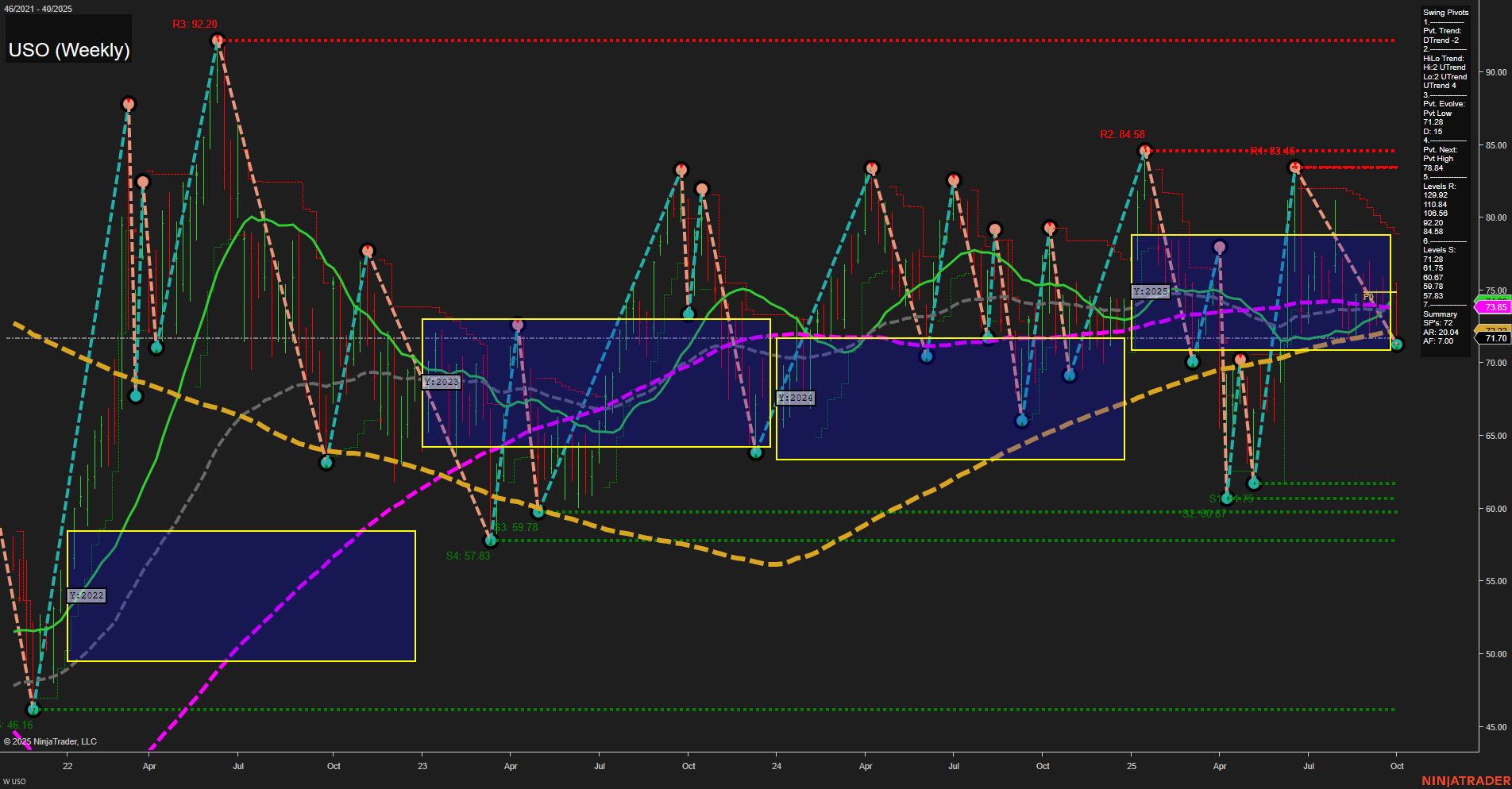

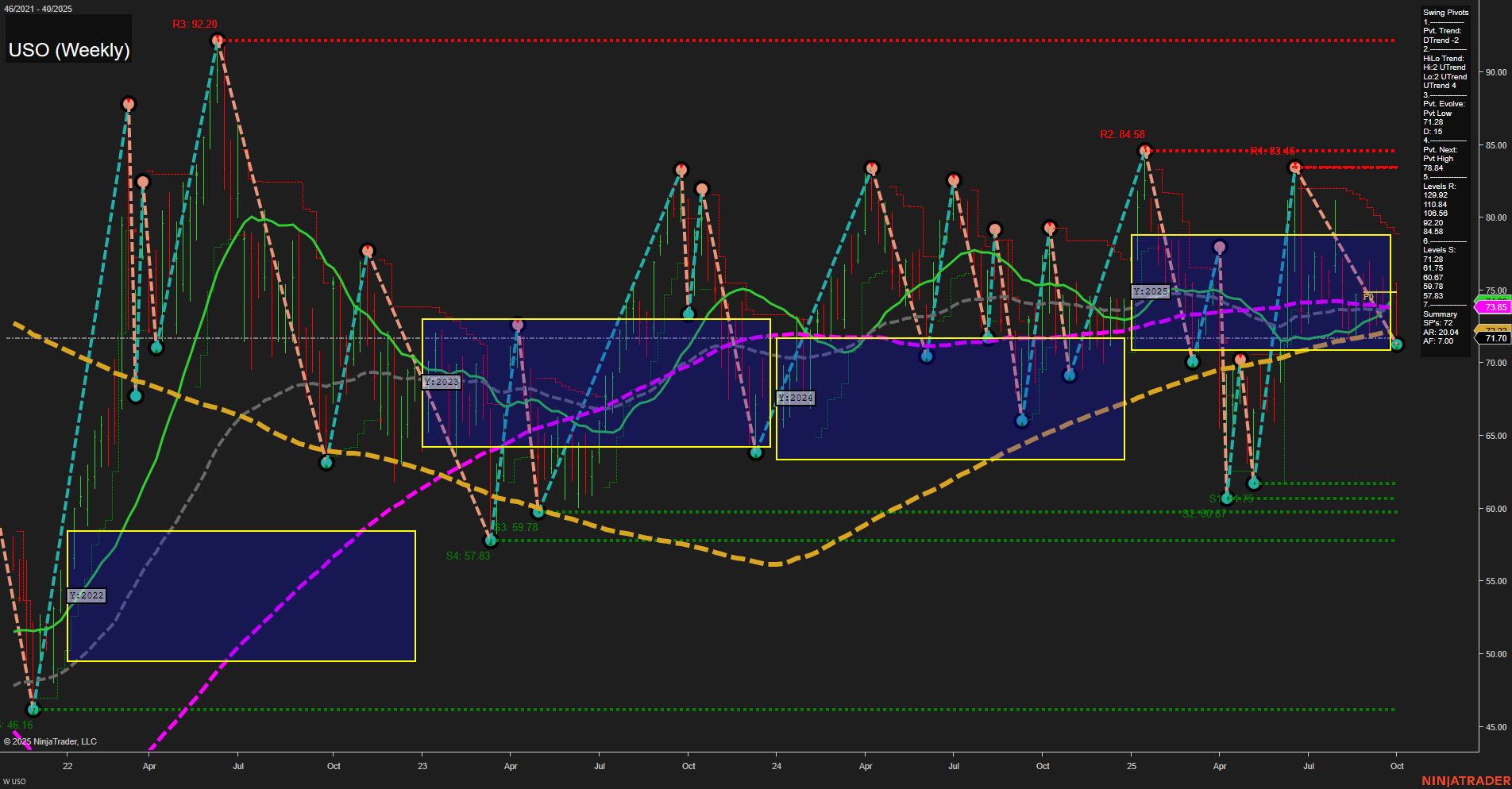

USO United States Oil Fund LP Weekly Chart Analysis: 2025-Oct-05 18:18 CT

Price Action

- Last: 73.85,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt low 71.70,

- 4. Pvt. Next: Pvt high 75.84,

- 5. Levels R: 92.20, 84.58, 83.46, 75.84,

- 6. Levels S: 72.04, 71.70, 57.83, 53.59, 45.16.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 75.00 Down Trend,

- (Intermediate-Term) 10 Week: 74.00 Down Trend,

- (Long-Term) 20 Week: 73.85 Down Trend,

- (Long-Term) 55 Week: 71.70 Up Trend,

- (Long-Term) 100 Week: 72.00 Up Trend,

- (Long-Term) 200 Week: 71.70 Up Trend.

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Neutral,

- Long-Term: Neutral.

Key Insights Summary

USO is currently trading in a broad consolidation range, with price action showing medium-sized bars and slow momentum, indicating a lack of strong directional conviction. The short-term swing pivot trend is down, but the intermediate-term HiLo trend remains up, reflecting mixed signals and a choppy environment. Price is hovering near key support levels (71.70–72.04) and just below the next resistance pivot at 75.84, with major resistance overhead at 83.46–92.20 and deeper support at 57.83–53.59. All major session Fib grid trends (weekly, monthly, yearly) are neutral, and the moving averages are tightly clustered, with short-term MAs trending down but long-term MAs still holding an upward bias. This technical setup suggests a market in balance, with neither bulls nor bears in clear control, and a tendency for mean reversion or range-bound trading. Volatility has contracted after previous swings, and the market is likely awaiting a catalyst for a decisive breakout or breakdown. For swing traders, this environment favors patience and monitoring for a confirmed trend or breakout from the current neutral zone.

Chart Analysis ATS AI Generated: 2025-10-05 18:19 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.