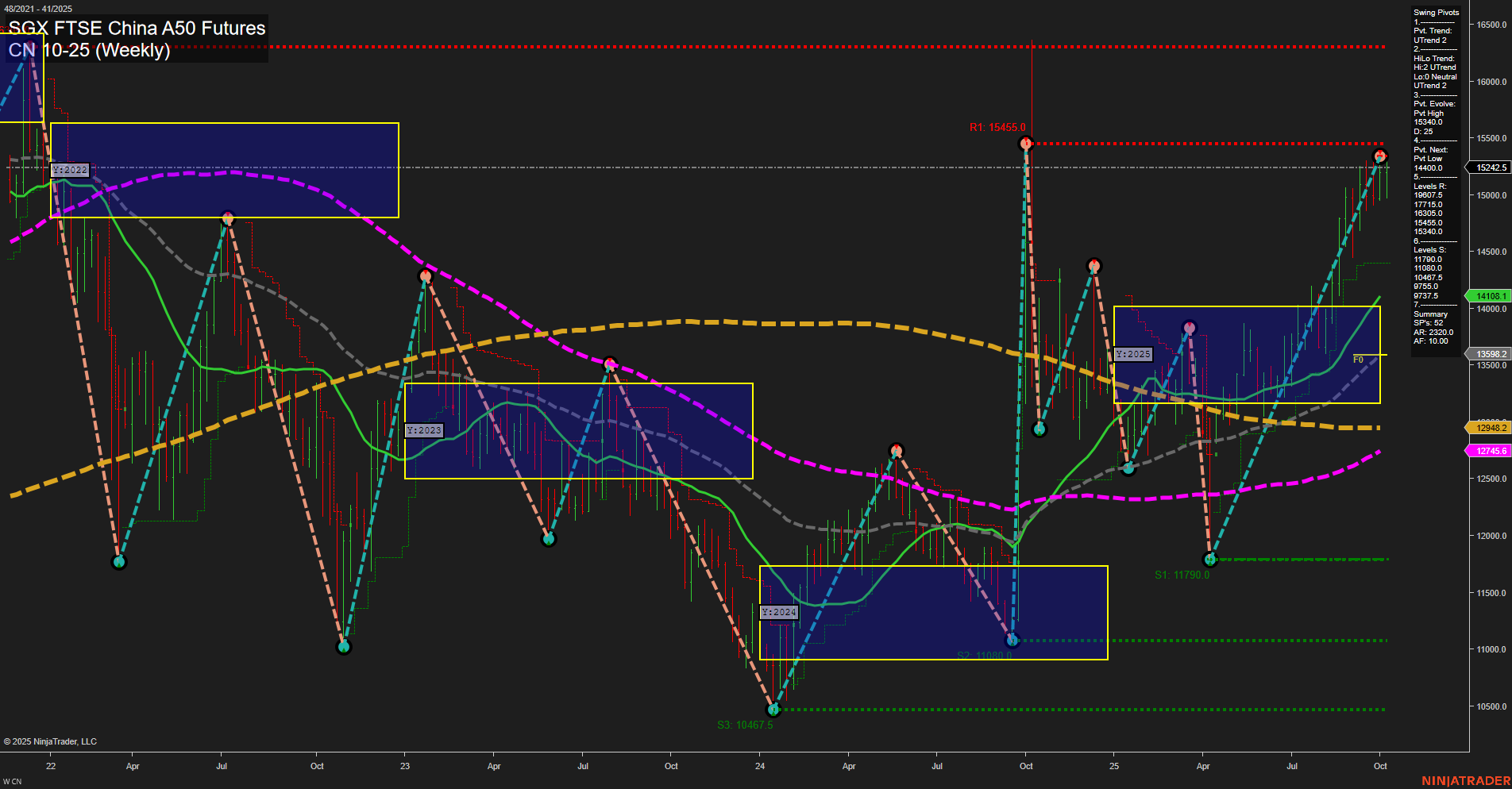

The CN SGX FTSE China A50 Futures have shown a strong upward move, with the latest weekly bar being large and momentum fast, indicating robust buying interest. Both short-term and intermediate-term swing pivot trends are in an uptrend, with the most recent pivot high at 15,455.0 and the next significant support at 14,000.0. Resistance levels are stacked above, but the price is currently testing the upper end of the recent range. All key weekly moving averages (5, 10, 20, 55) are trending up, confirming the bullish momentum, while the longer-term 100 and 200 week MAs remain in a downtrend, suggesting the longer-term structure is still in transition. The price is above all major moving averages except the 100 and 200 week, which may act as lagging resistance. The overall structure reflects a strong recovery from prior lows, with a series of higher lows and higher highs, and the market is currently in a bullish swing phase. However, the neutral bias on the session fib grids and the long-term moving averages indicate that the market is at a critical juncture, potentially transitioning from a long-term base to a new uptrend. Volatility remains elevated, and the market is susceptible to sharp pullbacks, but the prevailing trend is upward in the short and intermediate term.