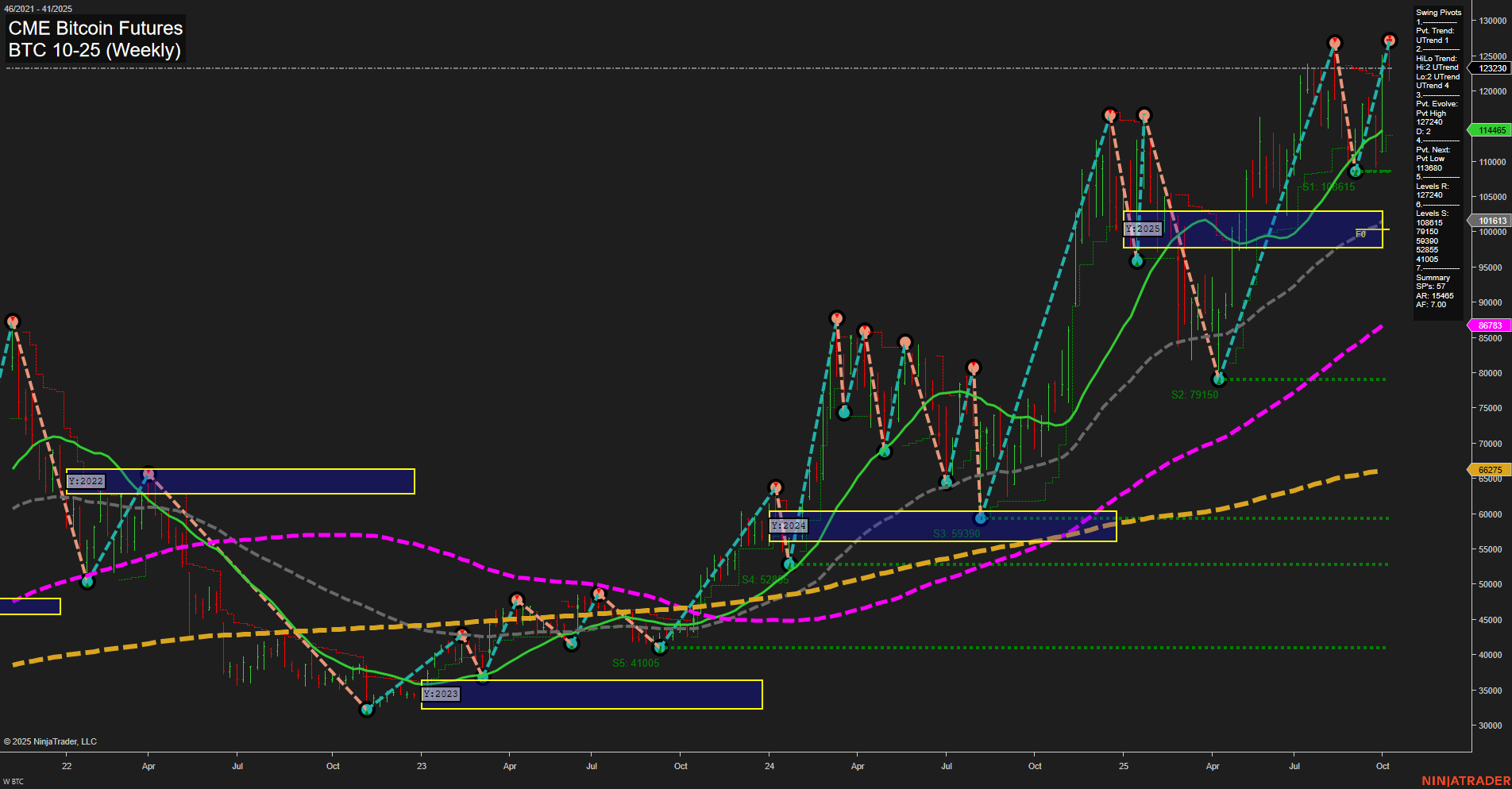

The weekly chart for CME Bitcoin Futures as of October 2025 shows a market that has recently experienced a strong upward move, with price action currently consolidating below recent highs. Momentum is average, and the bars are medium-sized, indicating a pause after a rally rather than a sharp reversal or breakout. The short-term WSFG trend is neutral, reflecting indecision or a potential transition phase, while both the intermediate and long-term MSFG and YSFG trends remain firmly up, with price well above their respective F0%/NTZ levels. Swing pivots confirm an uptrend in both short and intermediate terms, with the most recent pivot high at 124240 acting as resistance and the next pivot low at 113680 as a key support to watch. Multiple support levels are stacked below, suggesting a strong underlying bid on pullbacks. All benchmark moving averages are trending upward, reinforcing the bullish structure across timeframes. Recent trade signals show mixed short-term direction but a bias toward long entries on the intermediate-term. Overall, the market is in a bullish phase on higher timeframes, with short-term consolidation or a minor pullback underway. This environment often precedes either a continuation breakout or a deeper retracement, so swing traders will be watching for confirmation of direction at these key pivot and support/resistance levels.