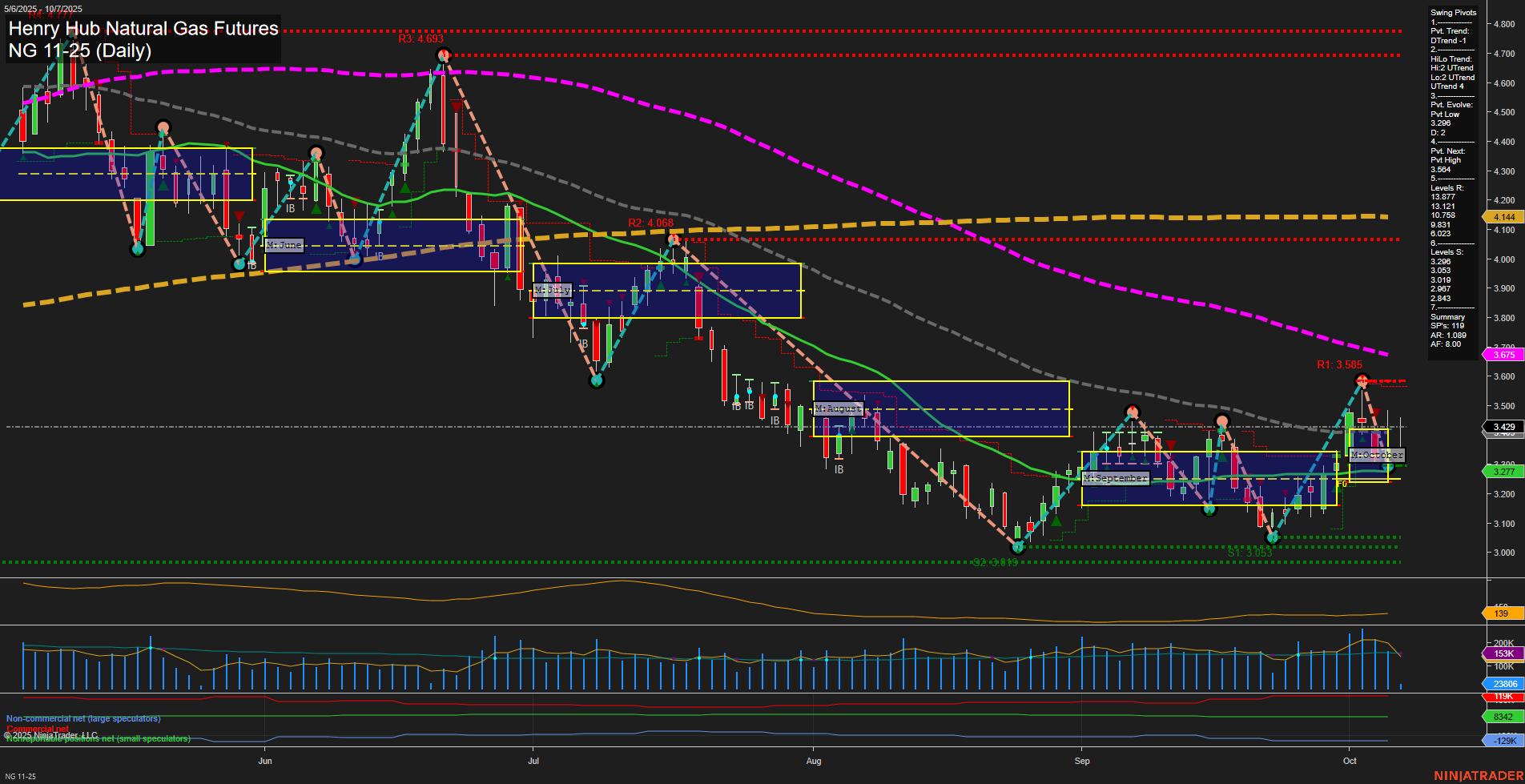

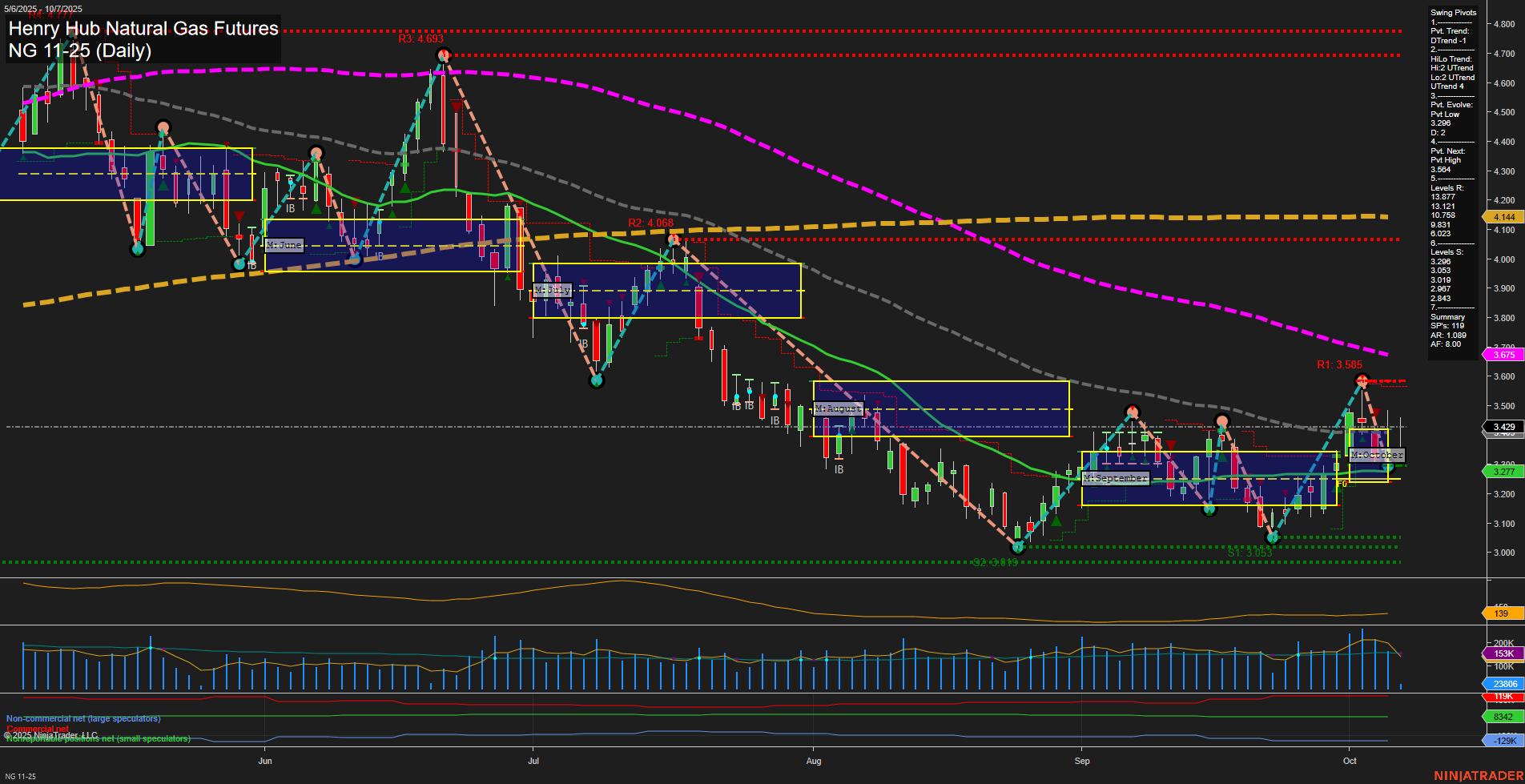

NG Henry Hub Natural Gas Futures Daily Chart Analysis: 2025-Oct-07 07:13 CT

Price Action

- Last: 3.429,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 3.210,

- 4. Pvt. Next: Pvt High 3.585,

- 5. Levels R: 3.585, 4.068, 4.693,

- 6. Levels S: 3.277, 3.063, 2.843.

Daily Benchmarks

- (Short-Term) 5 Day: 3.453 Up Trend,

- (Short-Term) 10 Day: 3.365 Up Trend,

- (Intermediate-Term) 20 Day: 3.277 Up Trend,

- (Intermediate-Term) 55 Day: 3.675 Down Trend,

- (Long-Term) 100 Day: 4.144 Down Trend,

- (Long-Term) 200 Day: 4.023 Down Trend.

Additional Metrics

Recent Trade Signals

- 07 Oct 2025: Long NG 11-25 @ 3.429 Signals.USAR-MSFG

- 06 Oct 2025: Long NG 11-25 @ 3.453 Signals.USAR.TR120

- 01 Oct 2025: Long NG 11-25 @ 3.365 Signals.USAR.TR720

- 29 Sep 2025: Short NG 11-25 @ 3.15 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures have recently shifted from a period of pronounced downtrend to a more neutral-to-bullish posture in the short and intermediate term. Price action shows a medium bar structure with average momentum, indicating a pause after a recent rally. The short-term swing pivot trend remains down (DTrend), but the intermediate HiLo trend has turned up (UTrend), suggesting a possible transition phase. The most recent pivots highlight a support base at 3.210–3.277 and resistance at 3.585, with price currently consolidating just below resistance after a strong bounce from late September lows. Moving averages confirm this mixed environment: short-term and intermediate-term MAs are trending up, while long-term MAs remain in decline, reflecting the broader bearish structure that has dominated most of 2025. Volatility (ATR) and volume (VOLMA) are elevated, consistent with recent breakout and reversal attempts. Recent trade signals have favored the long side, aligning with the intermediate-term bullish shift, but the presence of major resistance overhead and the long-term downtrend suggest the market is at a critical inflection point. The overall setup is one of consolidation and potential trend transition, with the market testing whether it can sustain a move above resistance or revert to the broader bearish trend.

Chart Analysis ATS AI Generated: 2025-10-07 07:13 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.