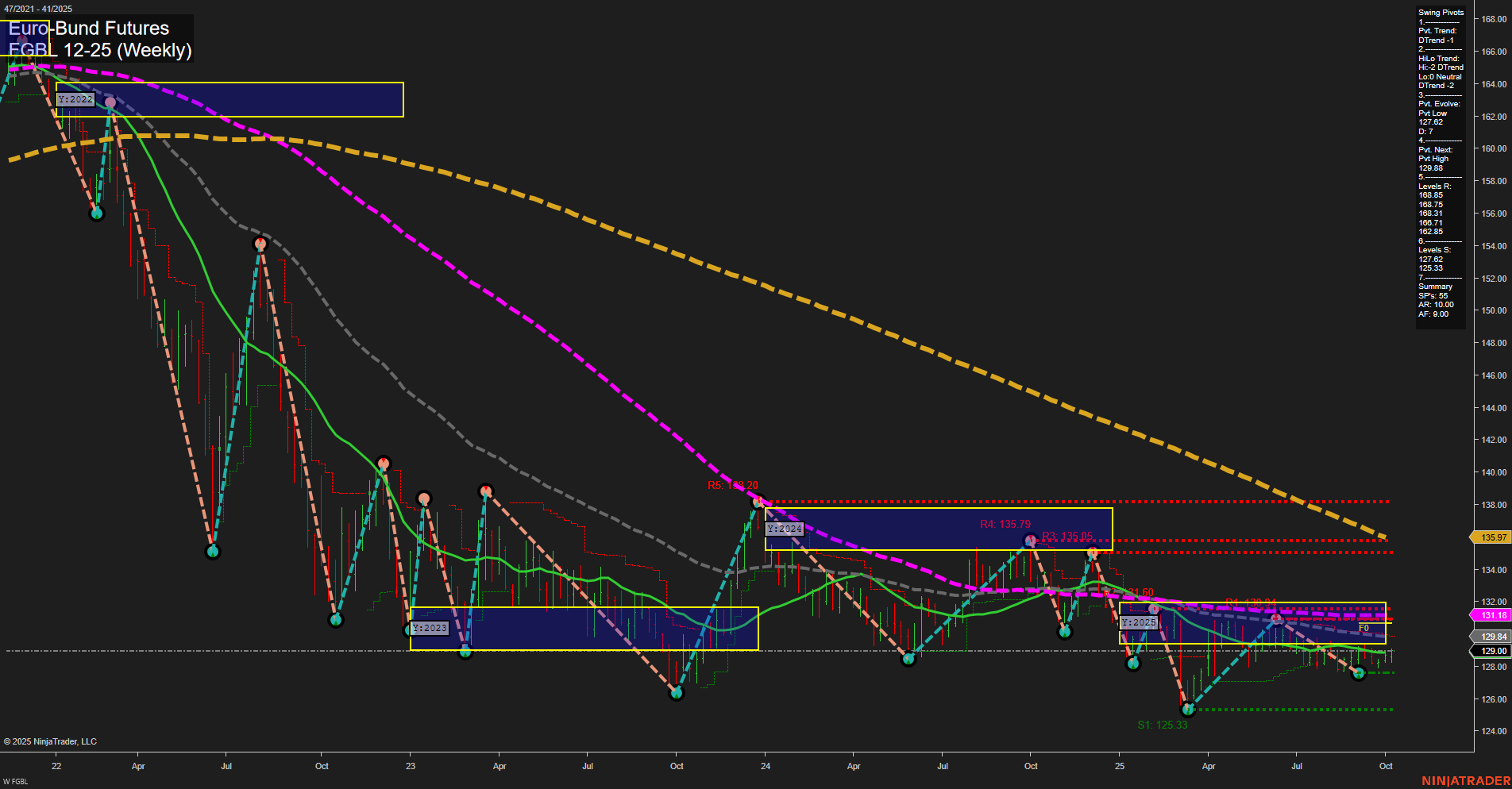

The FGBL Euro-Bund Futures weekly chart shows a market in transition. Price action is subdued, with small bars and slow momentum, indicating a lack of strong conviction in either direction. Short- and intermediate-term Fib grid trends (WSFG, MSFG) are both up, with price holding above their respective NTZ/F0% levels, suggesting some underlying support for a potential bounce or consolidation phase. However, the long-term yearly grid (YSFG) remains in a downtrend, with price below the NTZ/F0% and negative grid reading, reflecting persistent bearish pressure from the higher timeframe. Swing pivot analysis highlights a prevailing short-term and intermediate-term downtrend, with the most recent pivot low at 127.02 and the next significant resistance at 139.88. Multiple resistance levels cluster above current price, while support is relatively close below, indicating a market boxed within a range and facing overhead supply. All benchmark moving averages (from 5-week to 200-week) are trending down, reinforcing the dominant long-term bearish structure. Recent trade signals have triggered long entries, reflecting attempts to capture a countertrend move or a short-term reversal, but these are set against the backdrop of a broader downtrend. Overall, the market is in a corrective or consolidative phase within a larger bearish cycle. Short- and intermediate-term outlooks are neutral as price attempts to stabilize, but the long-term trend remains decisively bearish. The chart suggests a market at a technical crossroads, with any sustained move above resistance levels needed to shift the longer-term bias.