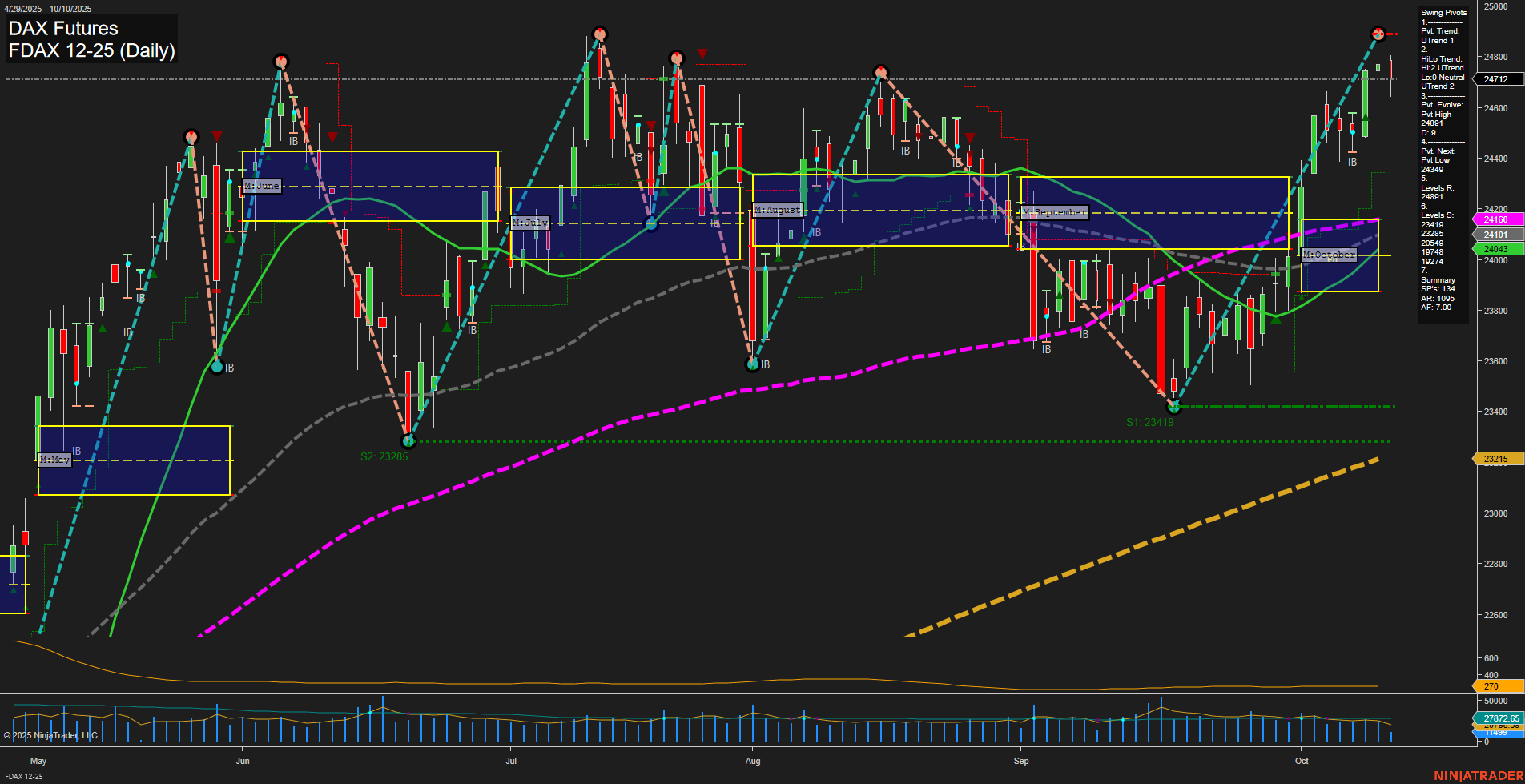

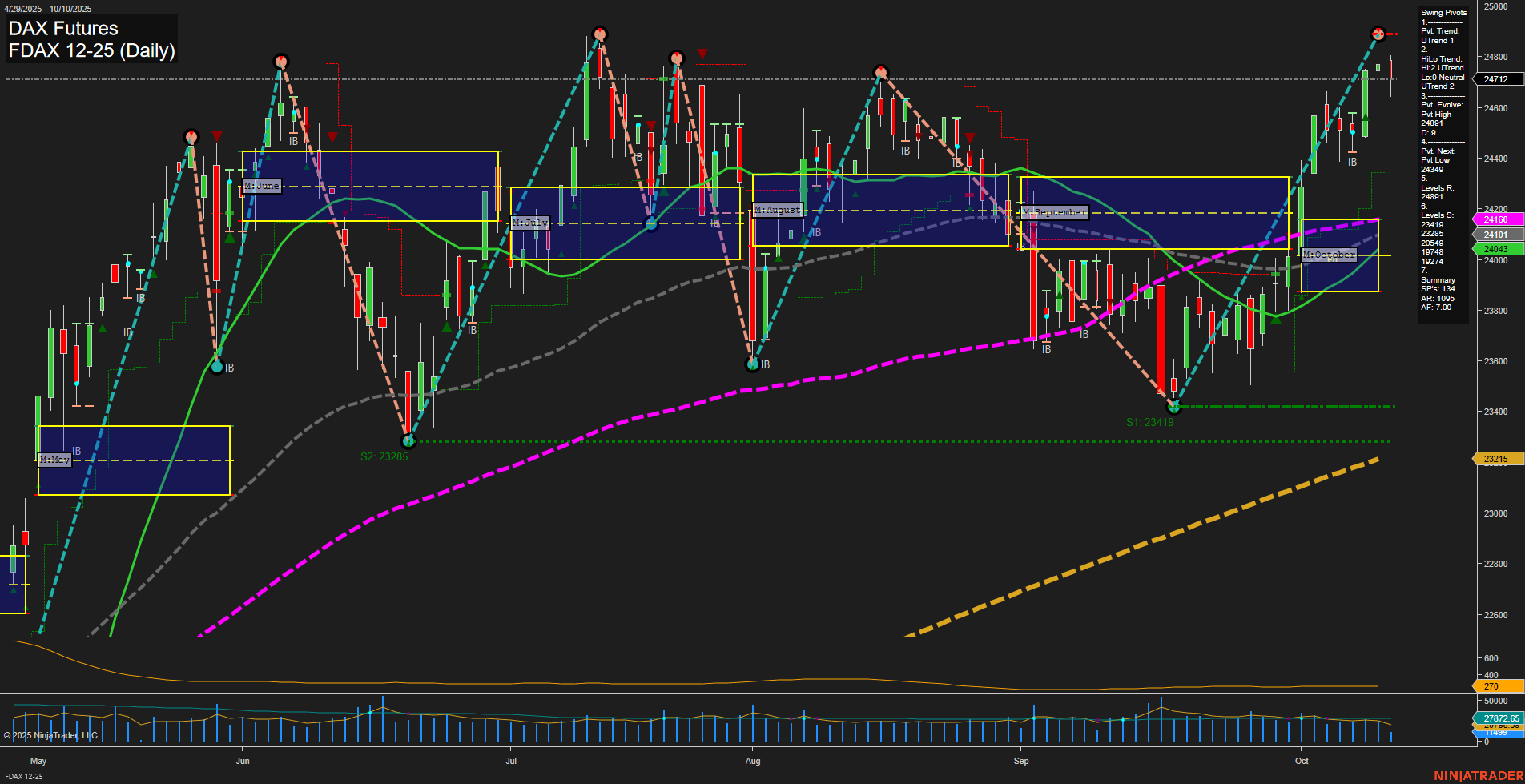

FDAX DAX Futures Daily Chart Analysis: 2025-Oct-10 07:09 CT

Price Action

- Last: 24712,

- Bars: Large,

- Mom: Fast.

WSFG Weekly

- Short-Term

- WSFG Current: 43%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 68%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 129%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 24901,

- 4. Pvt. Next: Pvt Low 24160,

- 5. Levels R: 24901, 24712, 24548, 24349,

- 6. Levels S: 24160, 24043, 23945, 23419, 23285.

Daily Benchmarks

- (Short-Term) 5 Day: 24548 Up Trend,

- (Short-Term) 10 Day: 24160 Up Trend,

- (Intermediate-Term) 20 Day: 24101 Up Trend,

- (Intermediate-Term) 55 Day: 24043 Up Trend,

- (Long-Term) 100 Day: 23945 Up Trend,

- (Long-Term) 200 Day: 23215 Up Trend.

Additional Metrics

Recent Trade Signals

- 08 Oct 2025: Long FDAX 12-25 @ 24590 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures daily chart is showing strong bullish momentum across all timeframes. Price has broken above key resistance levels and is trading well above the NTZ center lines for weekly, monthly, and yearly session fib grids, confirming a persistent uptrend. The most recent swing pivot is a new high at 24901, with the next potential reversal level at 24160, indicating that the market is in an extension phase after a sharp rally. All benchmark moving averages (from 5-day to 200-day) are trending upward, reinforcing the strength of the current move. Volatility, as measured by ATR, remains elevated, and volume is robust, supporting the conviction behind the breakout. The recent long signal aligns with the prevailing trend, and the market is currently in a trend continuation phase, with higher highs and higher lows dominating the structure. No significant signs of exhaustion or reversal are present, and the technical environment favors ongoing bullish price action.

Chart Analysis ATS AI Generated: 2025-10-10 07:09 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.