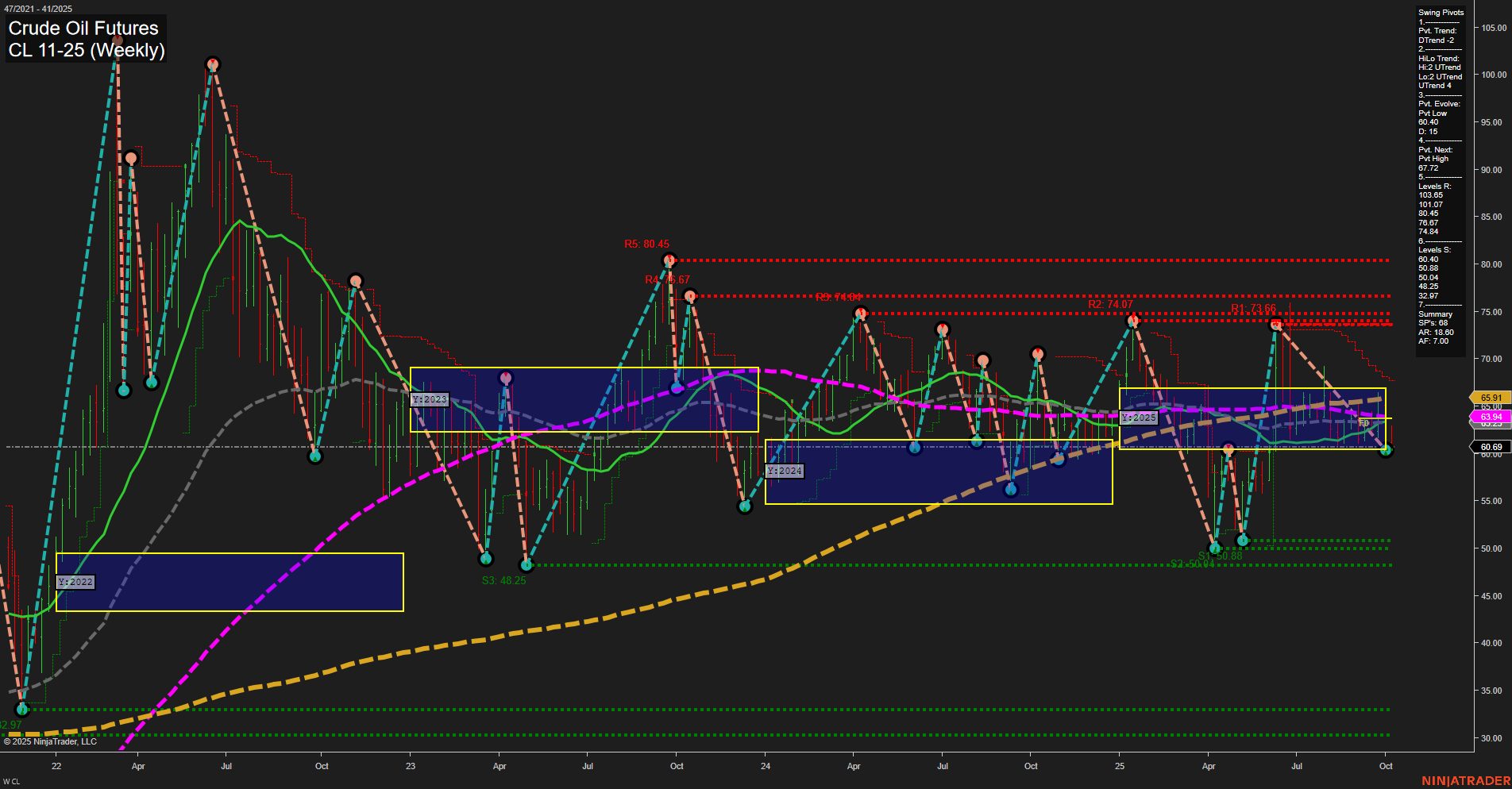

Crude oil futures are currently trading at 60.69, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term WSFG grid is neutral, with price sitting at the center of the NTZ, reflecting indecision and consolidation. Intermediate-term MSFG and long-term YSFG both show price below their respective NTZ centers, with clear downtrends, suggesting that the broader trend remains bearish. Swing pivot analysis highlights a short-term downtrend, while the intermediate-term HiLo trend is up, indicating some divergence and potential for choppy, range-bound trading. The most recent pivot low is at 60.45, with the next significant resistance at 67.72 and multiple resistance levels stacked above, while support is well below at 50.88 and lower. All key moving averages (except the 200-week) are trending down, reinforcing the bearish bias on both intermediate and long-term timeframes. Recent trade signals have shifted to the short side, with two consecutive short entries following a brief long attempt, aligning with the prevailing downtrend in the benchmarks and session grids. Overall, the market is in a corrective or consolidative phase short-term, but the weight of evidence from the intermediate and long-term metrics points to a bearish environment. Price is testing lower levels, and the lack of strong momentum suggests a potential for further downside or continued sideways action unless a significant catalyst emerges.