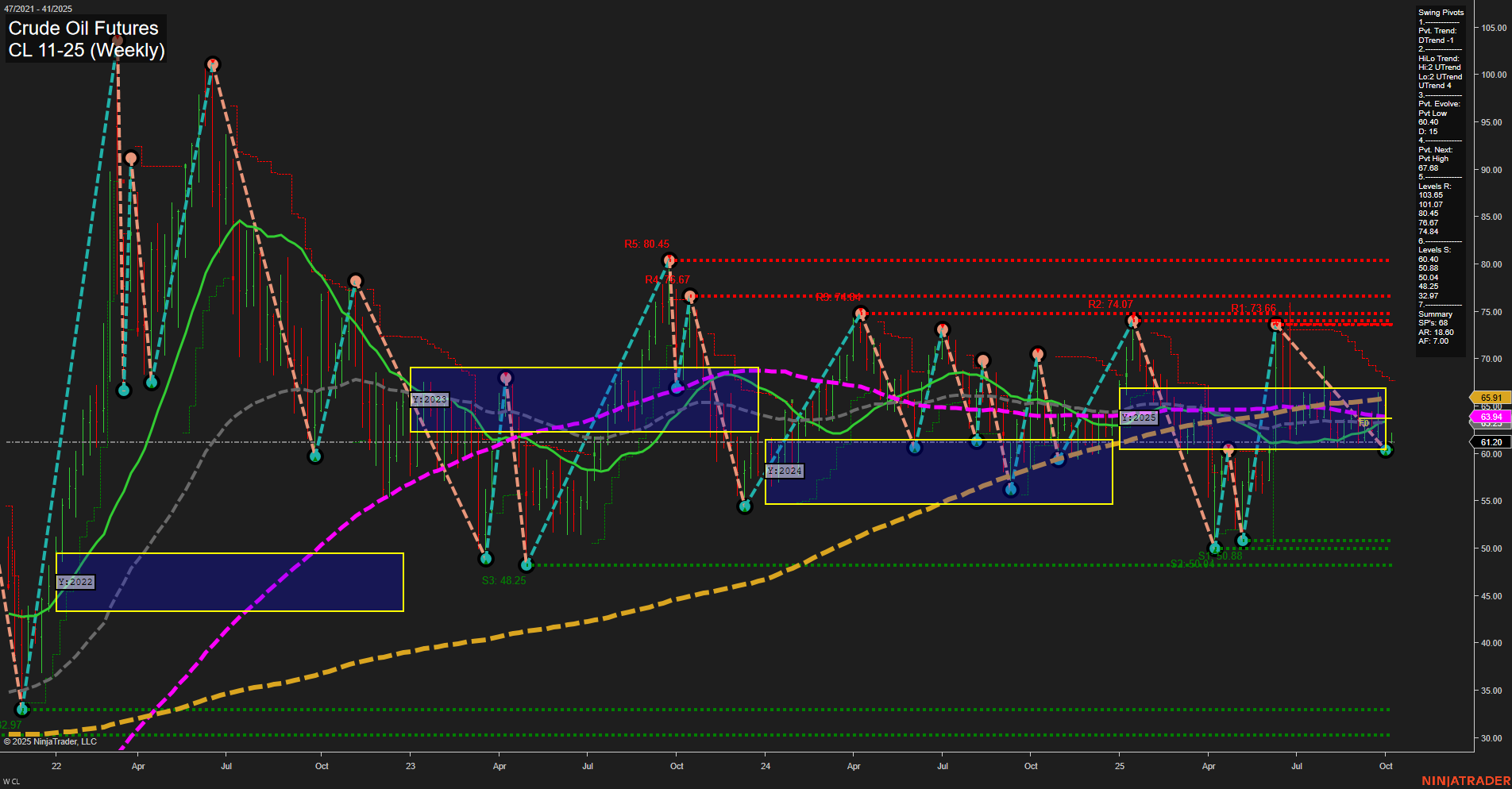

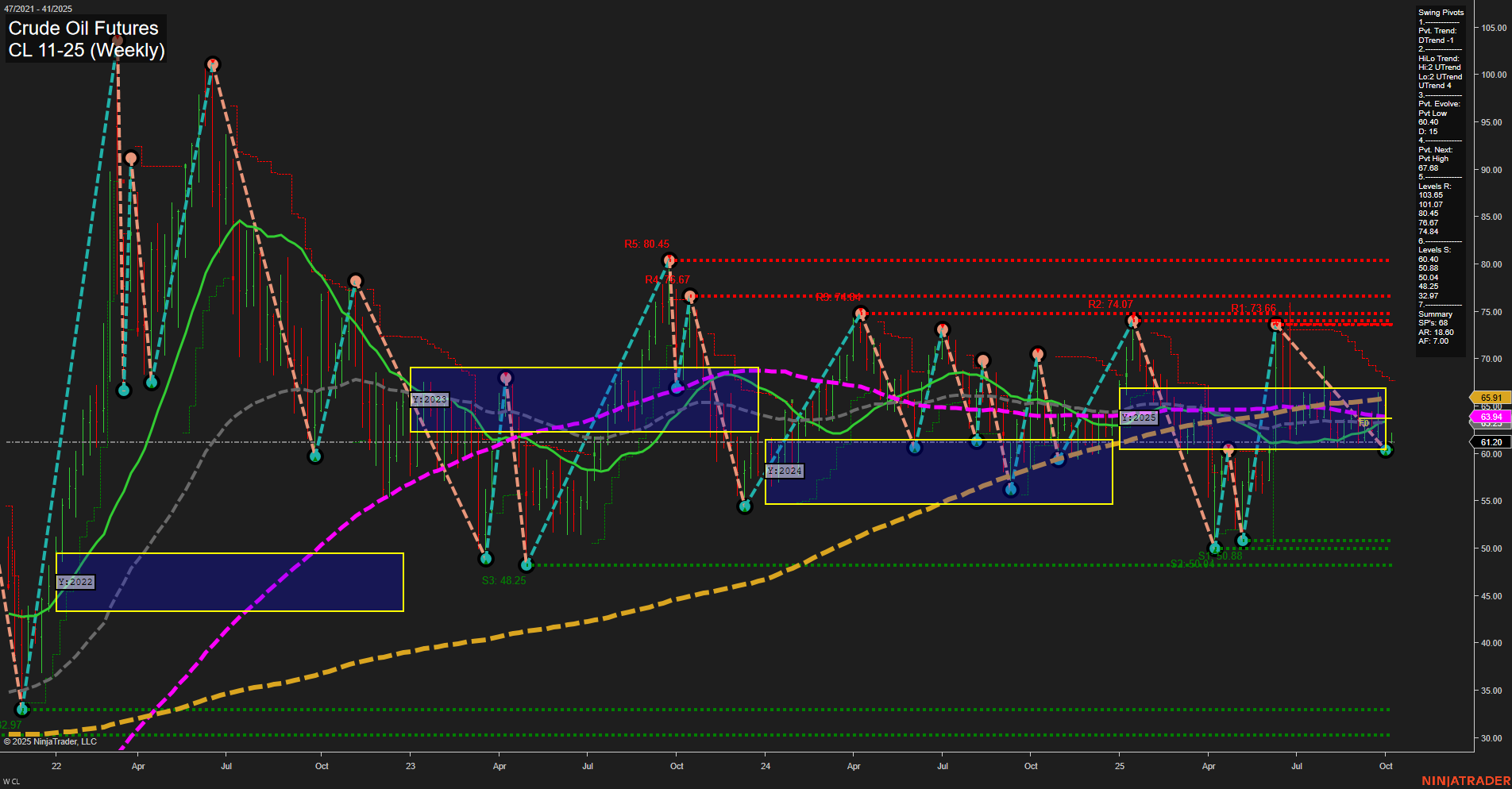

CL Crude Oil Futures Weekly Chart Analysis: 2025-Oct-06 07:05 CT

Price Action

- Last: 61.20,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -14%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: -8%

- F0%/NTZ' Bias: Price Below,

- YSFG Trend: Down.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 60.45,

- 4. Pvt. Next: Pvt high 67.68,

- 5. Levels R: 101.07, 86.67, 80.45, 74.07, 71.09, 67.68, 63.66,

- 6. Levels S: 50.88, 50.48, 48.25, 45.62, 39.27.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 61.88 Down Trend,

- (Intermediate-Term) 10 Week: 62.77 Down Trend,

- (Long-Term) 20 Week: 65.91 Down Trend,

- (Long-Term) 55 Week: 63.94 Down Trend,

- (Long-Term) 100 Week: 69.38 Down Trend,

- (Long-Term) 200 Week: 53.98 Up Trend.

Recent Trade Signals

- 06 Oct 2025: Long CL 11-25 @ 62.01 Signals.USAR.TR120

- 05 Oct 2025: Long CL 11-25 @ 61.43 Signals.USAR-WSFG

- 03 Oct 2025: Short CL 11-25 @ 60.74 Signals.USAR-MSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

Crude oil futures are currently trading in a consolidative range with slow momentum and medium-sized weekly bars, reflecting indecision and a lack of strong directional conviction. The short-term WSFG trend is up, with price holding just above the NTZ center, but the swing pivot trend remains down, indicating a lack of follow-through on recent upward moves. Intermediate-term signals are mixed: the HiLo trend is up, but the MSFG and key moving averages are trending down, suggesting that rallies are being sold into and the market is struggling to sustain higher prices. Long-term structure is bearish, with the yearly fib grid and most long-term moving averages sloping downward, and price below key resistance levels. Major resistance is clustered between 63.66 and 101.07, while support is found in the 39-51 range. Recent trade signals show both long and short entries, highlighting the choppy, range-bound nature of the current market. Overall, the market is in a transition phase, with no clear trend dominance, and is prone to mean reversion and false breakouts as it digests prior volatility and awaits a new catalyst.

Chart Analysis ATS AI Generated: 2025-10-06 07:06 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.