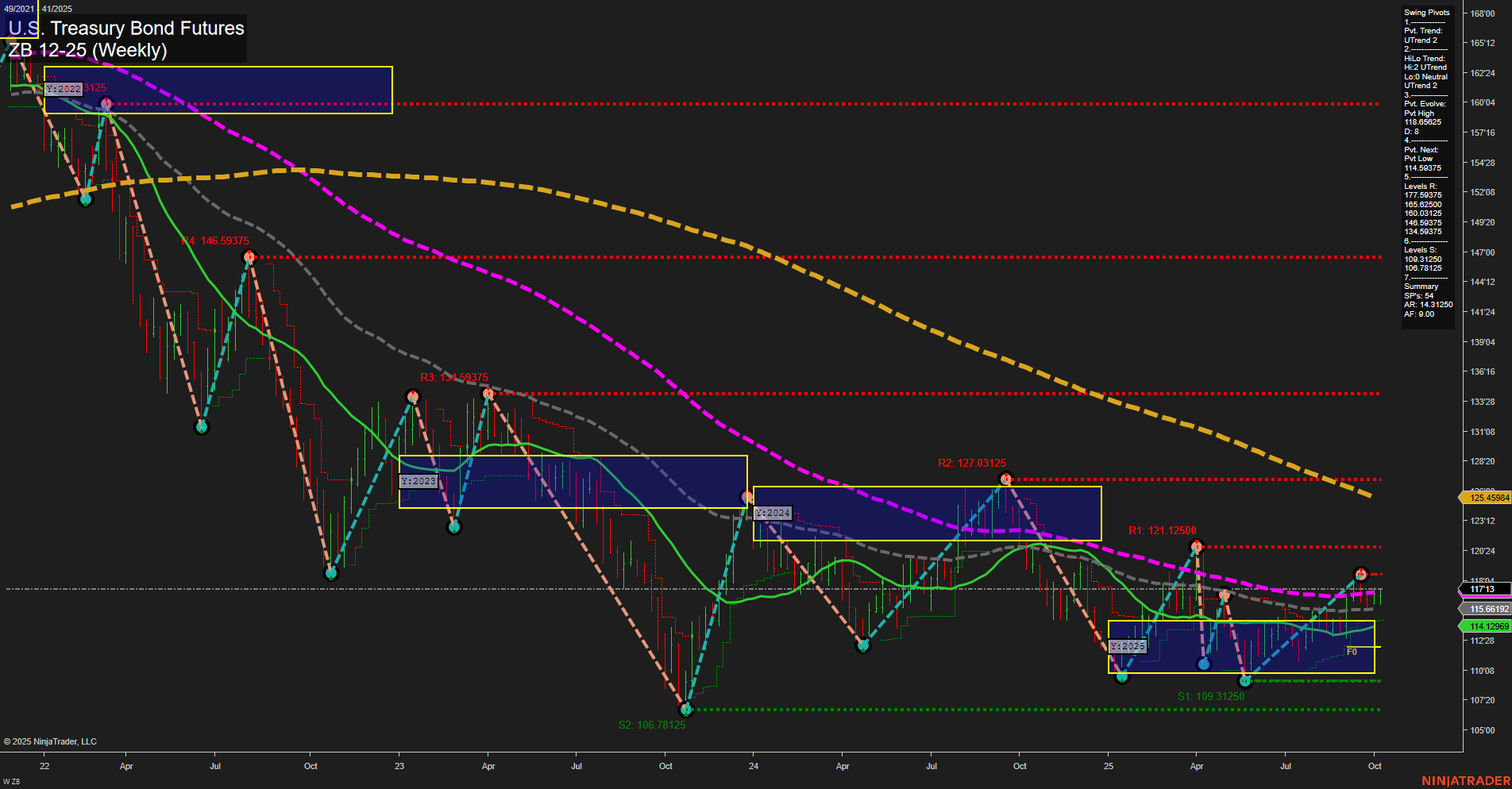

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum phase, with medium-sized bars reflecting a steady but not aggressive move. Both short-term and intermediate-term swing pivot trends have turned upward, supported by a series of higher lows and a recent pivot high at 118.09375. The price is currently above the 5, 10, and 20-week moving averages, all of which are trending up, indicating underlying strength in the short and intermediate timeframes. However, the 55, 100, and 200-week moving averages remain in a downtrend, highlighting that the broader, long-term trend is still bearish. The price is consolidating near the lower end of the yearly session fib grid, with neutral bias across all session grids, suggesting a lack of clear directional conviction on the longer horizon. Key resistance levels are clustered above at 118.09375, 121.12500, and 127.03125, while support is well-defined at 114.59375 and 109.31250. The market appears to be in a recovery phase, possibly staging a counter-trend rally within a larger bearish structure. This environment is characterized by a potential for further upside tests, but with significant overhead resistance and the long-term trend still acting as a headwind. The overall setup suggests a choppy, range-bound market with bullish momentum in the short to intermediate term, but with caution warranted as the long-term downtrend remains intact.