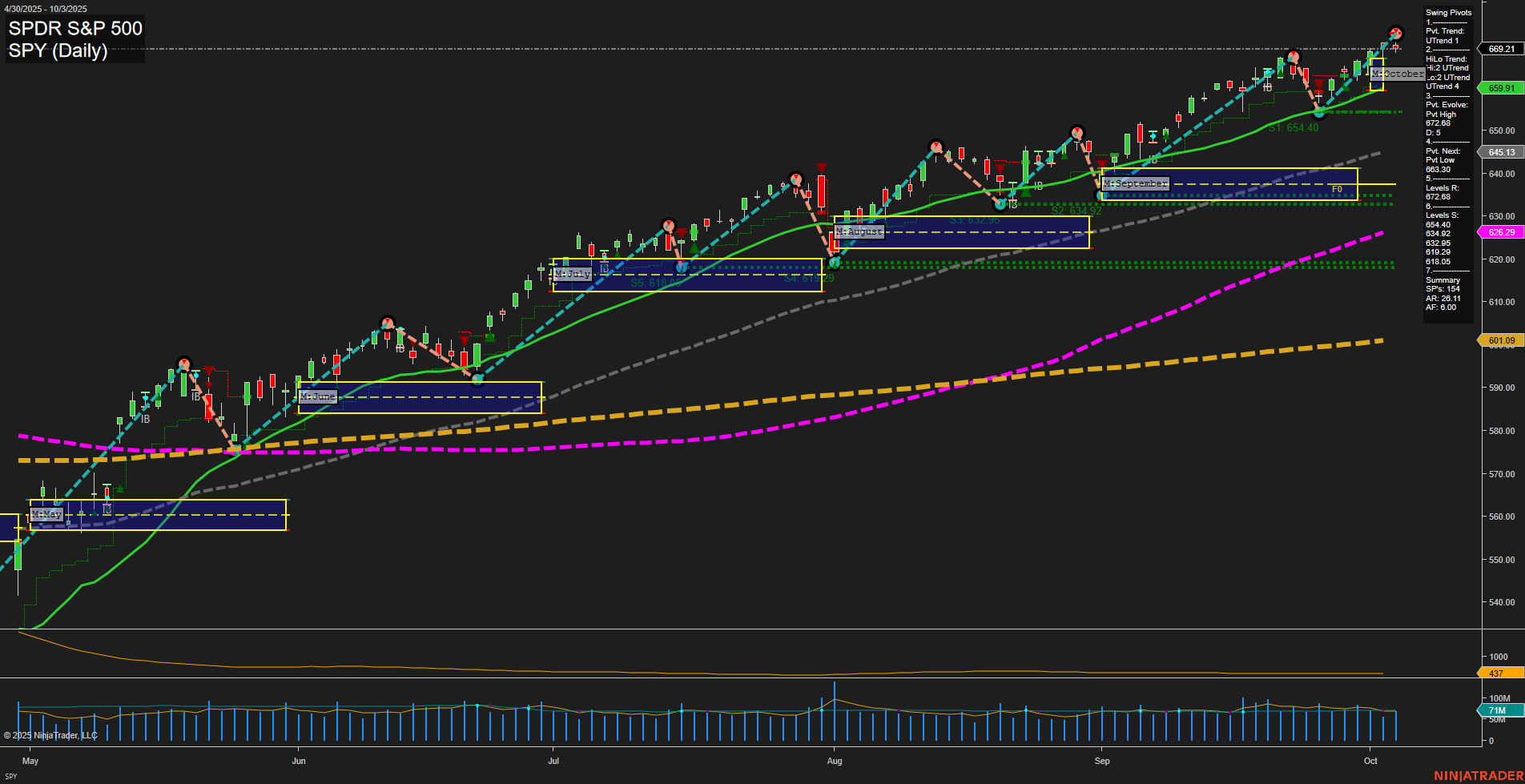

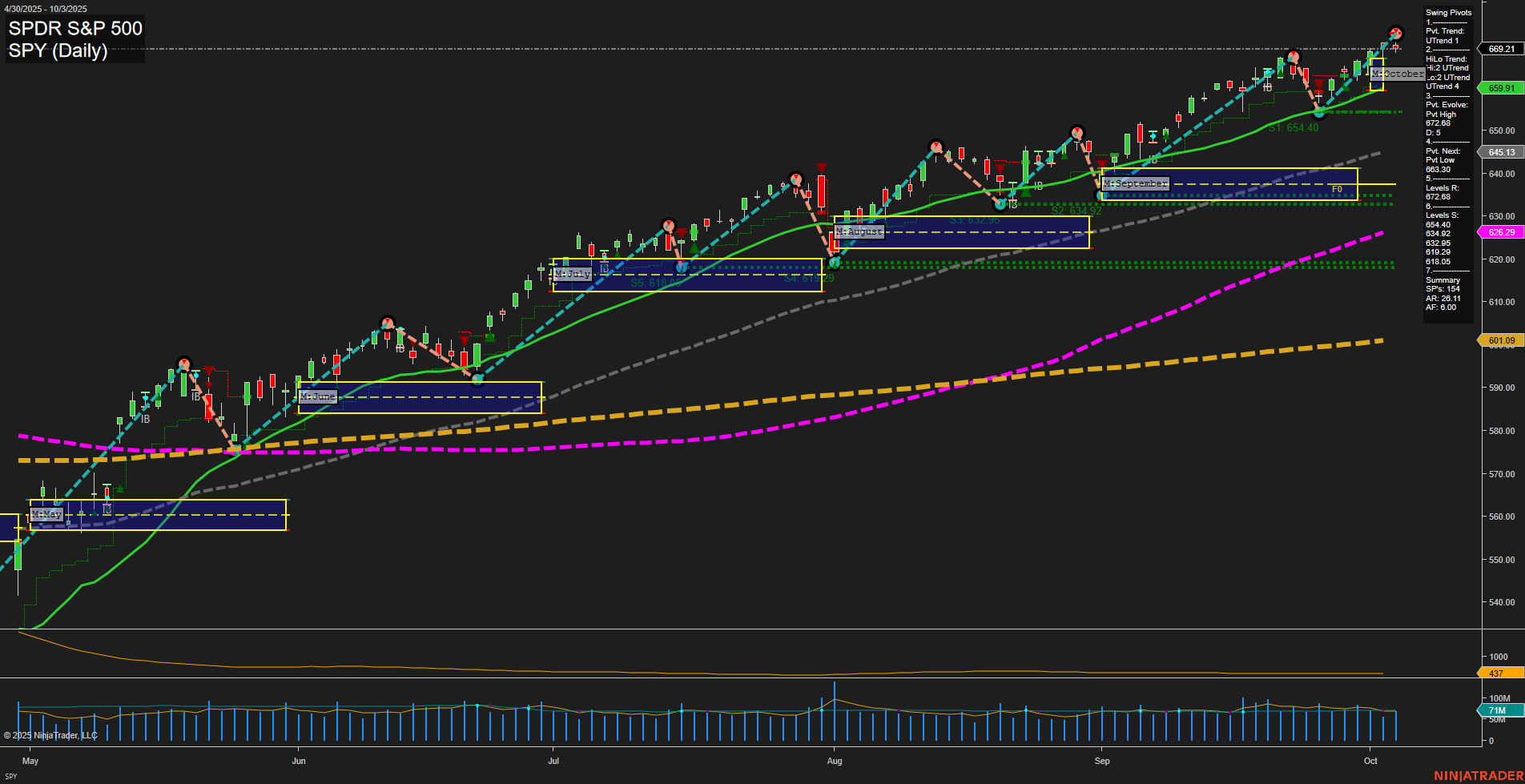

SPY SPDR S&P 500 Daily Chart Analysis: 2025-Oct-05 18:17 CT

Price Action

- Last: 659.21,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 659.21,

- 4. Pvt. Next: Pvt low 654.40,

- 5. Levels R: 659.21, 657.85, 655.30,

- 6. Levels S: 654.40, 652.68, 649.92, 646.02, 639.96, 636.29.

Daily Benchmarks

- (Short-Term) 5 Day: 654.40 Up Trend,

- (Short-Term) 10 Day: 652.68 Up Trend,

- (Intermediate-Term) 20 Day: 659.91 Up Trend,

- (Intermediate-Term) 55 Day: 645.13 Up Trend,

- (Long-Term) 100 Day: 626.29 Up Trend,

- (Long-Term) 200 Day: 601.09 Up Trend.

Additional Metrics

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY daily chart shows a strong and persistent uptrend across all timeframes, with price action making new highs and all benchmark moving averages trending upward. The most recent swing pivot is a new high at 659.21, with the next potential pivot low at 654.40, indicating that the market is currently in an upward extension phase. Support levels are well-defined and stacked below, while resistance is only at the most recent highs, suggesting limited overhead supply. The ATR remains moderate, reflecting controlled volatility, and volume is steady, supporting the trend. The neutral bias on the session fib grids (weekly, monthly, yearly) suggests price is not extended relative to recent session ranges, and there is no immediate sign of exhaustion or reversal. Overall, the technical structure favors continuation of the bullish trend, with higher lows and higher highs dominating the chart, and no significant counter-trend signals present at this time.

Chart Analysis ATS AI Generated: 2025-10-05 18:17 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.