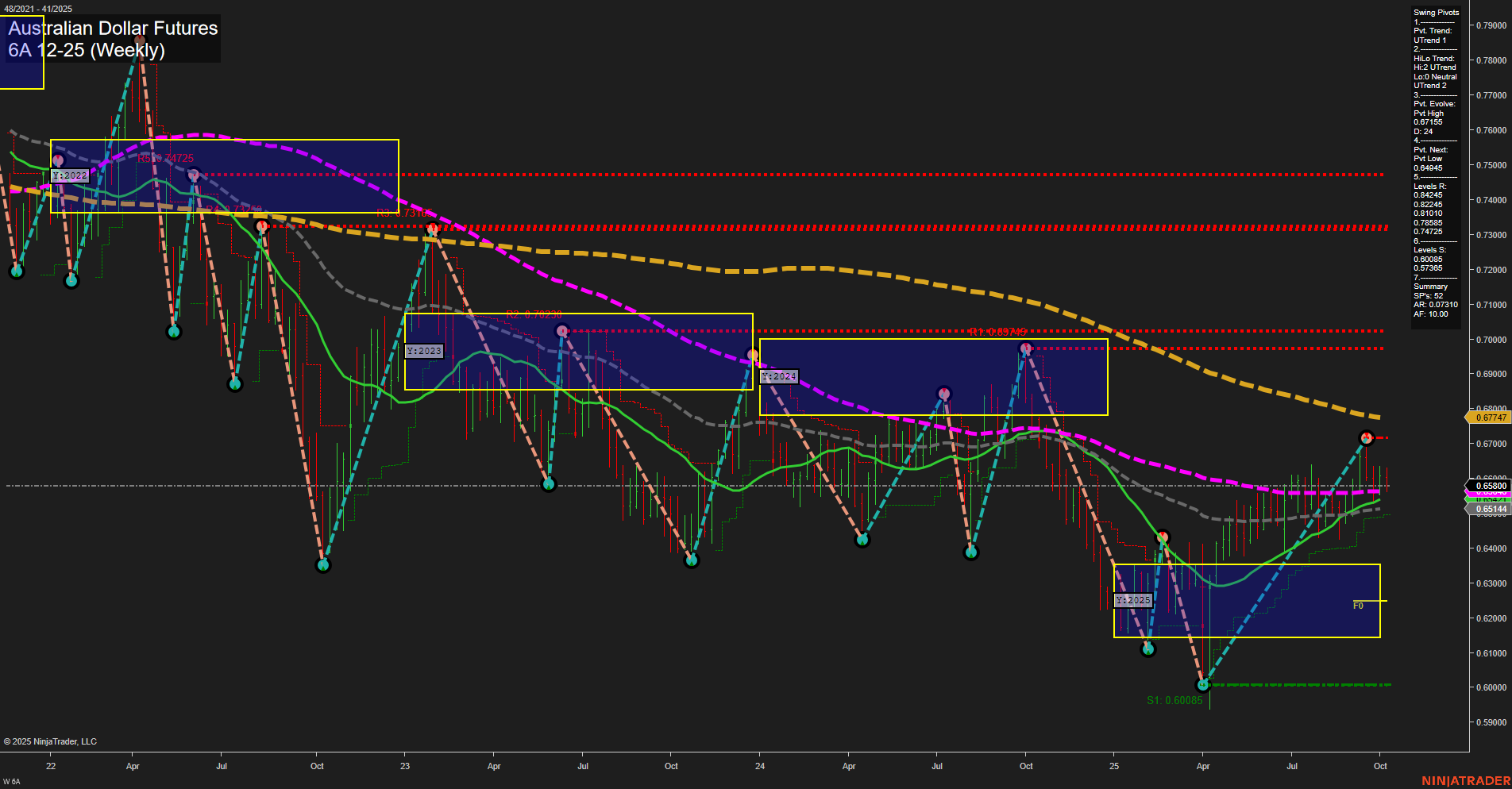

The Australian Dollar Futures (6A) weekly chart shows a market in recovery mode, with price action characterized by medium-sized bars and average momentum, suggesting a steady but not aggressive move. Both short-term and intermediate-term swing pivot trends are up, supported by a series of higher lows and a recent pivot high at 0.67747. The price is currently above the 5, 10, and 20-week moving averages, all of which are trending upward, reinforcing the bullish tone in the short to intermediate term. However, the 55, 100, and 200-week moving averages remain in a downtrend, indicating that the longer-term structure is still neutral and has not yet confirmed a full reversal. Resistance levels are clustered above at 0.67747, 0.69749, and 0.74725, while support is found at 0.65144 and 0.60085. The market is consolidating just below a key resistance, and the neutral bias from the session fib grids across all timeframes suggests a pause or potential inflection point. Overall, the chart reflects a market in transition, with bullish momentum in the short and intermediate term, but with longer-term headwinds still present. This environment often leads to choppy price action as the market tests and potentially rejects higher resistance levels.