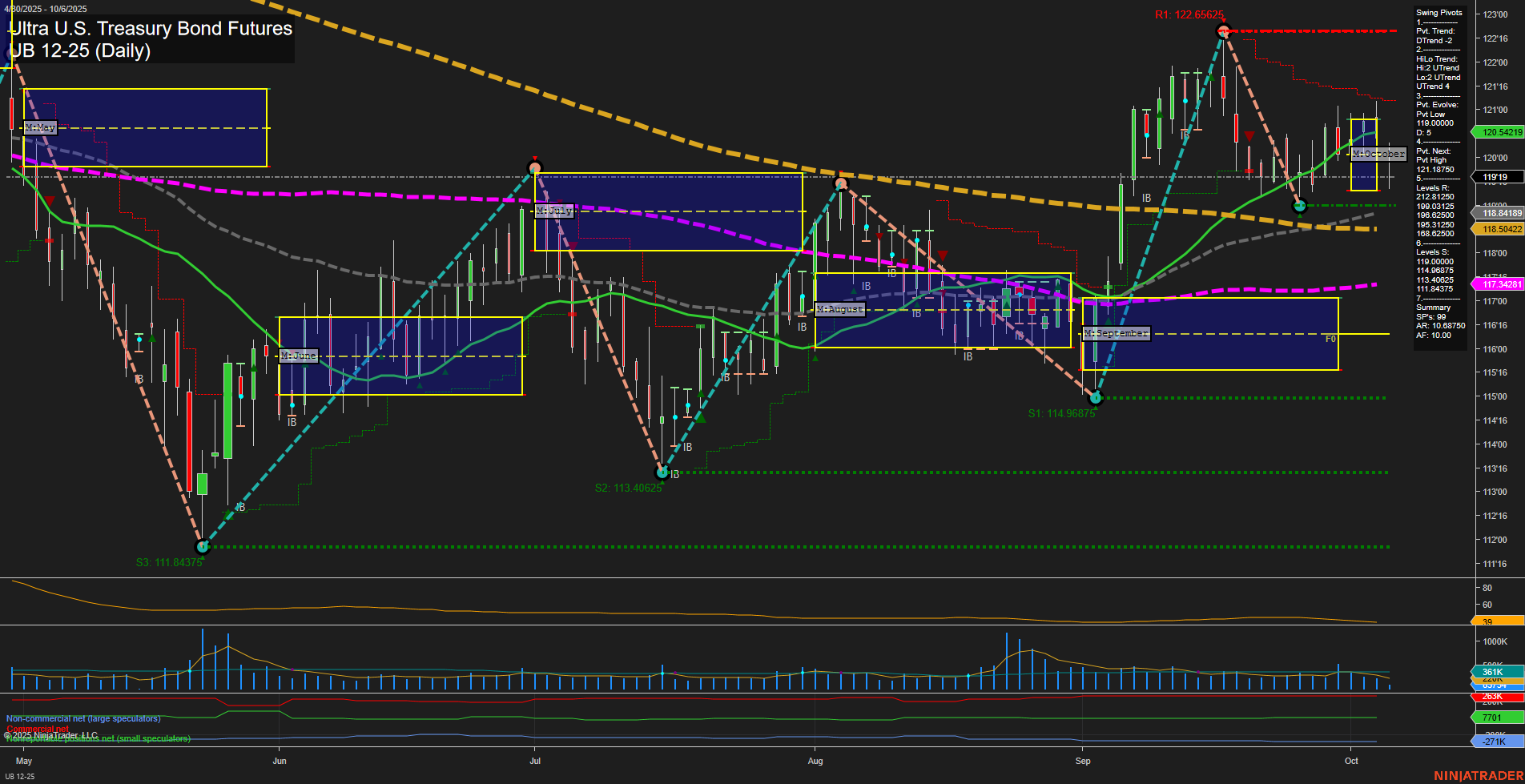

The UB Ultra U.S. Treasury Bond Futures daily chart reflects a market in transition. Short-term momentum remains bearish, as indicated by the downward WSFG trend, price action below the weekly and monthly NTZ/F0% levels, and both 5- and 10-day moving averages trending down. However, the intermediate-term picture is more mixed: while the MSFG trend is still down, the HiLo swing pivot trend has shifted to up, and the 20-, 55-, 100-, and 200-day moving averages are all in uptrends, suggesting underlying support and a possible base forming. The long-term YSFG trend is up, with price holding above the annual NTZ/F0% level, reinforcing a bullish structural bias. Swing pivots show the most recent evolution at a swing high (121.1875), with the next key level to watch being a potential swing low at 118.8125. Resistance is layered above at 121.1875 and 122.65625, while support is well-defined below, with several levels down to 111.84375. Recent trade signals have triggered long entries, reflecting attempts to capture a reversal or continuation from recent lows. Volatility (ATR) and volume (VOLMA) are moderate, indicating a market that is active but not excessively volatile. Overall, the market is in a short-term pullback or consolidation phase within a broader bullish long-term structure. The interplay between short-term weakness and long-term strength suggests a period of choppy price action, with potential for either a deeper retracement or a resumption of the uptrend if support levels hold and momentum shifts.