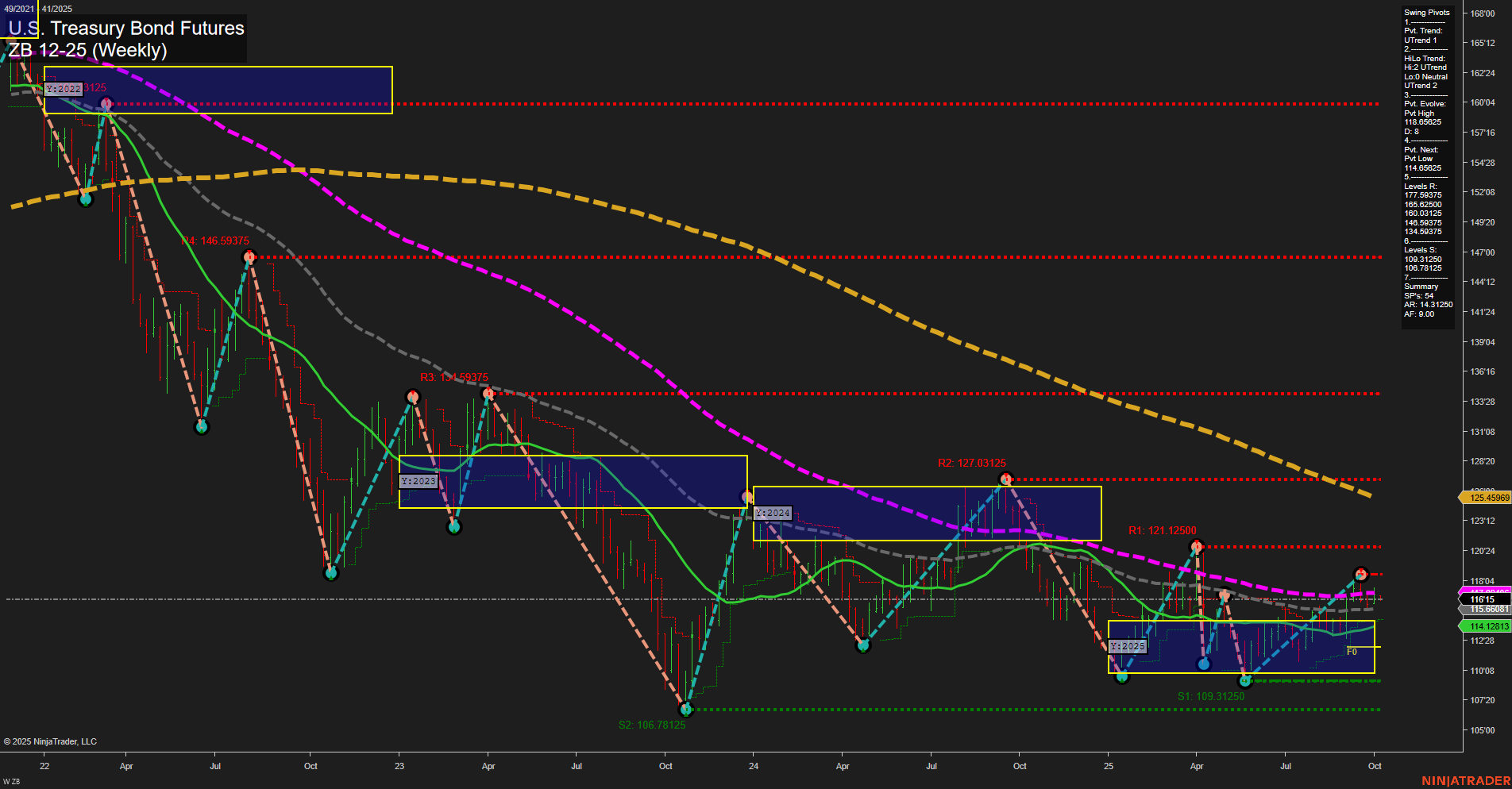

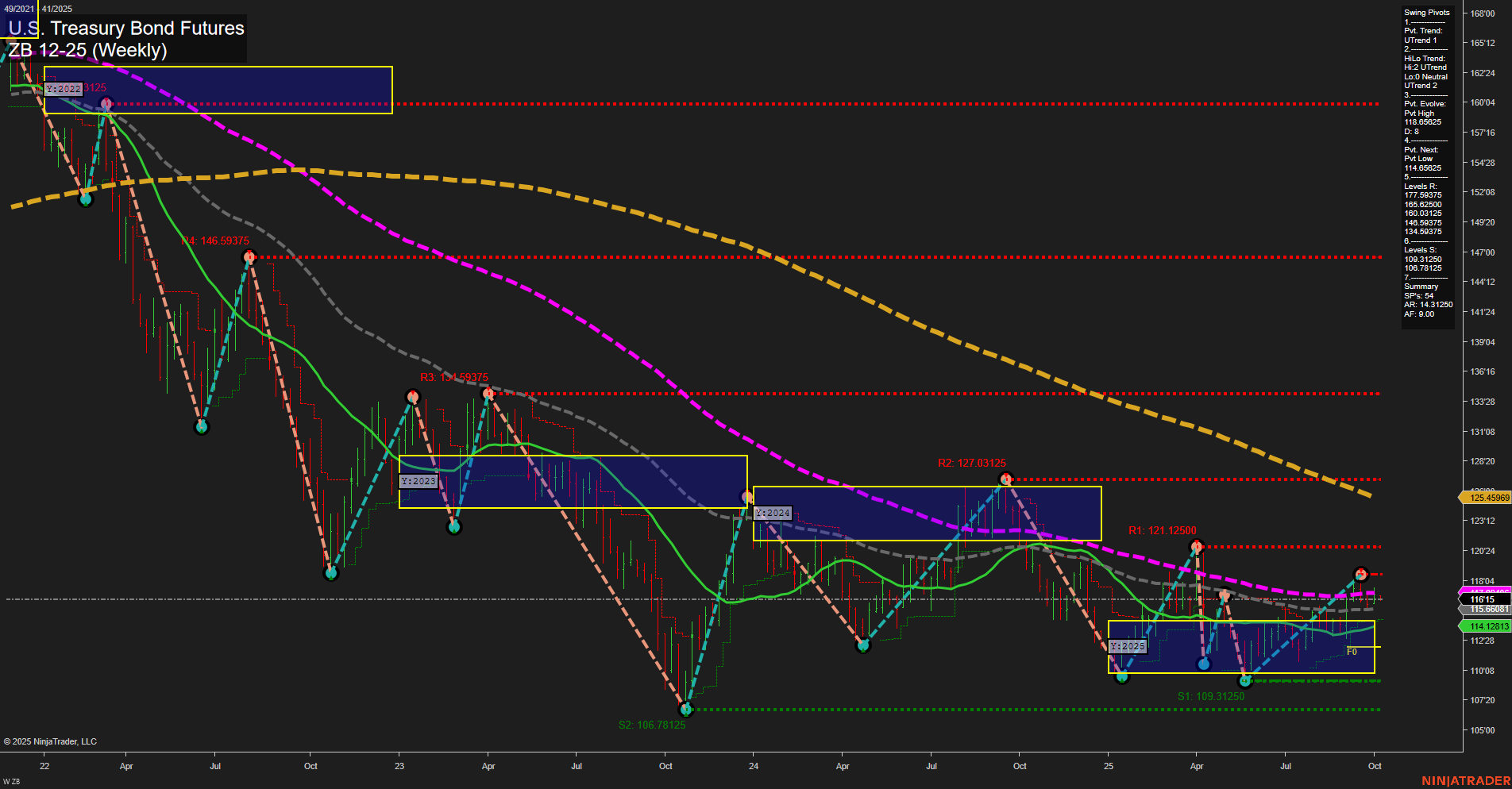

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Oct-05 18:20 CT

Price Action

- Last: 125.45969,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Lo2 Neutral UTrend,

- 3. Pvt. Evolve: Pvt high 118.09375,

- 4. Pvt. Next: Pvt low 114.06225,

- 5. Levels R: 127.59375, 121.125, 118.09375, 114.59375,

- 6. Levels S: 109.3125, 106.78125, 100.78125.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 116.175 Up Trend,

- (Intermediate-Term) 10 Week: 115.60851 Up Trend,

- (Long-Term) 20 Week: 114.12813 Up Trend,

- (Long-Term) 55 Week: 118.04 Down Trend,

- (Long-Term) 100 Week: 125.45969 Down Trend,

- (Long-Term) 200 Week: 146.59375 Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bearish.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a market in transition. Price action has shifted to an average momentum phase with medium-sized bars, indicating a balanced but active environment. The short-term swing pivot trend is up, supported by rising 5, 10, and 20-week moving averages, suggesting bullish sentiment in the near term. However, intermediate-term signals are more neutral, with the HiLo trend showing a transition from lower lows to a potential uptrend, and the next key pivot low at 114.06225 acting as a critical support. Long-term benchmarks (55, 100, and 200-week MAs) remain in a downtrend, reflecting persistent bearish pressure from higher timeframes. Resistance levels at 127.59375 and 121.125 are significant, while support is established at 109.3125 and 106.78125. The market is currently consolidating within the yearly NTZ, with no clear directional bias from the session fib grids, and is likely digesting prior volatility. This environment is characterized by a tug-of-war between short-term bullish momentum and long-term bearish structure, with the potential for range-bound trading or a breakout as the next major catalyst emerges.

Chart Analysis ATS AI Generated: 2025-10-05 18:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.