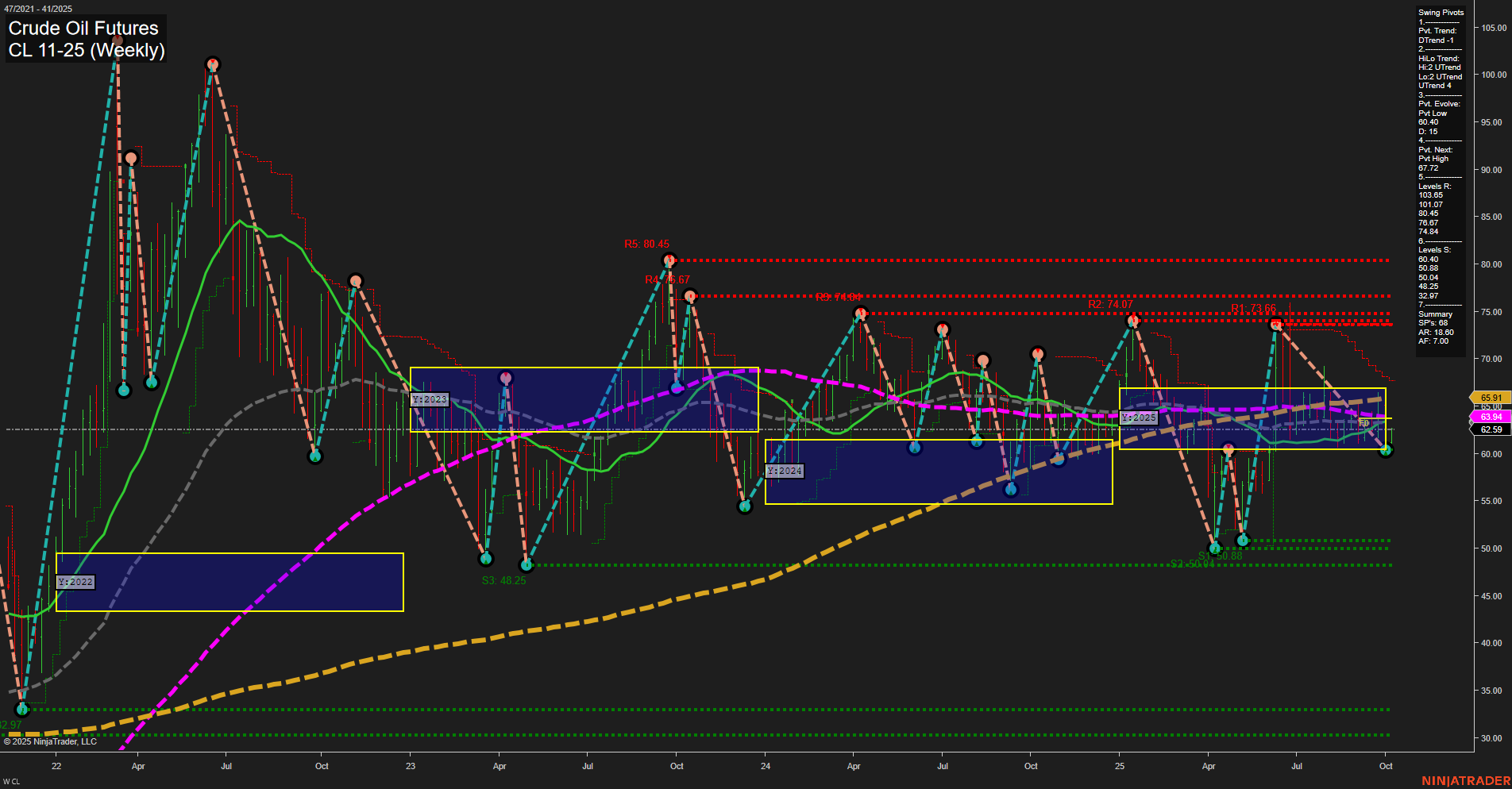

Crude oil futures are currently trading in a consolidation phase, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term WSFG and intermediate-term MSFG both show an upward trend with price above their respective NTZ/F0% levels, suggesting some bullish bias in the near to intermediate term. However, the long-term YSFG remains in a downtrend with price below the yearly NTZ, reflecting persistent bearish pressure on a broader timeframe. Swing pivot analysis highlights a short-term downtrend but an intermediate-term uptrend, with the most recent pivot low at 60.45 and the next significant resistance at the pivot high of 67.72. Major resistance levels are clustered above, while support is well below current prices, indicating a wide trading range and potential for volatility if key levels are tested. All benchmark moving averages across timeframes are in a downtrend, reinforcing the long-term bearish structure despite recent short-term long signals. Recent trade signals show mixed activity, with both long and short entries in early October, reflecting the choppy and indecisive nature of the current market. Overall, the market is in a transitional phase: short-term signals are neutral, intermediate-term structure is bullish, but the long-term trend remains bearish. This environment is characterized by range-bound trading, with potential for breakout or breakdown as price approaches key resistance or support levels. Swing traders should be attentive to evolving momentum and the resolution of this consolidation phase.