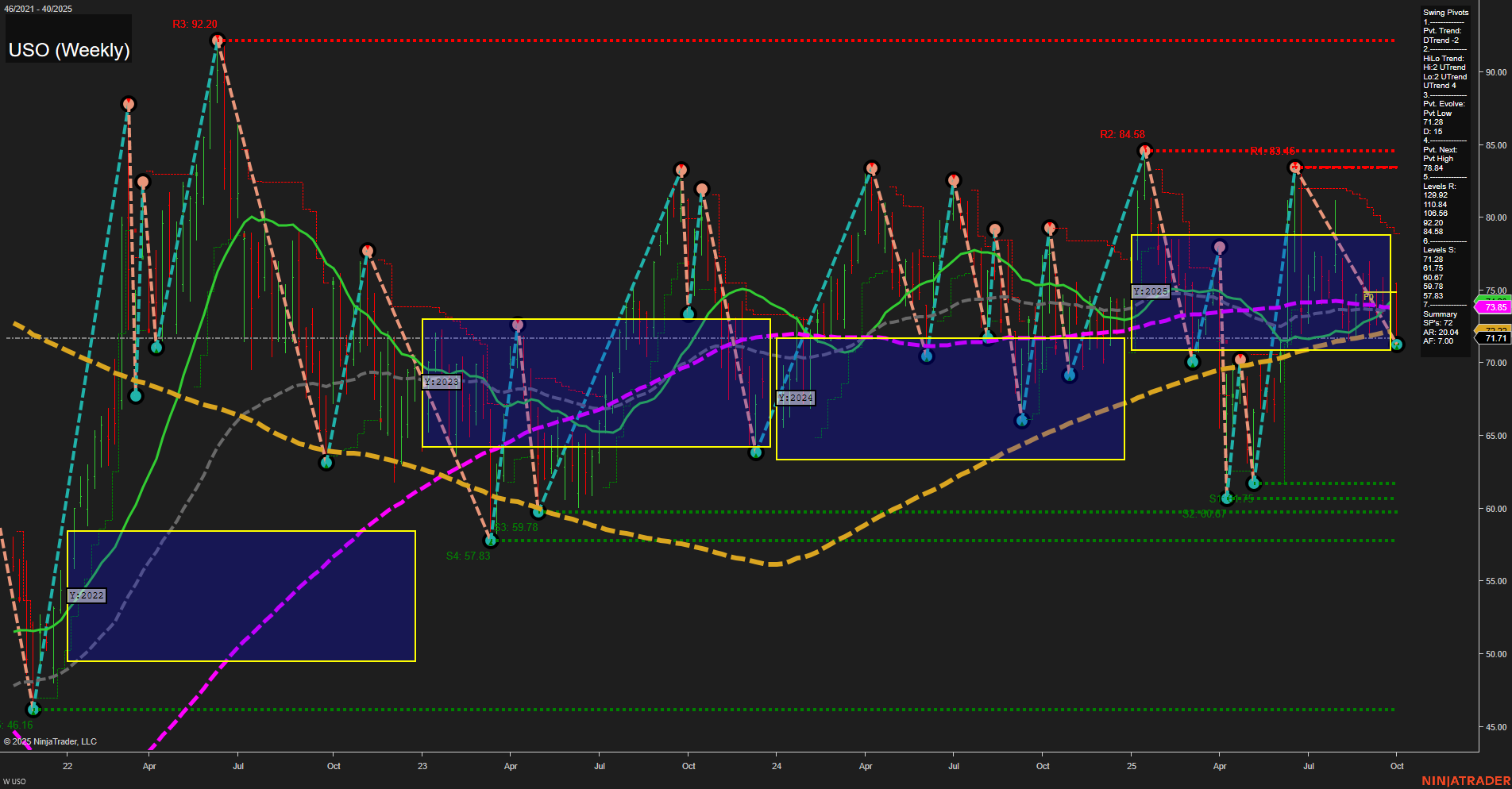

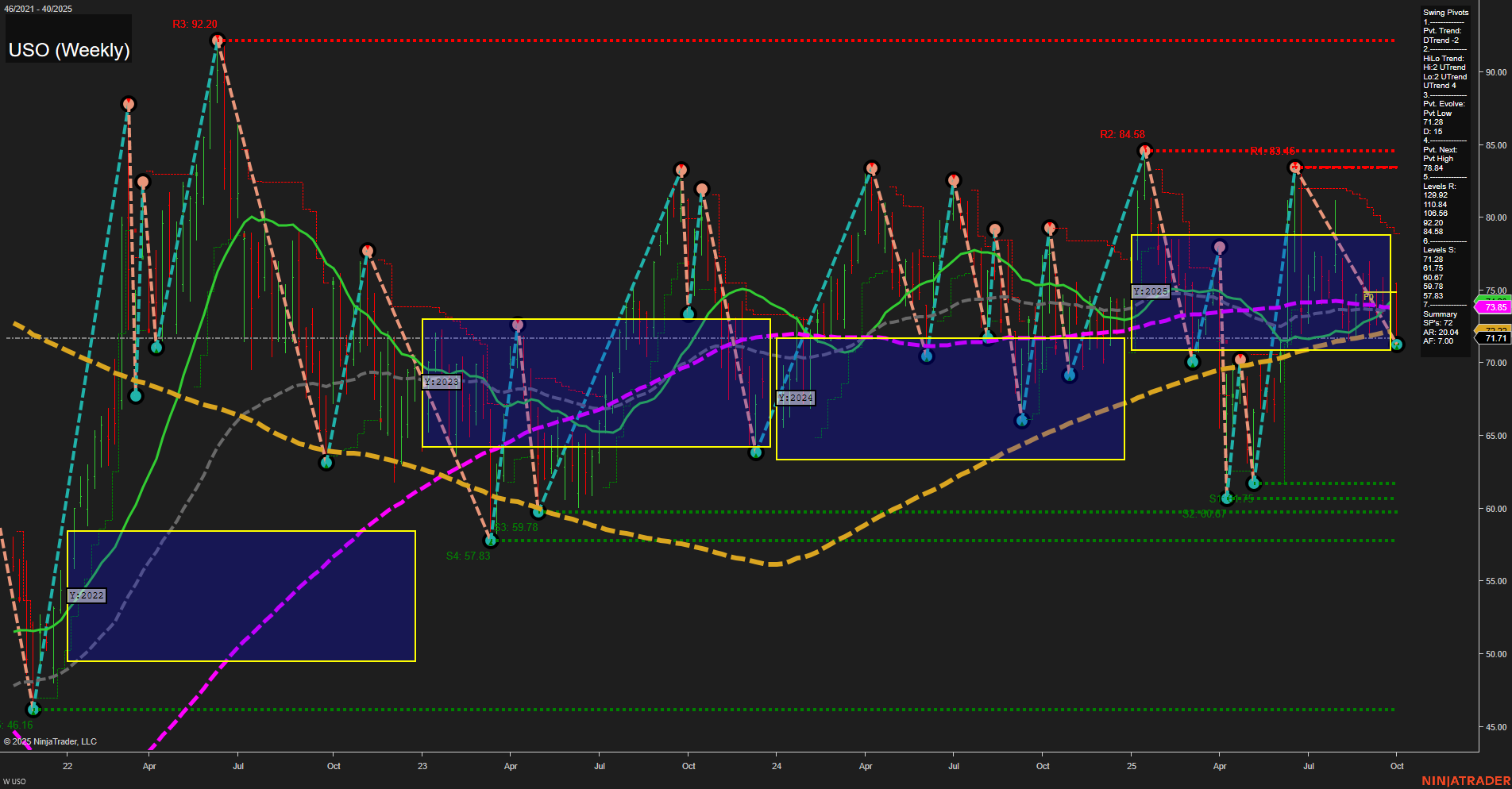

USO United States Oil Fund LP Weekly Chart Analysis: 2025-Oct-06 07:22 CT

Price Action

- Last: 73.85,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 67.49,

- 4. Pvt. Next: Pvt high 84.58,

- 5. Levels R: 92.20, 89.46, 84.58, 83.46,

- 6. Levels S: 67.49, 57.83, 53.59, 45.16.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 75.00 Down Trend,

- (Intermediate-Term) 10 Week: 73.72 Down Trend,

- (Long-Term) 20 Week: 73.85 Down Trend,

- (Long-Term) 55 Week: 71.71 Up Trend,

- (Long-Term) 100 Week: 72.04 Up Trend,

- (Long-Term) 200 Week: 71.11 Up Trend.

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

USO is currently trading in a broad consolidation range, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, while the intermediate-term HiLo trend remains up, reflecting a mixed environment. Price is hovering near the 20-week and 10-week moving averages, both of which are trending down, suggesting short-term pressure. However, the longer-term 55, 100, and 200-week moving averages are still in uptrends, providing underlying support. Resistance is clustered in the mid-80s to low-90s, while support is well-defined in the high-60s and below. The neutral stance across the session fib grids (weekly, monthly, yearly) and the lack of a clear breakout or breakdown pattern point to continued range-bound trading. Futures swing traders may note the choppy, sideways structure, with potential for mean reversion plays between established support and resistance, but no clear trend continuation or reversal signal at this time.

Chart Analysis ATS AI Generated: 2025-10-06 07:23 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.