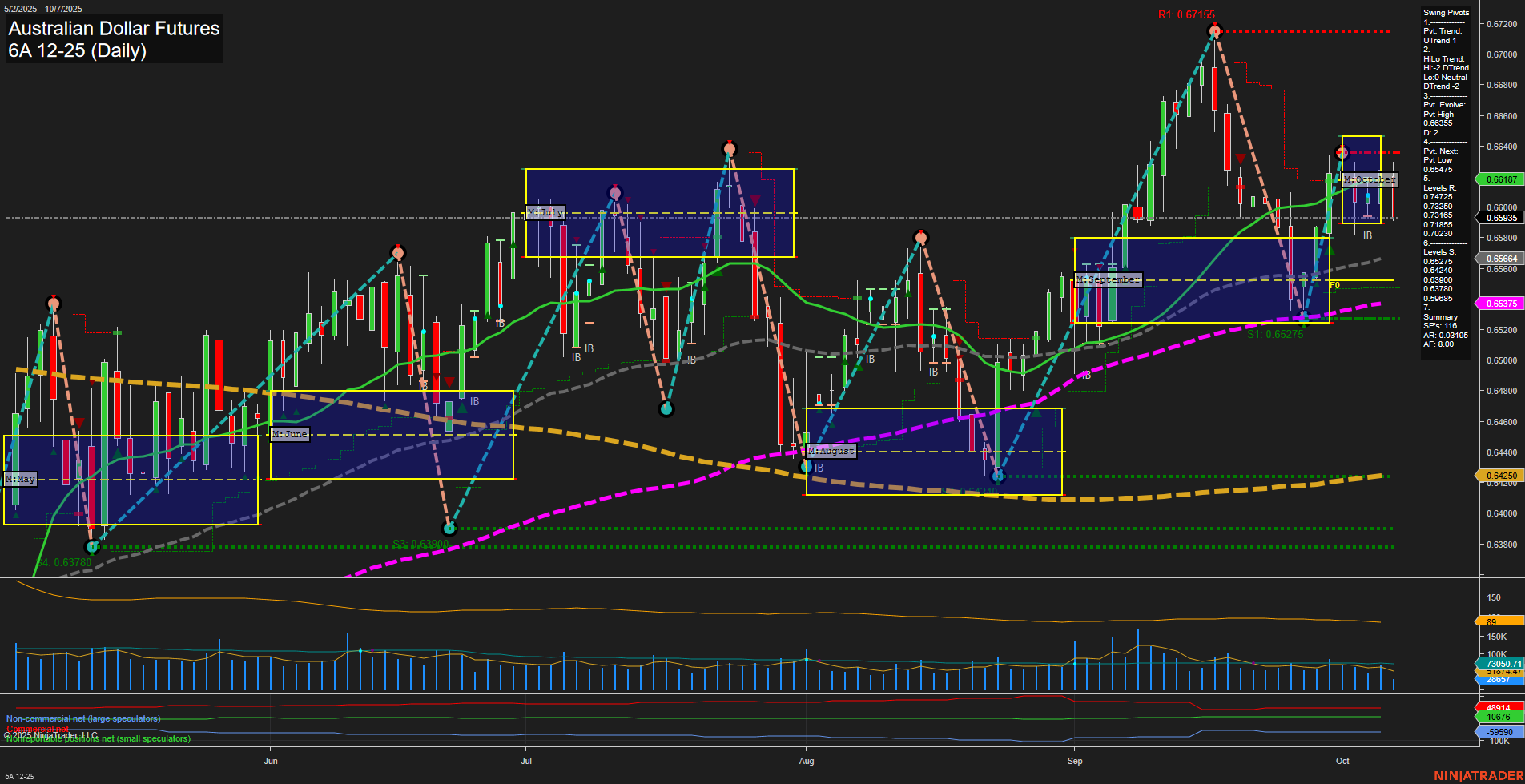

The Australian Dollar Futures (6A) daily chart is currently showing a mixed technical landscape. Price action is consolidating near 0.65965 with medium-sized bars and average momentum, reflecting a lack of clear directional conviction. Both the weekly and monthly session fib grids (WSFG, MSFG) are neutral, indicating no dominant short- or intermediate-term bias. Swing pivots reveal a short-term uptrend but an intermediate-term downtrend, with the most recent pivot high at 0.66475 and the next key support at 0.65275. Resistance levels are stacked above, suggesting overhead supply, while support levels are layered below, providing a potential floor. Short-term moving averages (5 and 10 day) are in uptrends, but the 20-day is in a downtrend, highlighting some near-term indecision. Intermediate and long-term moving averages (55, 100, 200 day) remain in uptrends, supporting a broader bullish structure. ATR and volume metrics indicate moderate volatility and participation. Recent trade signals have flipped between long and short, underscoring the choppy, range-bound nature of the current market. Overall, the short-term outlook is neutral, the intermediate-term is bearish due to the prevailing downtrend in swing pivots and the 20-day MA, while the long-term remains bullish as supported by the higher timeframe moving averages. The market is in a consolidation phase, with traders watching for a breakout or breakdown from the current range to establish the next directional move.