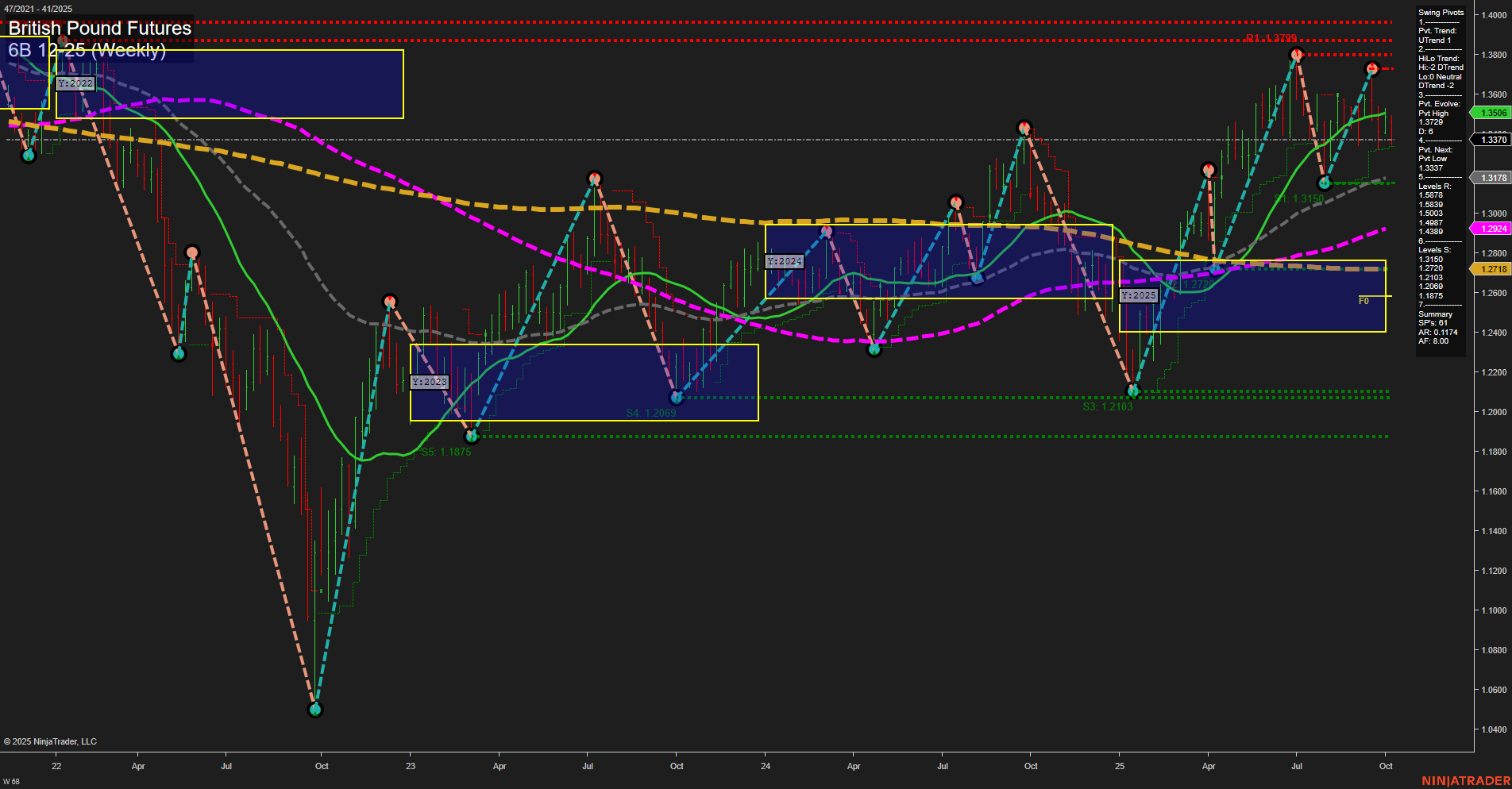

The British Pound Futures (6B) weekly chart shows a complex interplay between short/intermediate-term weakness and long-term strength. Price action is currently at 1.3370 with medium-sized bars and average momentum, indicating neither extreme volatility nor stagnation. The Weekly and Monthly Session Fib Grids (WSFG, MSFG) both show price below their respective NTZ centers and are trending down, confirming a bearish short- and intermediate-term environment. This is reinforced by recent short trade signals and a downward HiLo trend on the swing pivots. However, the Yearly Session Fib Grid (YSFG) remains in an uptrend with price above the NTZ center, and all major long-term moving averages (20, 55, 100, 200 week) are trending up, suggesting underlying bullishness on a larger time frame. The swing pivot structure shows the most recent evolution at a pivot high (1.3749) with the next key support at 1.3150, and further supports much lower, indicating a potential for further downside tests before any sustained recovery. Overall, the market is experiencing a pullback or correction within a broader uptrend, with short-term and intermediate-term traders facing a bearish environment, while long-term participants may still view the structure as constructive. The chart suggests a period of consolidation or retracement, with the potential for volatility as price approaches key support and resistance levels.