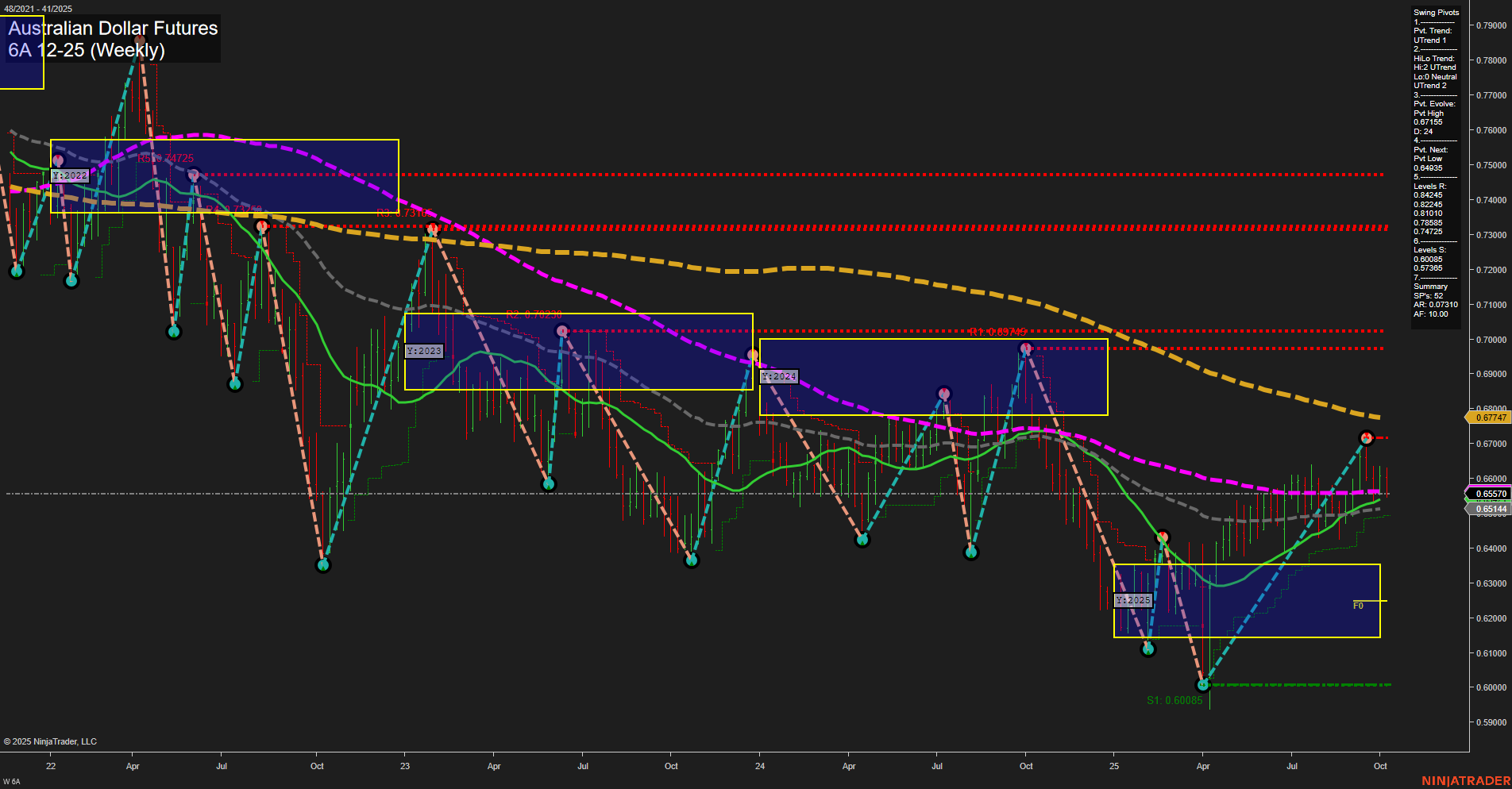

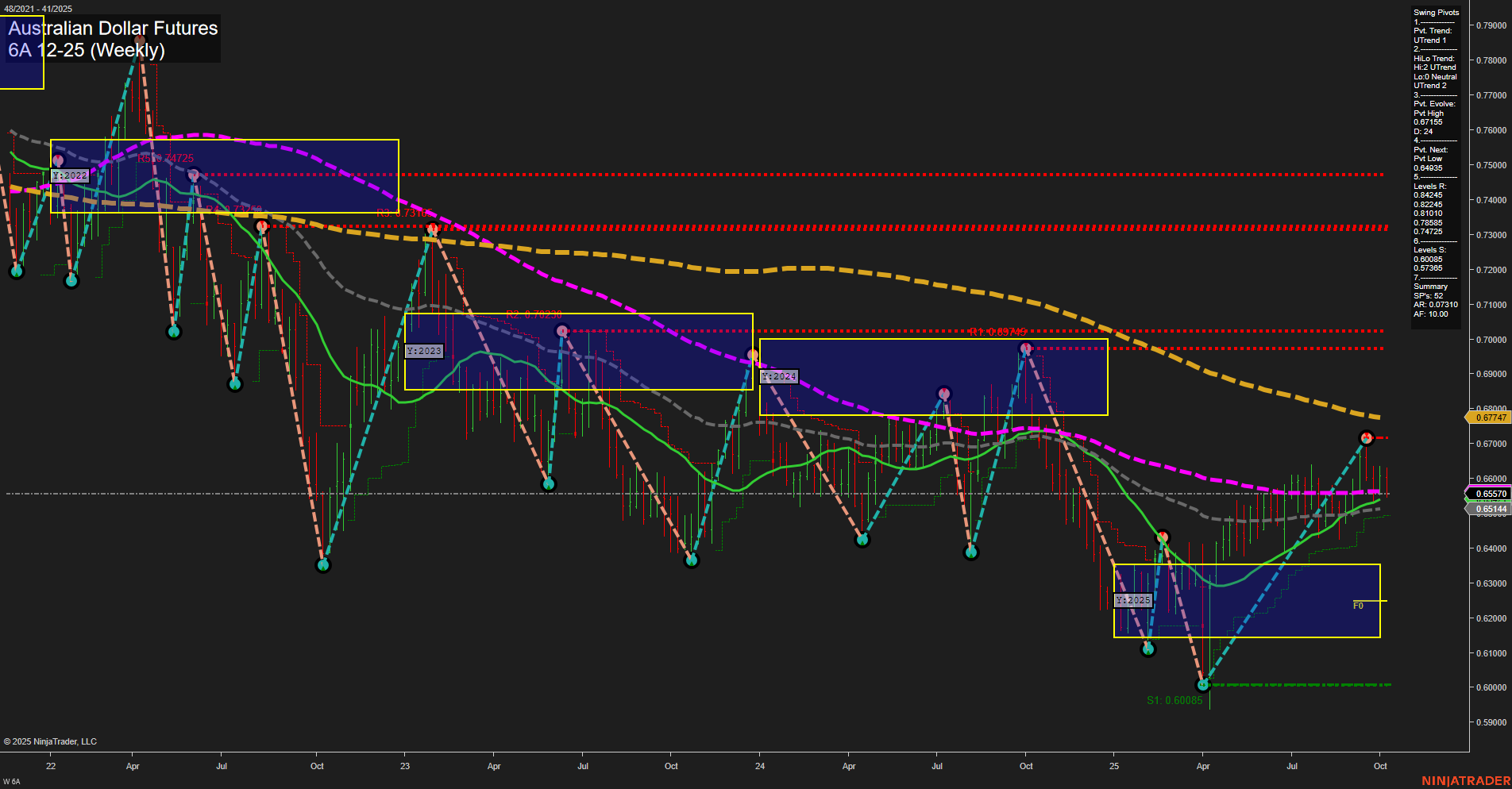

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Oct-10 07:00 CT

Price Action

- Last: 0.65577,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.67747,

- 4. Pvt. Next: Pvt low 0.60085,

- 5. Levels R: 0.67747, 0.69749, 0.74725,

- 6. Levels S: 0.60085, 0.61713, 0.62710.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65514 Up Trend,

- (Intermediate-Term) 10 Week: 0.65154 Up Trend,

- (Long-Term) 20 Week: 0.65577 Up Trend,

- (Long-Term) 55 Week: 0.67477 Down Trend,

- (Long-Term) 100 Week: 0.69749 Down Trend,

- (Long-Term) 200 Week: 0.73735 Down Trend.

Recent Trade Signals

- 10 Oct 2025: Short 6A 12-25 @ 0.6572 Signals.USAR-MSFG

- 09 Oct 2025: Short 6A 12-25 @ 0.65565 Signals.USAR.TR120

- 09 Oct 2025: Short 6A 12-25 @ 0.65865 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a market in transition. Price action is currently consolidating near the 0.65577 level, with medium-sized bars and average momentum, indicating neither strong buying nor selling pressure. The short- and intermediate-term trends, as reflected by the WSFG and MSFG, are neutral, with price oscillating around key moving averages and within the NTZ (neutral zone) of the yearly session fib grid. Swing pivots indicate an uptrend in both short- and intermediate-term metrics, with the most recent pivot high at 0.67747 acting as resistance and the next significant support at 0.60085.

Weekly benchmarks show short- and intermediate-term moving averages trending up, but the longer-term 55, 100, and 200 week MAs remain in a downtrend, suggesting that the broader bearish structure is still intact. Recent trade signals have triggered short entries, aligning with the longer-term bearish bias despite the recent upward swing. Overall, the market is in a consolidation phase with a neutral to bearish tilt, as longer-term resistance levels remain unchallenged and the price is struggling to break above key moving averages. Swing traders should note the potential for further range-bound action or a possible retest of lower support if the recent upward momentum fails to sustain.

Chart Analysis ATS AI Generated: 2025-10-10 07:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.