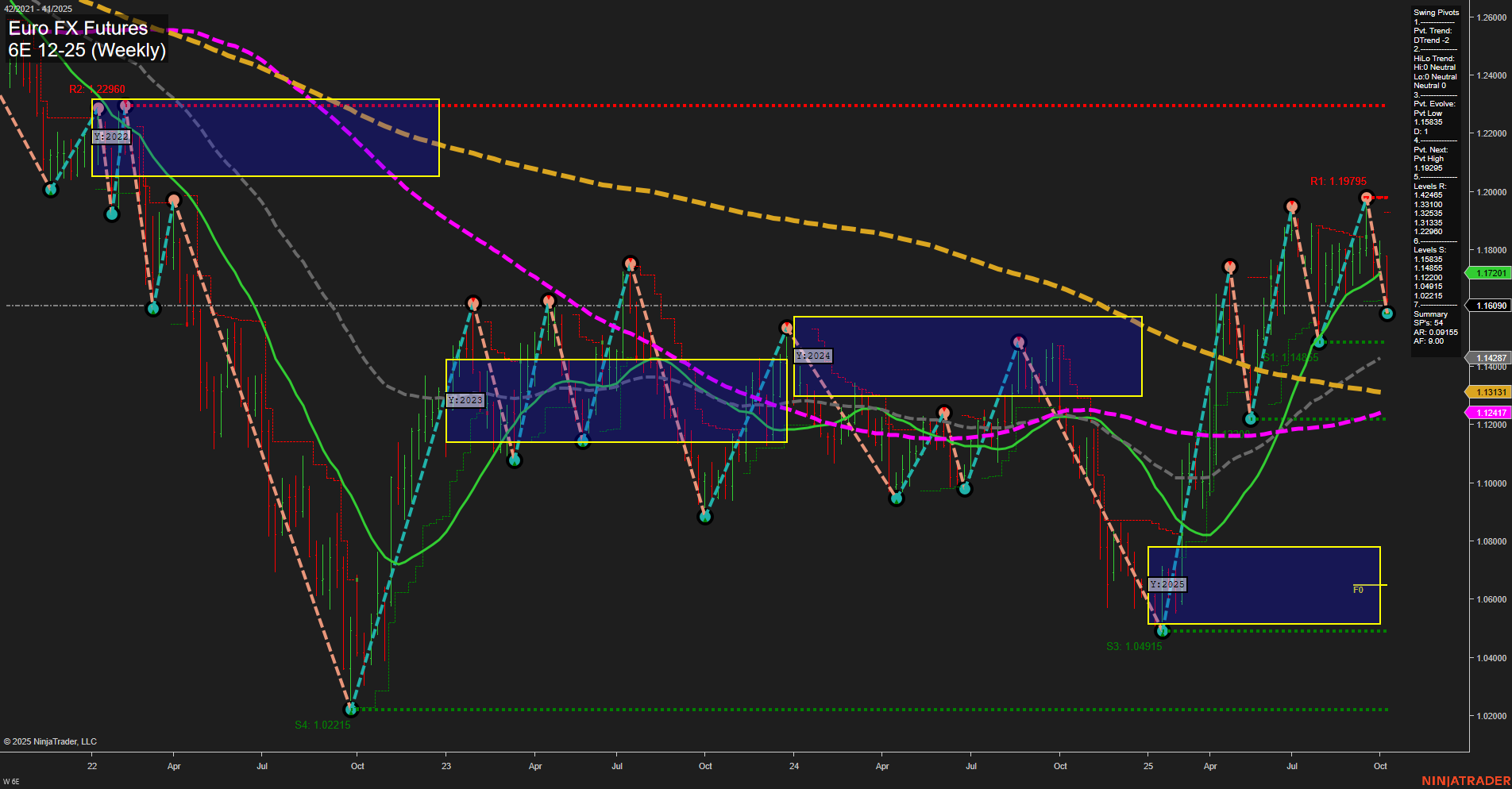

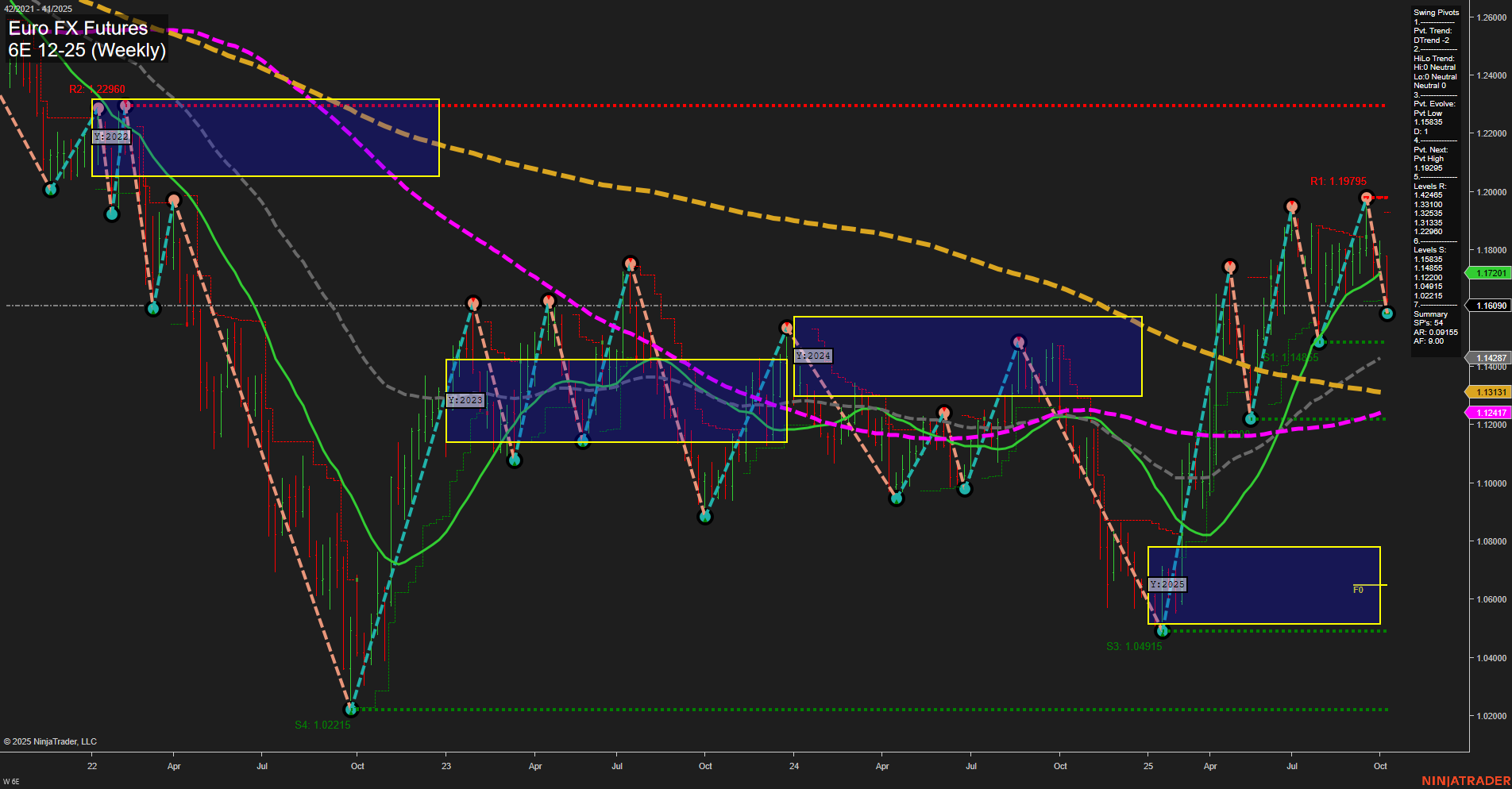

6E Euro FX Futures Weekly Chart Analysis: 2025-Oct-10 07:02 CT

Price Action

- Last: 1.17201,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -132%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -51%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 75%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 1.15983,

- 4. Pvt. Next: Pvt high 1.19975,

- 5. Levels R: 1.19975, 1.22960,

- 6. Levels S: 1.15983, 1.11495, 1.04915, 1.02215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.16090 Down Trend,

- (Intermediate-Term) 10 Week: 1.14267 Up Trend,

- (Long-Term) 20 Week: 1.17201 Up Trend,

- (Long-Term) 55 Week: 1.13131 Up Trend,

- (Long-Term) 100 Week: 1.12417 Up Trend,

- (Long-Term) 200 Week: 1.13311 Down Trend.

Recent Trade Signals

- 07 Oct 2025: Short 6E 12-25 @ 1.17375 Signals.USAR-MSFG

- 06 Oct 2025: Short 6E 12-25 @ 1.1709 Signals.USAR.TR120

- 06 Oct 2025: Short 6E 12-25 @ 1.17665 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a market in transition. Short-term and intermediate-term trends are both bearish, as confirmed by the WSFG and MSFG readings, swing pivot trends, and recent short trade signals. Price is currently below the NTZ center on both the weekly and monthly session fib grids, reinforcing the downside bias. The most recent swing pivot is a low at 1.15983, with the next resistance at 1.19975 and support levels below at 1.15983, 1.11495, and 1.04915.

Despite the short-term weakness, the long-term YSFG trend remains up, with price above the yearly NTZ center and most long-term moving averages trending higher, except for the 200-week MA, which is still in a downtrend. This suggests that while the market is experiencing a corrective phase or pullback within a broader uptrend, the long-term structure remains constructive. The recent price action is characterized by medium-sized bars and average momentum, indicating a controlled but persistent move lower rather than a sharp selloff.

Overall, the market is currently in a short-term and intermediate-term pullback or retracement phase within a longer-term bullish cycle. Swing traders should note the potential for further downside toward key support levels, but also be aware of the underlying long-term uptrend that could reassert itself if support holds and momentum shifts.

Chart Analysis ATS AI Generated: 2025-10-10 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.