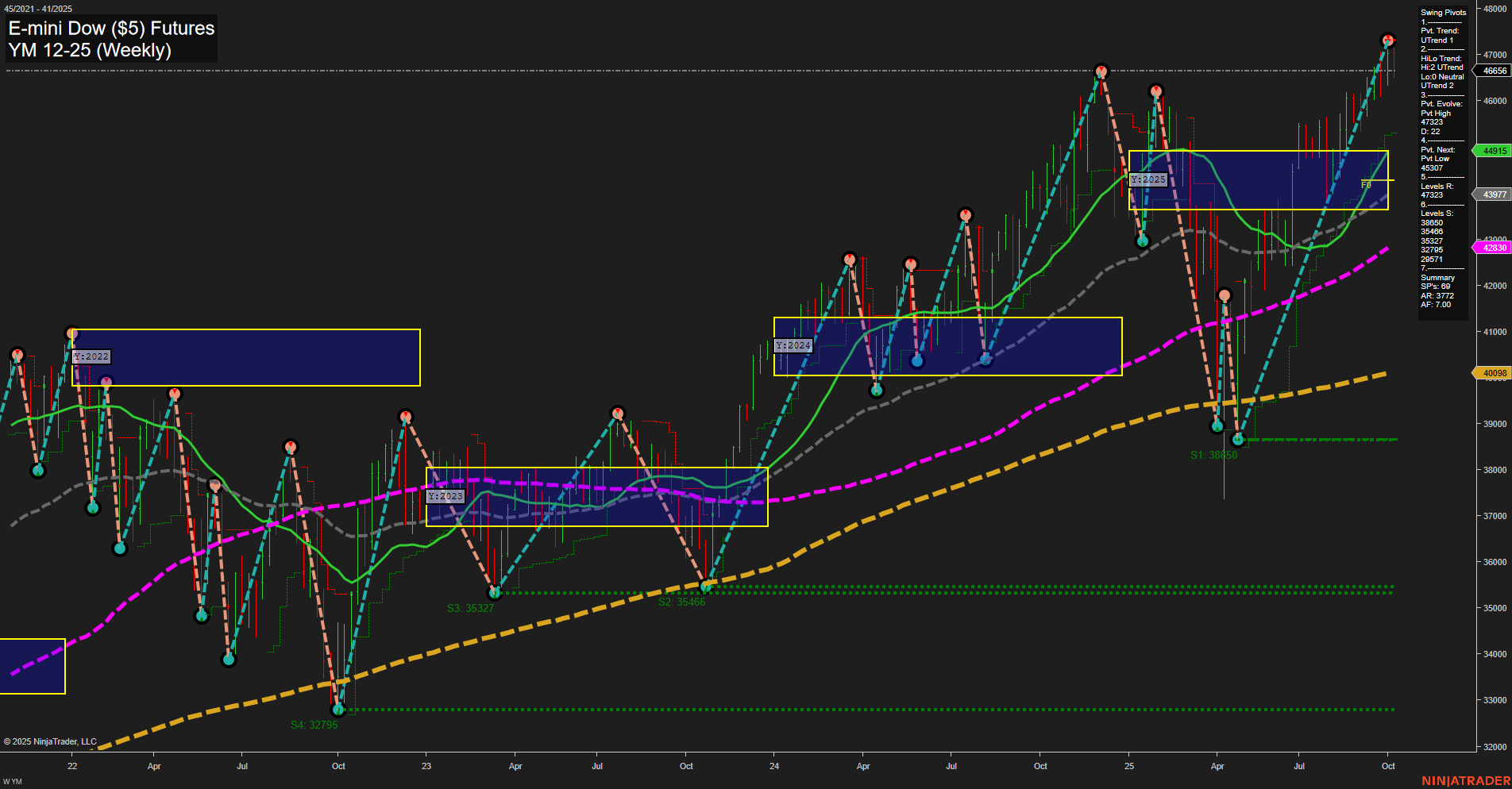

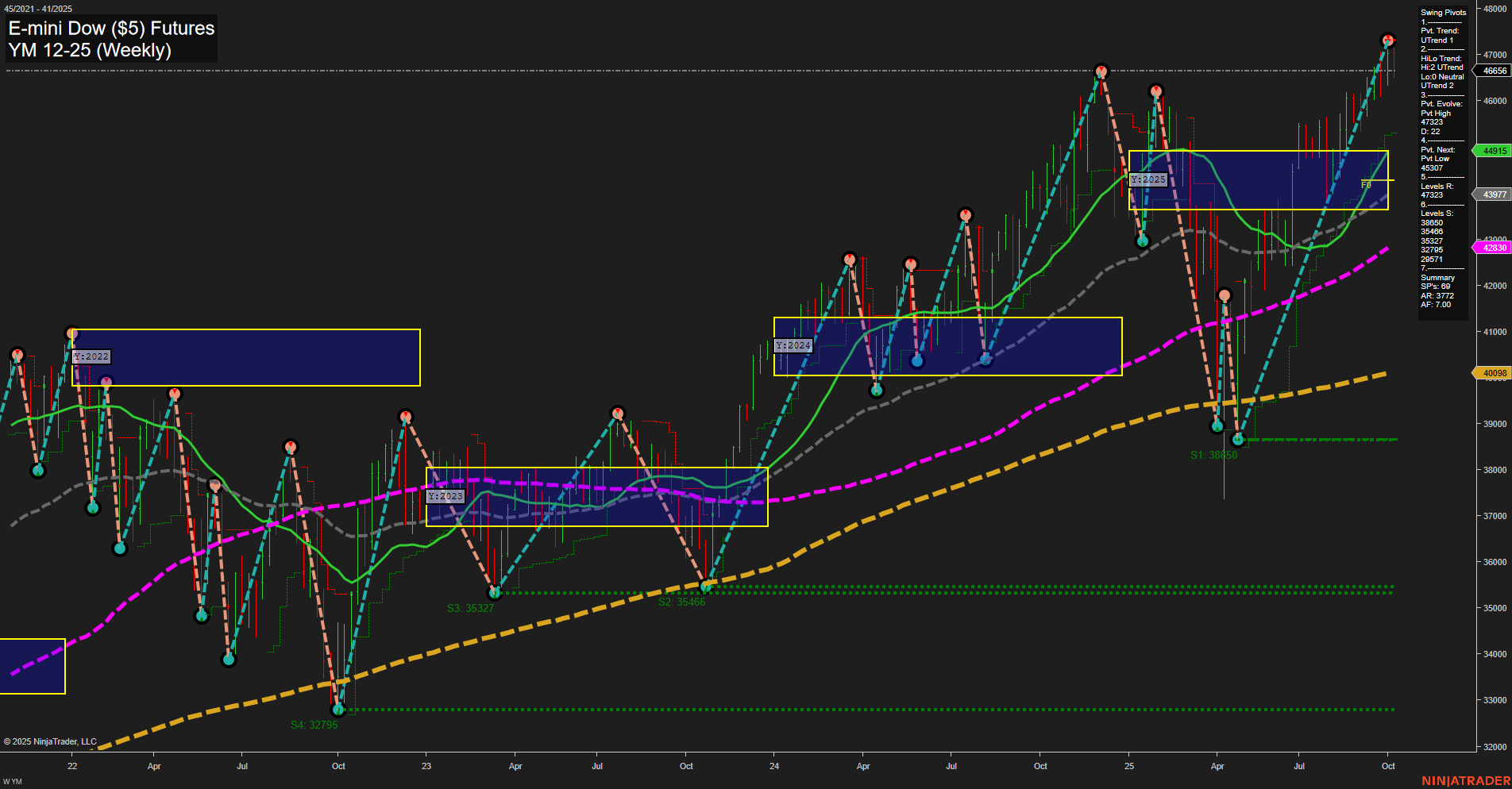

YM E-mini Dow ($5) Futures Weekly Chart Analysis: 2025-Oct-10 07:20 CT

Price Action

- Last: 46656,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: -44%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 8%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 37%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 47223,

- 4. Pvt. Next: Pvt low 44915,

- 5. Levels R: 47223, 46656,

- 6. Levels S: 40998, 35466, 35327, 32795.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 45307 Up Trend,

- (Intermediate-Term) 10 Week: 43977 Up Trend,

- (Long-Term) 20 Week: 44915 Up Trend,

- (Long-Term) 55 Week: 42330 Up Trend,

- (Long-Term) 100 Week: 40998 Up Trend,

- (Long-Term) 200 Week: 37792 Up Trend.

Recent Trade Signals

- 08 Oct 2025: Short YM 12-25 @ 46896 Signals.USAR-WSFG

- 07 Oct 2025: Short YM 12-25 @ 46844 Signals.USAR.TR120

- 06 Oct 2025: Long YM 12-25 @ 46927 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The YM E-mini Dow futures weekly chart shows a market in transition. Short-term momentum has turned bearish, as indicated by the WSFG trend and recent short trade signals, with price currently below the NTZ center and a developing swing pivot downtrend. However, the intermediate and long-term outlooks remain bullish, supported by upward trends in all major moving averages and the MSFG/YSFG grids, with price holding above key monthly and yearly NTZ levels. The market recently tested resistance near 47223 and is now pulling back, but strong support levels are established well below current price, suggesting the broader uptrend remains intact. This environment reflects a classic swing scenario: a short-term correction within a larger bullish structure, with volatility and large bars signaling active price discovery. Traders are likely watching for signs of stabilization or reversal at support, or confirmation of further downside if the short-term trend accelerates.

Chart Analysis ATS AI Generated: 2025-10-10 07:21 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.