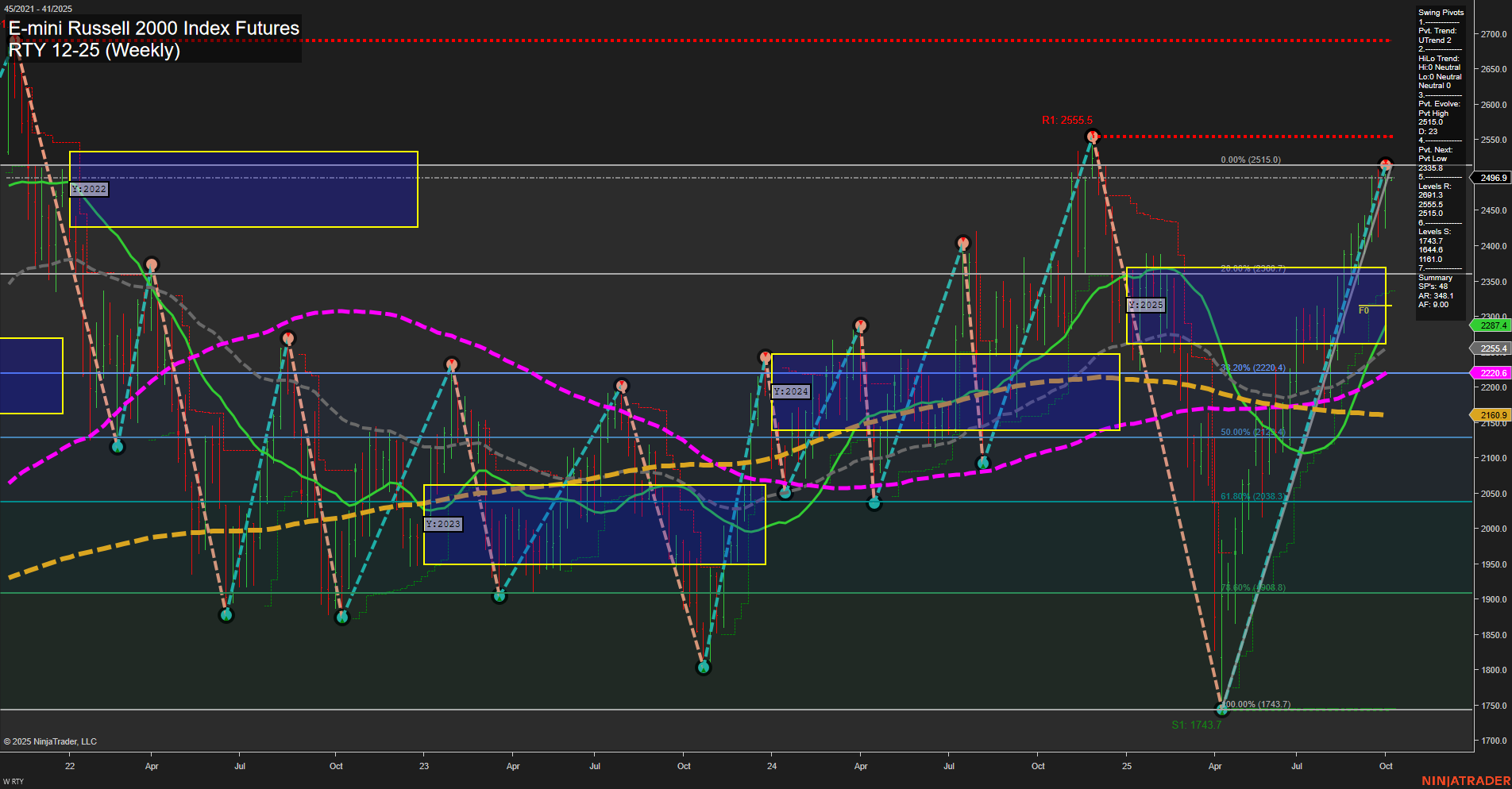

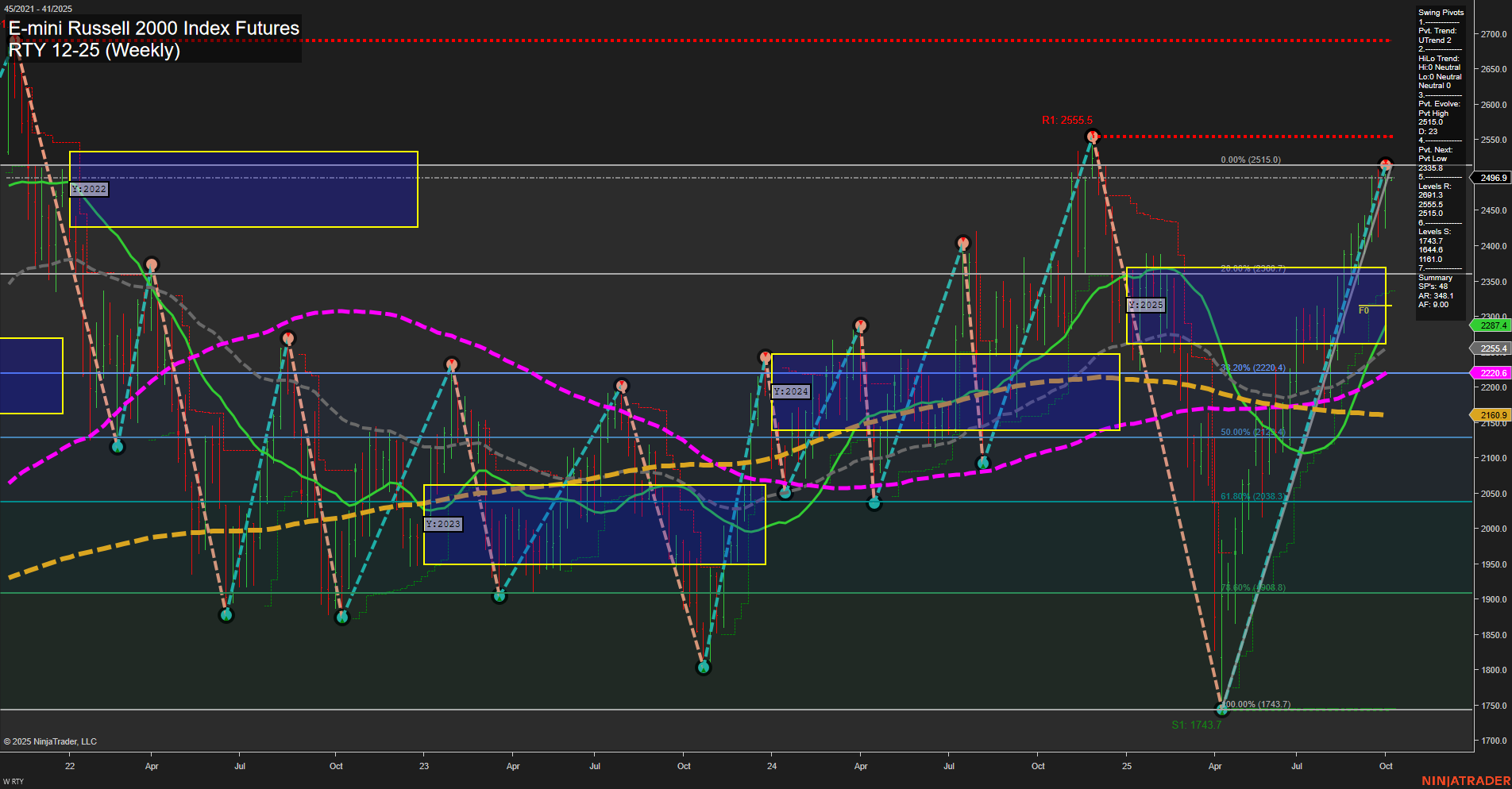

RTY E-mini Russell 2000 Index Futures Weekly Chart Analysis: 2025-Oct-05 18:15 CT

Price Action

- Last: 2496.9,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: 10%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 35%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 34%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: Neutral,

- 3. Pvt. Evolve: Pvt high 2515.5,

- 4. Pvt. Next: Pvt low 1743.7,

- 5. Levels R: 2655.5, 2515.5,

- 6. Levels S: 1743.7, 1814.0.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 2387.4 Up Trend,

- (Intermediate-Term) 10 Week: 2255.4 Up Trend,

- (Long-Term) 20 Week: 2200.0 Up Trend,

- (Long-Term) 55 Week: 2160.9 Up Trend,

- (Long-Term) 100 Week: 2220.6 Up Trend,

- (Long-Term) 200 Week: 2200.0 Up Trend.

Recent Trade Signals

- 02 Oct 2025: Long RTY 12-25 @ 2464.8 Signals.USAR-MSFG

- 02 Oct 2025: Long RTY 12-25 @ 2459.3 Signals.USAR-WSFG

- 30 Sep 2025: Short RTY 12-25 @ 2433.7 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The RTY E-mini Russell 2000 Index Futures weekly chart shows a strong bullish recovery with price action breaking above key NTZ/F0% levels across all session fib grids (weekly, monthly, yearly). Large bars and fast momentum confirm aggressive buying, with the last price near recent swing highs. All benchmark moving averages are trending up, supporting the bullish structure across timeframes. Swing pivots indicate an uptrend in the short term, while intermediate-term HiLo trend is neutral, suggesting some consolidation or digestion after the recent rally. Resistance is seen at 2515.5 and 2655.5, with major support far below at 1743.7 and 1814.0, highlighting the magnitude of the recent move. Recent trade signals are predominantly long, aligning with the prevailing uptrend. The overall technical landscape favors continued bullish sentiment, with the market exhibiting characteristics of a strong V-shaped recovery and potential for further upside, though some consolidation near resistance is possible.

Chart Analysis ATS AI Generated: 2025-10-05 18:15 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.