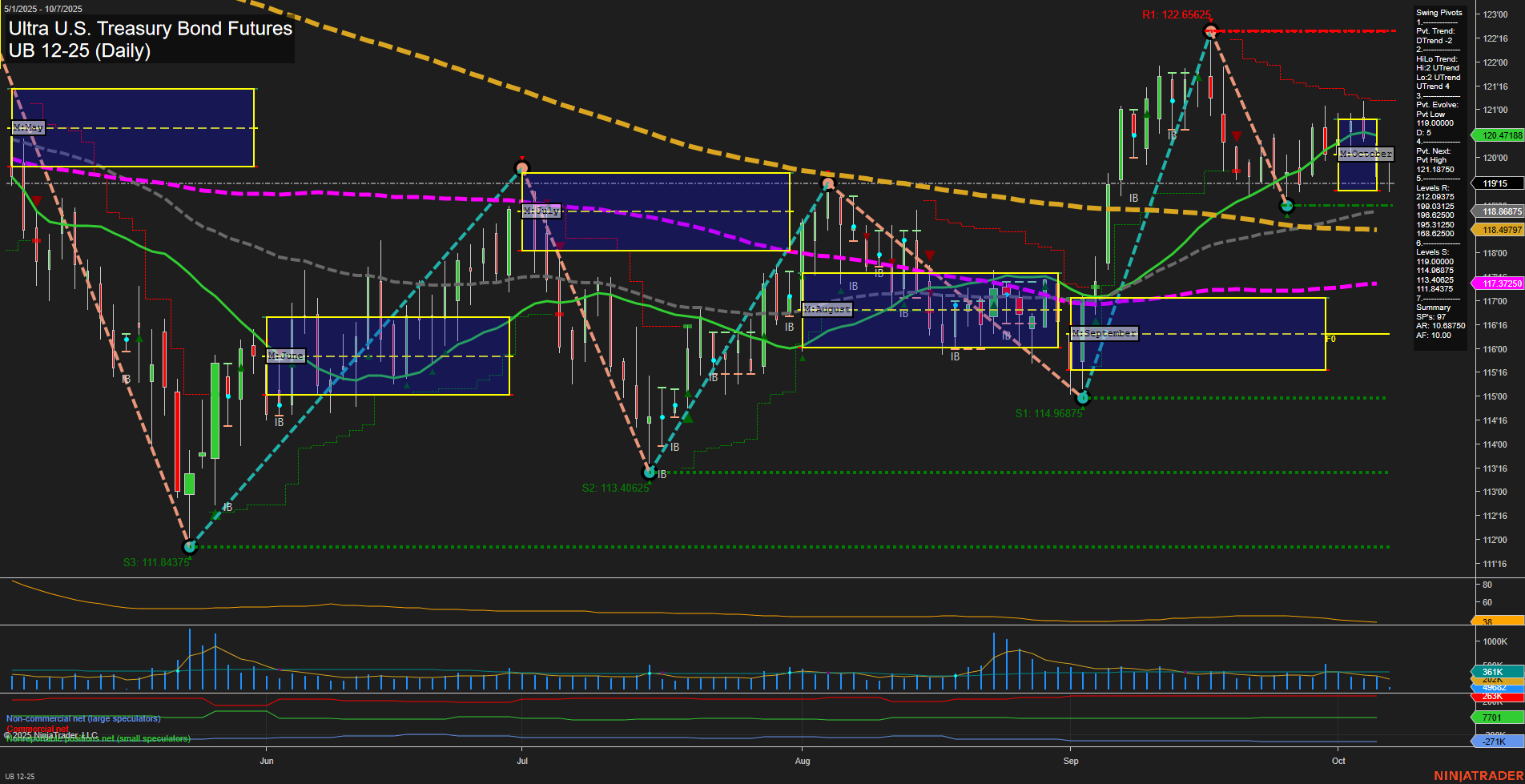

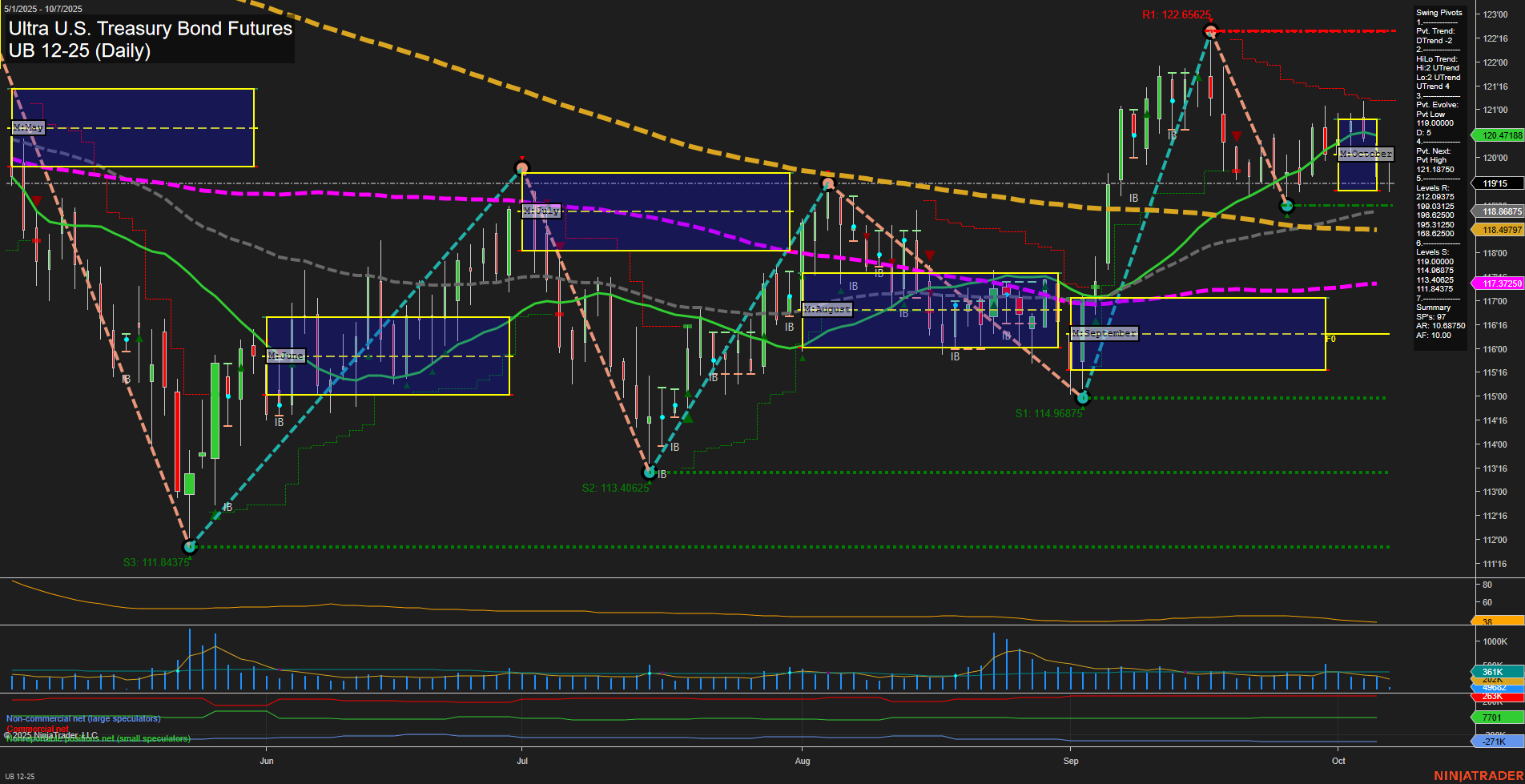

UB Ultra U.S. Treasury Bond Futures Daily Chart Analysis: 2025-Oct-07 07:19 CT

Price Action

- Last: 119.15,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: -52%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -14%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 4%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 118.6875,

- 4. Pvt. Next: Pvt high 120.8125,

- 5. Levels R: 122.65625, 120.8125,

- 6. Levels S: 118.6875, 114.96875, 113.40625, 111.84375.

Daily Benchmarks

- (Short-Term) 5 Day: 119.63 Down Trend,

- (Short-Term) 10 Day: 119.91 Down Trend,

- (Intermediate-Term) 20 Day: 120.47 Up Trend,

- (Intermediate-Term) 55 Day: 118.50 Up Trend,

- (Long-Term) 100 Day: 117.37 Up Trend,

- (Long-Term) 200 Day: 118.50 Down Trend.

Additional Metrics

Recent Trade Signals

- 07 Oct 2025: Short UB 12-25 @ 119.46875 Signals.USAR-MSFG

- 02 Oct 2025: Long UB 12-25 @ 120.8125 Signals.USAR.TR120

- 02 Oct 2025: Long UB 12-25 @ 120.3125 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The UB Ultra U.S. Treasury Bond Futures daily chart shows a market in transition. Short-term and intermediate-term trends are both down, as confirmed by the WSFG and MSFG readings, swing pivot trends, and the direction of the 5- and 10-day moving averages. Price is currently below both the weekly and monthly NTZ/F0% levels, reinforcing the bearish bias for these timeframes. The most recent swing pivot is a low at 118.6875, with the next potential reversal at the 120.8125 pivot high, suggesting a possible area for a counter-trend move if price rebounds. Resistance is stacked above at 120.8125 and 122.65625, while support sits at 118.6875 and lower at 114.96875.

Despite the short- and intermediate-term weakness, the long-term trend remains up, with the 100-day moving average trending higher and the yearly SFG showing price above its F0% level. The 200-day MA, however, is still in a downtrend, indicating some longer-term overhead pressure. Volatility (ATR) is moderate, and volume is steady, suggesting no extreme market conditions. Recent trade signals reflect this mixed environment, with both long and short entries triggered in early October. Overall, the market is in a corrective phase within a larger bullish structure, with short-term momentum favoring the downside but long-term participants still seeing underlying strength.

Chart Analysis ATS AI Generated: 2025-10-07 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.