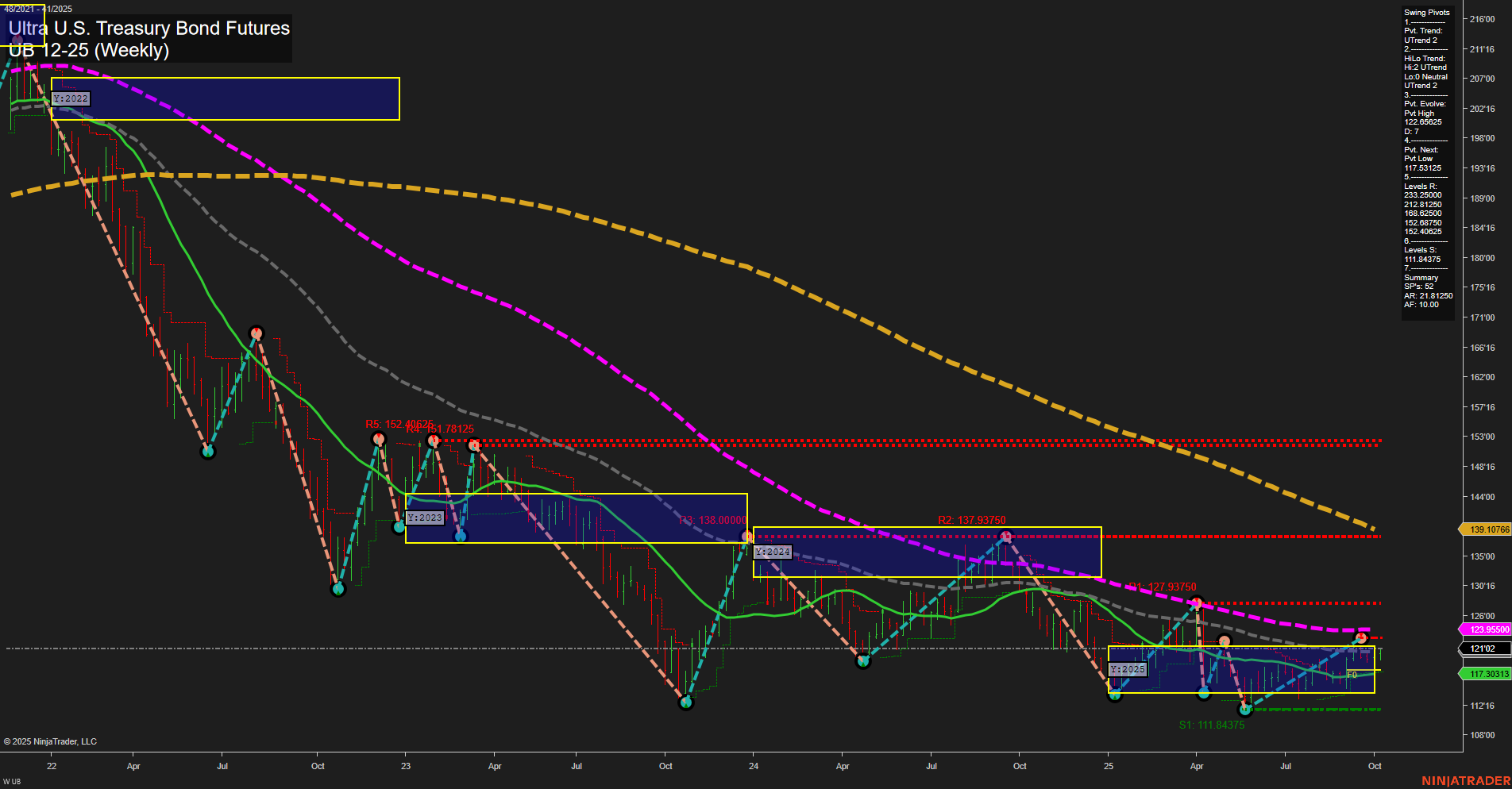

The UB Ultra U.S. Treasury Bond Futures weekly chart is showing a notable shift in sentiment, with both short-term and intermediate-term trends turning bullish as indicated by the upward momentum in the WSFG and MSFG grids, and confirmed by recent long trade signals. Price is currently above the NTZ center (F0%) across all session grids, reinforcing the upward bias. Swing pivots highlight a developing uptrend, with the most recent pivot high and a next potential pivot low at 117.53, suggesting a higher low structure. Resistance levels remain well above current price, while support is clustered just below, indicating a potential for further upside if these levels hold. The 5, 10, and 20 week moving averages are all trending up, supporting the bullish case in the short and intermediate term, though the longer-term 55, 100, and 200 week averages are still in a downtrend, reflecting the broader bearish structure that has dominated the past year. The market appears to be in a recovery phase, possibly transitioning from a prolonged downtrend to a base-building or early reversal environment. Volatility has moderated, and the price action suggests a consolidation breakout attempt, with the potential for a sustained rally if resistance levels are challenged. Overall, the technical landscape favors a bullish outlook in the near to intermediate term, while the long-term trend remains neutral as the market works through overhead supply and legacy resistance.