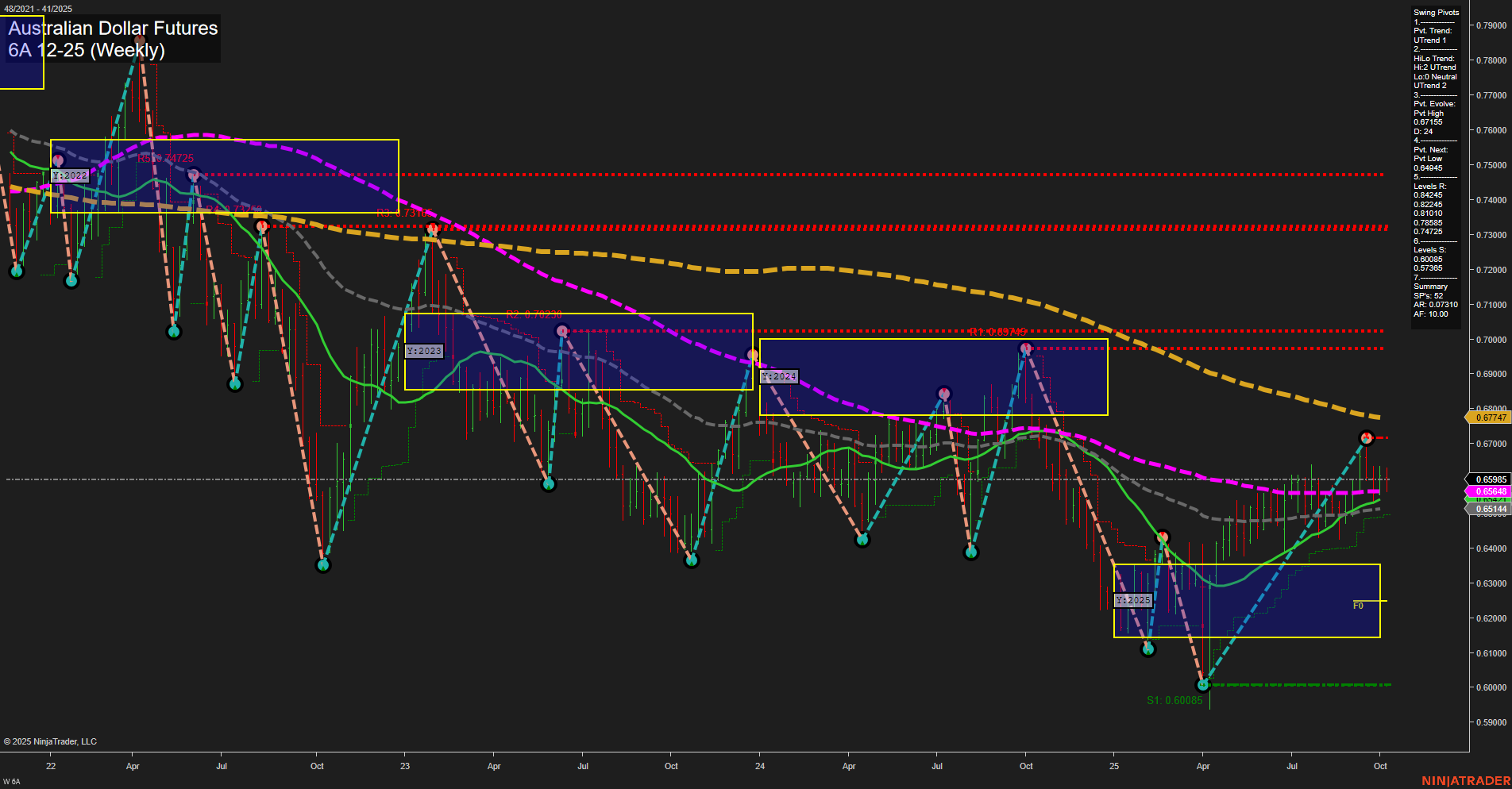

The Australian Dollar Futures (6A) weekly chart shows a market in transition. Price action has recently moved up with average momentum and medium-sized bars, reflecting a recovery from the yearly lows. Both short-term and intermediate-term swing pivot trends are up, indicating a recent bullish phase, but the price is now testing a key resistance area near 0.65865. The 5, 10, and 20-week moving averages are all in uptrends, supporting the intermediate-term bullishness, but the longer-term 55, 100, and 200-week moving averages remain in downtrends, highlighting persistent overhead resistance and a broader bearish structure. The WSFG, MSFG, and YSFG grids all indicate a neutral bias, suggesting the market is consolidating after a significant move. The most recent trade signal is a short entry, aligning with the idea that price is encountering resistance and may be due for a pullback or consolidation. Key resistance levels are stacked above, with 0.69749 as the next major upside barrier, while 0.60085 remains the critical support from the last major swing low. Overall, the chart reflects a market attempting to recover within a longer-term bearish context. The current environment is characterized by a potential pause or retracement after a bullish swing, with the possibility of further consolidation or a retest of support if resistance holds. Swing traders should note the mixed signals across timeframes, with intermediate-term strength facing off against entrenched long-term resistance.