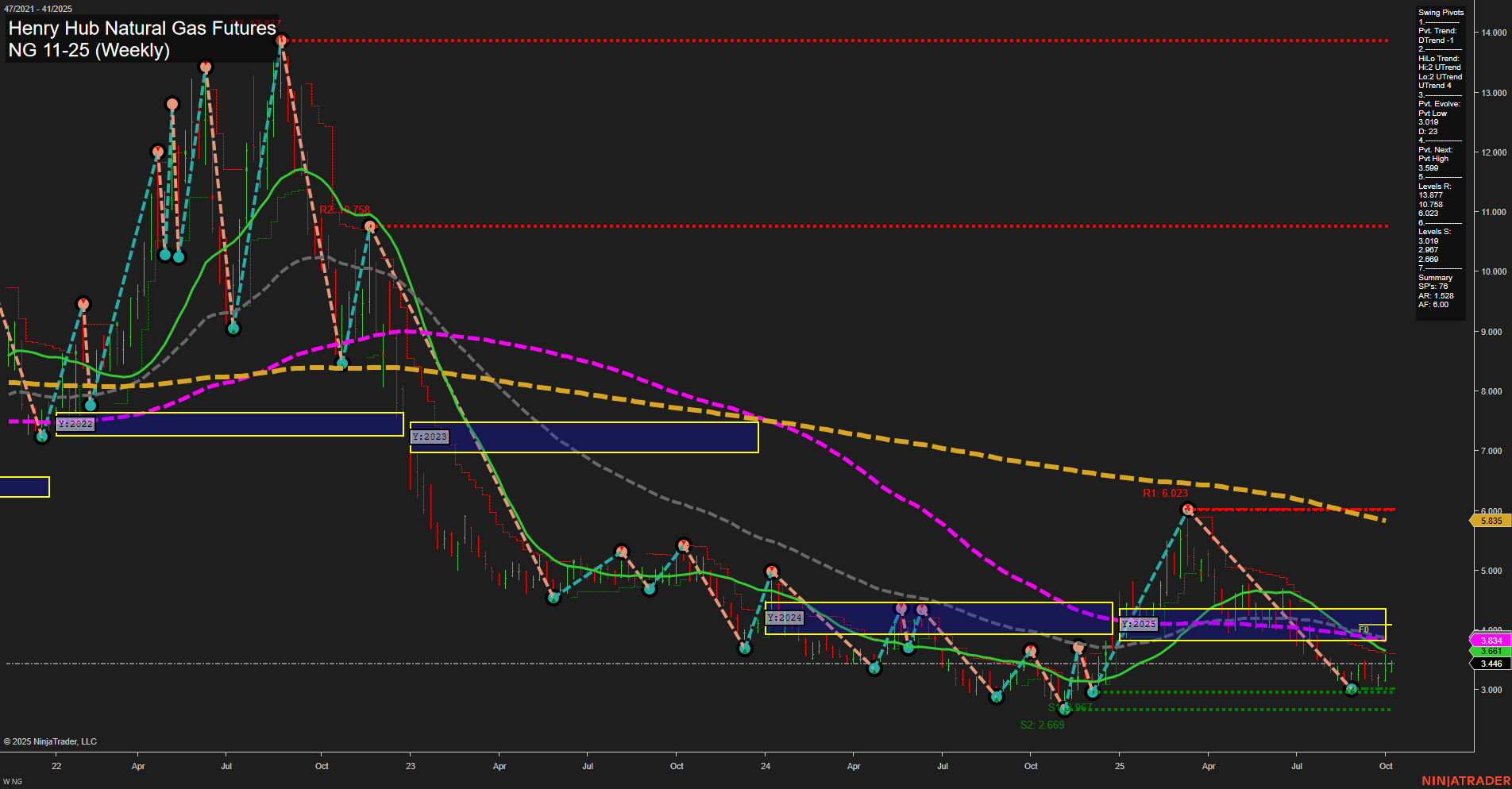

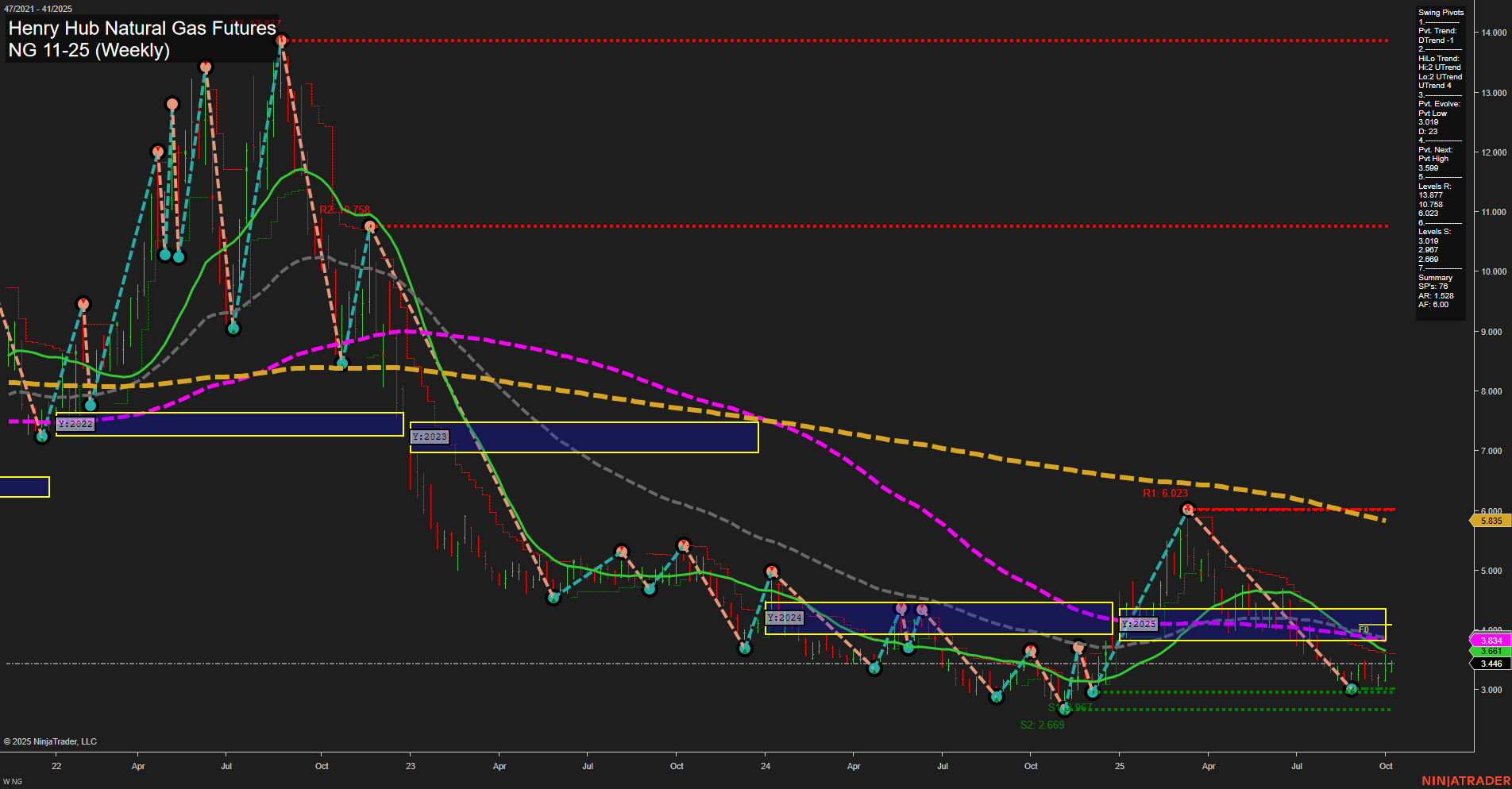

NG Henry Hub Natural Gas Futures Weekly Chart Analysis: 2025-Oct-06 07:14 CT

Price Action

- Last: 3.446,

- Bars: Small,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 3.109,

- 4. Pvt. Next: Pvt high 3.609,

- 5. Levels R: 13.877, 10.738, 6.023,

- 6. Levels S: 3.097, 2.669, 2.089.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 3.694 Down Trend,

- (Intermediate-Term) 10 Week: 3.834 Down Trend,

- (Long-Term) 20 Week: 4.061 Down Trend,

- (Long-Term) 55 Week: 5.835 Down Trend,

- (Long-Term) 100 Week: 7.768 Down Trend,

- (Long-Term) 200 Week: 9.601 Down Trend.

Recent Trade Signals

- 06 Oct 2025: Long NG 11-25 @ 3.453 Signals.USAR.TR120

- 06 Oct 2025: Long NG 11-25 @ 3.473 Signals.USAR-MSFG

- 01 Oct 2025: Long NG 11-25 @ 3.365 Signals.USAR.TR720

- 29 Sep 2025: Short NG 11-25 @ 3.15 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Natural gas futures are consolidating near multi-month lows, with price action characterized by small bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend remains down, but intermediate-term HiLo pivots have shifted to an uptrend, suggesting a potential base-building phase. All major weekly moving averages (5, 10, 20, 55, 100, 200) are trending down, reinforcing a bearish long-term structure. However, recent trade signals have shifted to the long side, hinting at a possible short-term bounce or mean reversion attempt. Key resistance is far overhead, while support levels cluster just below current prices, highlighting a market in transition. The overall environment is neutral in the short and intermediate term, but the dominant long-term trend remains bearish until a sustained move above key moving averages and resistance pivots occurs.

Chart Analysis ATS AI Generated: 2025-10-06 07:14 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.