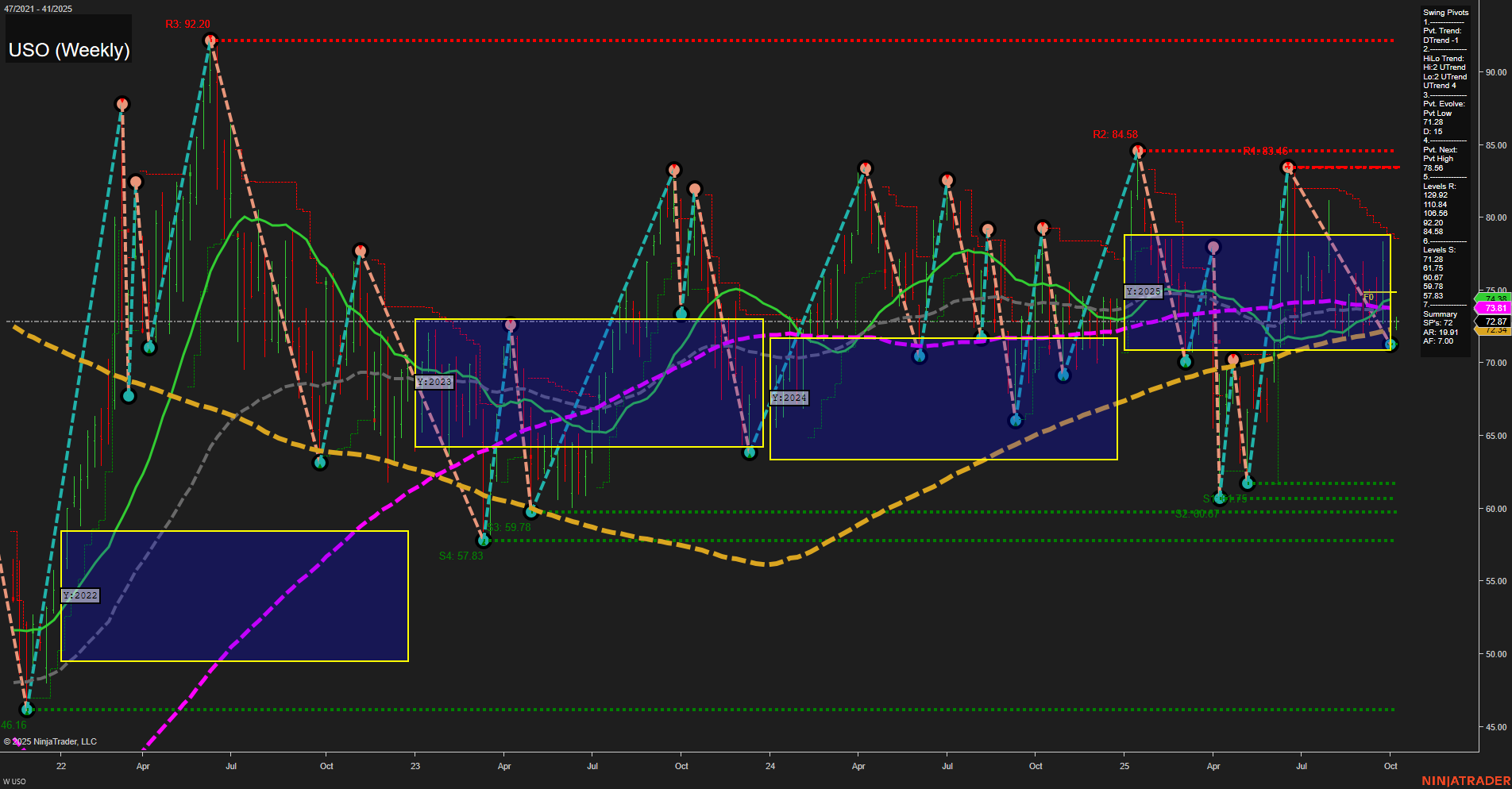

USO is currently trading in a broad consolidation range, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, supported by all key weekly moving averages (5, 10, 20, 55, 100) trending lower, except for the 200-week which remains in an uptrend, suggesting long-term structural support. Intermediate-term HiLo trend remains up, reflecting resilience at higher lows, but the market is struggling to break above resistance levels near 78.96 and higher at 83.46–92.20. Support is clustered around 72.06 and lower at 66.07 and 60.75, highlighting a well-defined trading range. The neutral bias across all session fib grids (weekly, monthly, yearly) and the lack of breakout or breakdown signals point to a choppy, range-bound environment. Futures swing traders may observe that the market is in a holding pattern, awaiting a catalyst for a decisive move, with volatility compressing and price cycling between established support and resistance. The technical landscape suggests a period of consolidation, with potential for either a trend continuation or reversal depending on future price action around these key levels.