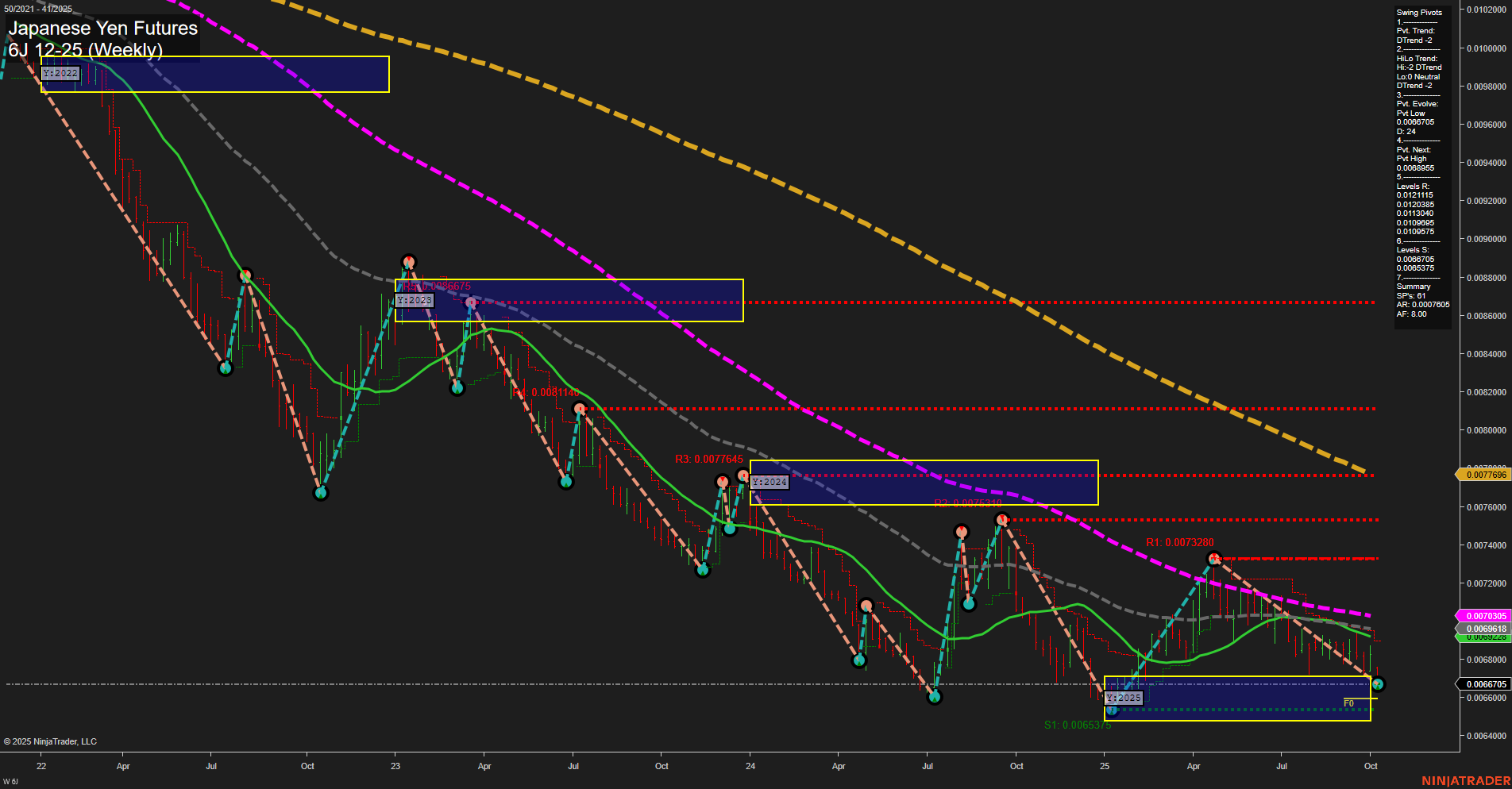

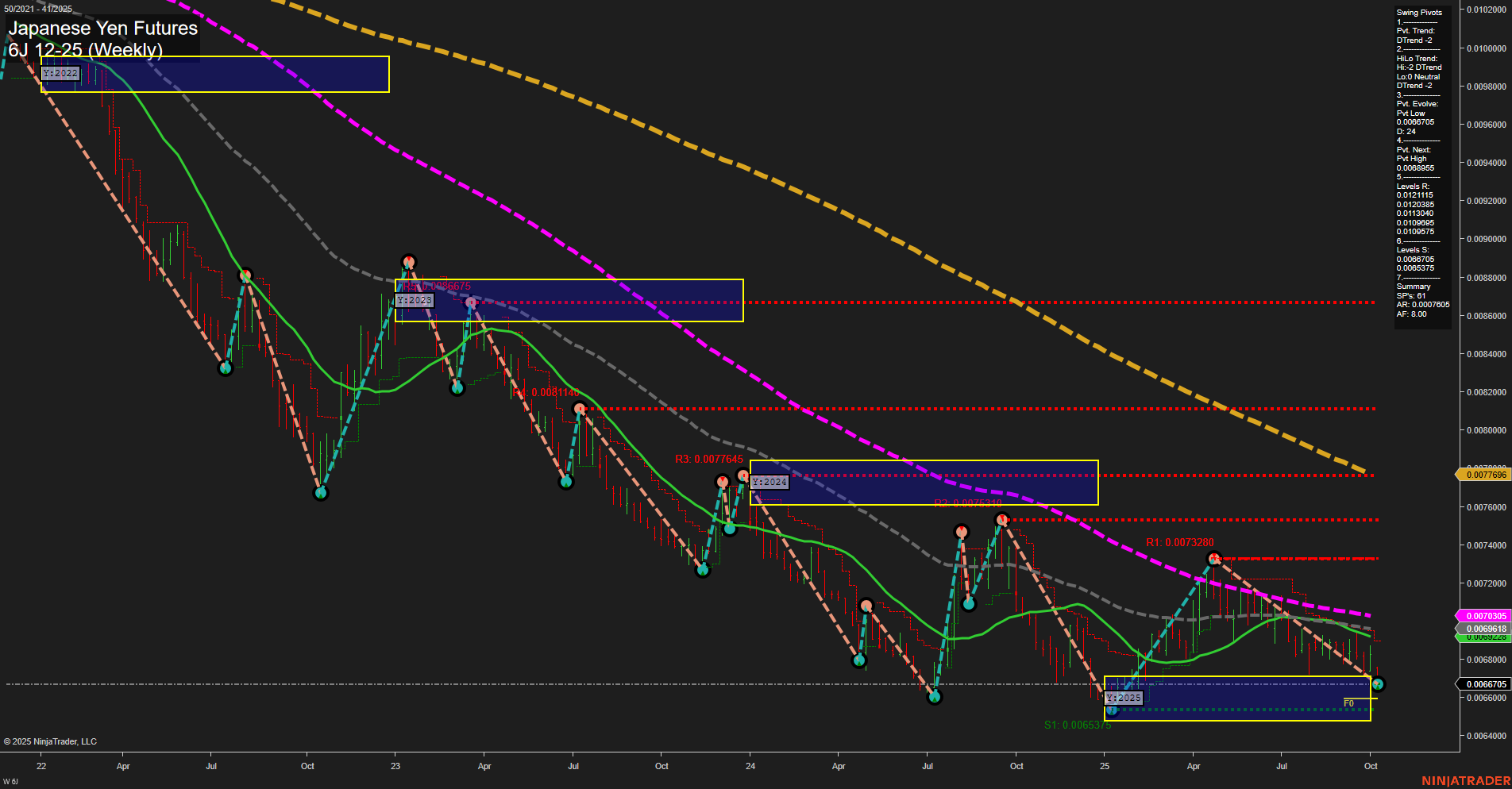

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Oct-07 07:03 CT

Price Action

- Last: 0.006769,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -127%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -51%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 7%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt Low 0.0063575,

- 4. Pvt. Next: Pvt High 0.0069855,

- 5. Levels R: 0.0123115, 0.0123045, 0.011304, 0.0109865, 0.0109875, 0.0077645, 0.0073280,

- 6. Levels S: 0.0063575, 0.0063575, 0.0063575.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0069618 Down Trend,

- (Intermediate-Term) 10 Week: 0.0070935 Down Trend,

- (Long-Term) 20 Week: 0.0070935 Down Trend,

- (Long-Term) 55 Week: 0.0079305 Down Trend,

- (Long-Term) 100 Week: 0.0086675 Down Trend,

- (Long-Term) 200 Week: 0.0097696 Down Trend.

Recent Trade Signals

- 03 Oct 2025: Long 6J 12-25 @ 0.006843 Signals.USAR-MSFG

- 01 Oct 2025: Long 6J 12-25 @ 0.006846 Signals.USAR.TR720

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart continues to reflect a dominant bearish structure in both the short- and intermediate-term timeframes, as evidenced by the persistent downtrend in swing pivots, HiLo trend, and all key moving averages. Price remains below the NTZ center and F0% on both the weekly and monthly session fib grids, reinforcing the downward momentum. The most recent swing pivot is a low at 0.0063575, with the next potential resistance at 0.0069855, but major resistance levels remain far above current price, indicating significant overhead supply. Despite a slight uptick in the yearly session fib grid and a couple of recent long signals, the long-term trend is only neutral, as price is still well below all major long-term moving averages. The market is in a prolonged downtrend, with slow momentum and medium-sized bars suggesting a lack of strong conviction from either buyers or sellers. The overall environment is characterized by continued weakness, with any rallies likely to encounter resistance at prior swing highs and moving averages. The technical landscape suggests the market is still searching for a durable bottom, with no clear evidence of a sustained reversal at this stage.

Chart Analysis ATS AI Generated: 2025-10-07 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.