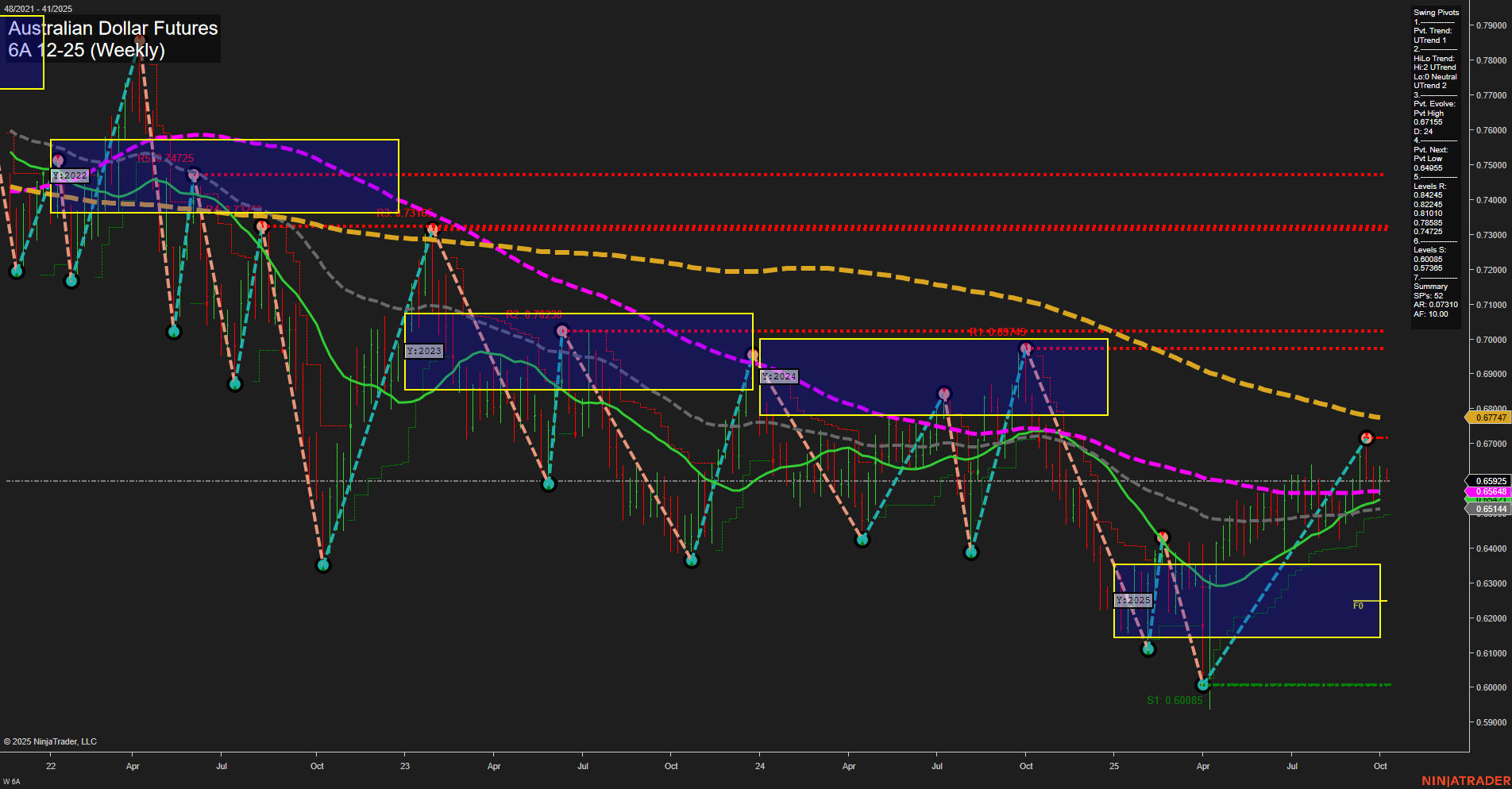

The Australian Dollar Futures (6A) weekly chart shows a market in transition. Price action has been characterized by medium-sized bars and average momentum, suggesting neither strong trending nor high volatility. The short-term and long-term Fib grid trends are neutral, with price currently oscillating near the center of the NTZ (neutral zone), indicating a lack of clear directional bias in both the weekly and yearly context. Swing pivot analysis reveals an upward trend in both short-term and intermediate-term metrics, with the most recent pivot high at 0.66949 acting as immediate resistance, and the next significant support at 0.60085. Multiple resistance levels above current price could cap further advances, while support levels are well-defined below. Benchmark moving averages show a constructive intermediate-term structure, with the 5, 10, and 20-week MAs all trending higher and clustered just below current price, providing a supportive base. However, the longer-term 55, 100, and 200-week MAs remain in downtrends and above the market, highlighting overhead resistance and a broader neutral to bearish backdrop. Recent trade signals reflect mixed sentiment, with both long and short entries triggered in the past two weeks, consistent with a choppy, range-bound environment. The overall rating is neutral for the short-term, bullish for the intermediate-term due to the uptrend in swing pivots and moving averages, and neutral for the long-term as price remains below major resistance and long-term MAs. In summary, the 6A futures market is consolidating after a recovery from yearly lows, with intermediate-term bullish momentum facing significant long-term resistance. The market is in a holding pattern, awaiting a catalyst for a decisive breakout or breakdown.