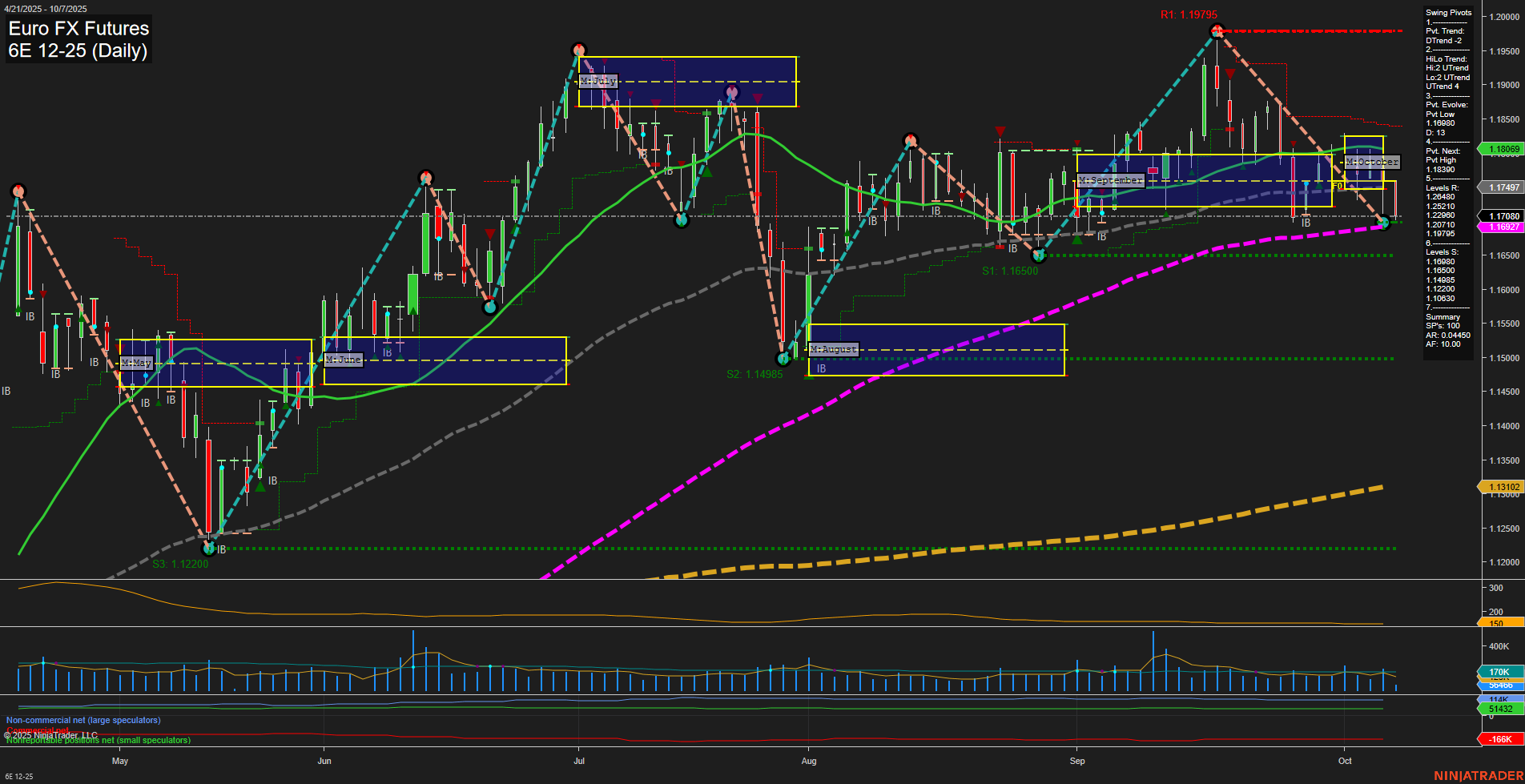

The 6E Euro FX Futures daily chart is currently showing a clear short-term and intermediate-term bearish structure, with price trading below both the weekly and monthly session fib grid NTZ levels and all short/intermediate moving averages trending down. The swing pivot trend is also down, with the most recent pivot low at 1.16627 acting as immediate support, while resistance is stacked above at 1.18069, 1.18380, and the major swing high at 1.19795. Recent trade signals have all been to the short side, confirming the prevailing downside momentum, though the pace is slow and bars are medium-sized, suggesting a controlled, non-volatile decline rather than a sharp selloff. Despite this, the long-term trend remains up, as indicated by the yearly session fib grid and the 100/200 day moving averages, which could provide a foundation for future bullish reversals if price finds support and stabilizes. For now, the market is in a corrective phase within a larger uptrend, with the potential for further downside tests toward the 1.16627 and 1.14985 support levels before any significant recovery attempt. Volatility and volume are moderate, and the market is not exhibiting signs of panic or capitulation, but rather a methodical retracement. Swing traders should be attentive to any signs of reversal or exhaustion near key support, as well as the behavior around the next pivot high at 1.18380 for clues on a possible trend change or continuation.