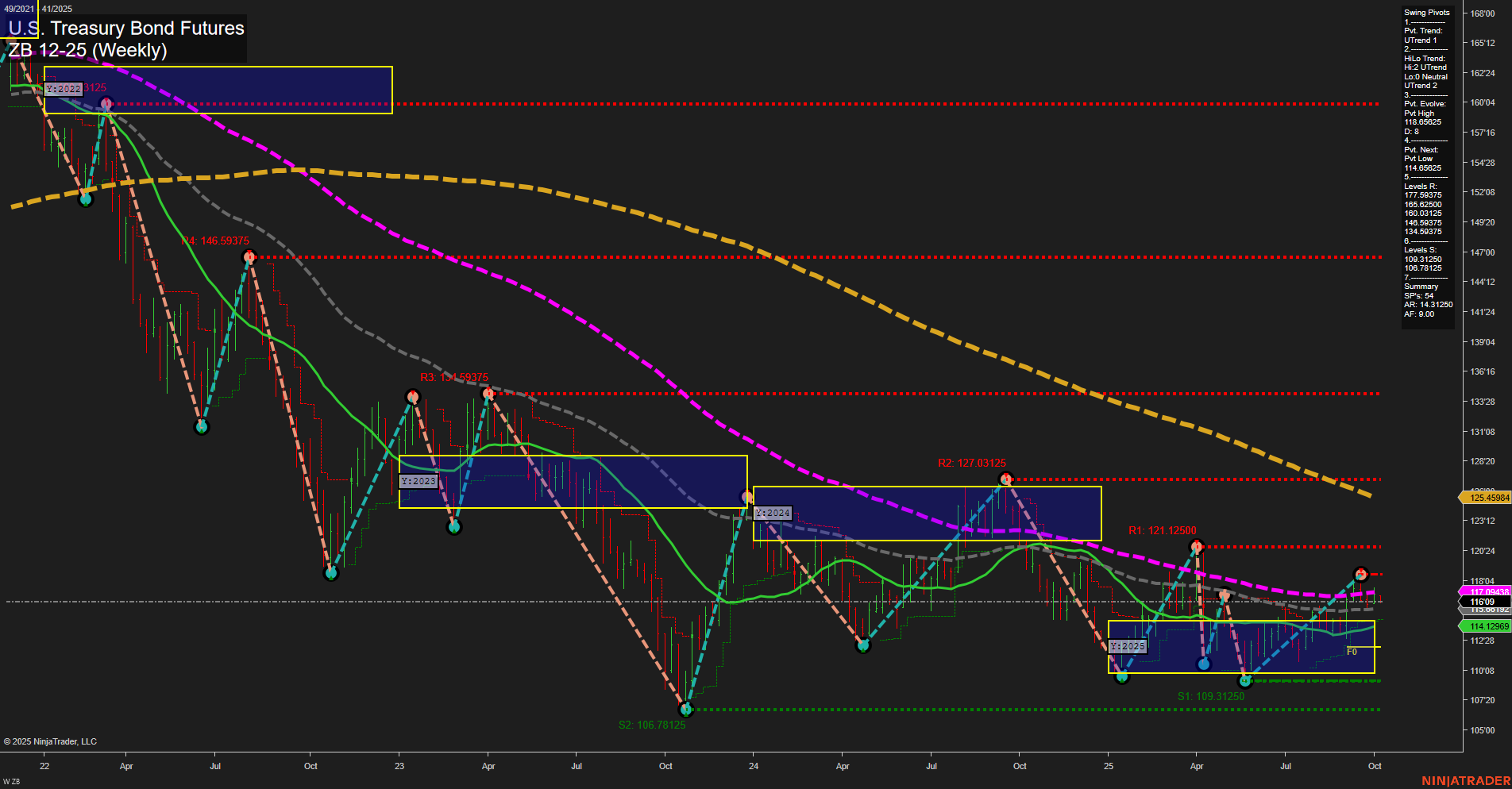

The ZB U.S. Treasury Bond Futures weekly chart shows a market in the midst of a recovery phase after a prolonged downtrend, with recent price action characterized by medium-sized bars and average momentum. The short- and intermediate-term trends have shifted to bullish, as indicated by both the swing pivot trends and the upward movement of the 5, 10, 20, and 55-week moving averages. However, the long-term picture remains neutral, with the 100- and 200-week moving averages still trending down, reflecting the legacy of the prior bear market. Price is currently trading above key intermediate and long-term moving averages, suggesting underlying strength, but remains well below the major resistance levels at 127.59375 and 125.03125. The market is consolidating within the yearly NTZ (neutral zone), with no clear directional bias from the session fib grids, indicating a period of digestion after the recent rally. Support is well-defined at 109.3125 and 106.78125, while resistance is layered above, hinting at potential for further upside if these levels are breached. Overall, the technical structure suggests a market transitioning from bearish to neutral/bullish, with swing traders likely to focus on breakout and pullback opportunities as the market tests overhead resistance and attempts to establish a new trend direction. The absence of strong directional signals from the fib grids and the presence of both higher lows and lower highs point to a choppy, range-bound environment in the near term, with volatility likely to persist as the market seeks clarity on macroeconomic drivers.