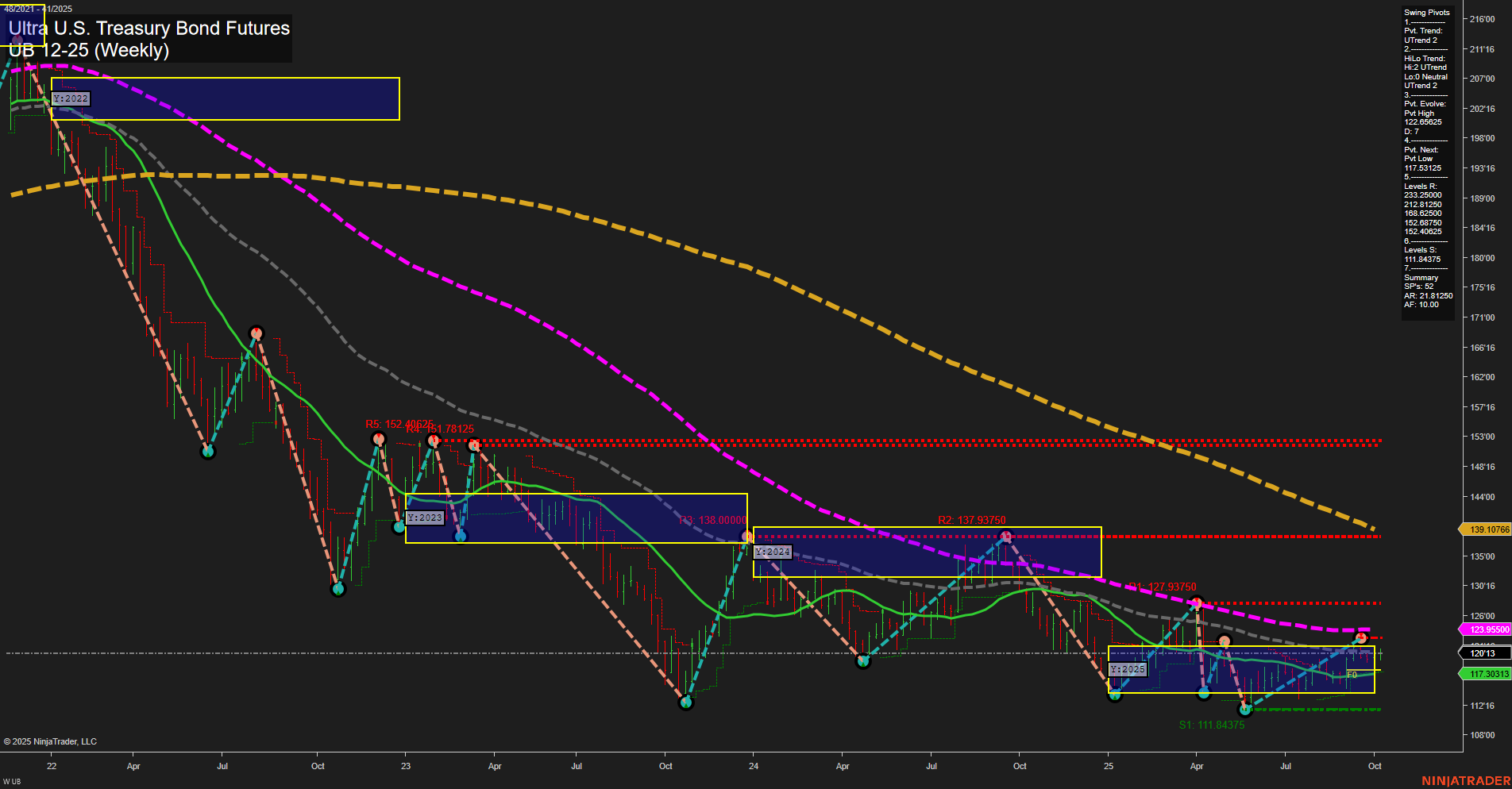

The UB Ultra U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action is consolidating with medium-sized bars and slow momentum, indicating a lack of strong directional conviction in the short term. The Weekly Session Fib Grid (WSFG) trend is down, with price below the NTZ center, reflecting short-term weakness. However, both the Monthly (MSFG) and Yearly (YSFG) Session Fib Grids are trending up, with price above their respective NTZ centers, suggesting a shift toward intermediate and long-term bullishness. Swing pivot analysis confirms an uptrend in both short-term and intermediate-term trends, with the most recent pivot high at 127'09.625 and the next key support at 117'53.125. Resistance levels are clustered well above current price, while support is relatively close, indicating a potential base-building phase. Benchmark moving averages show short- and intermediate-term uptrends, but longer-term averages (55, 100, 200 week) remain in downtrends, highlighting the market's ongoing recovery from a prolonged decline. Recent trade signals have triggered long entries, aligning with the improving intermediate-term outlook. Overall, the chart suggests a market emerging from a bottoming process, with intermediate-term bullish momentum building, but still facing significant overhead resistance and long-term trend inertia. The environment is characterized by consolidation, potential for further base formation, and the early stages of a possible trend reversal.