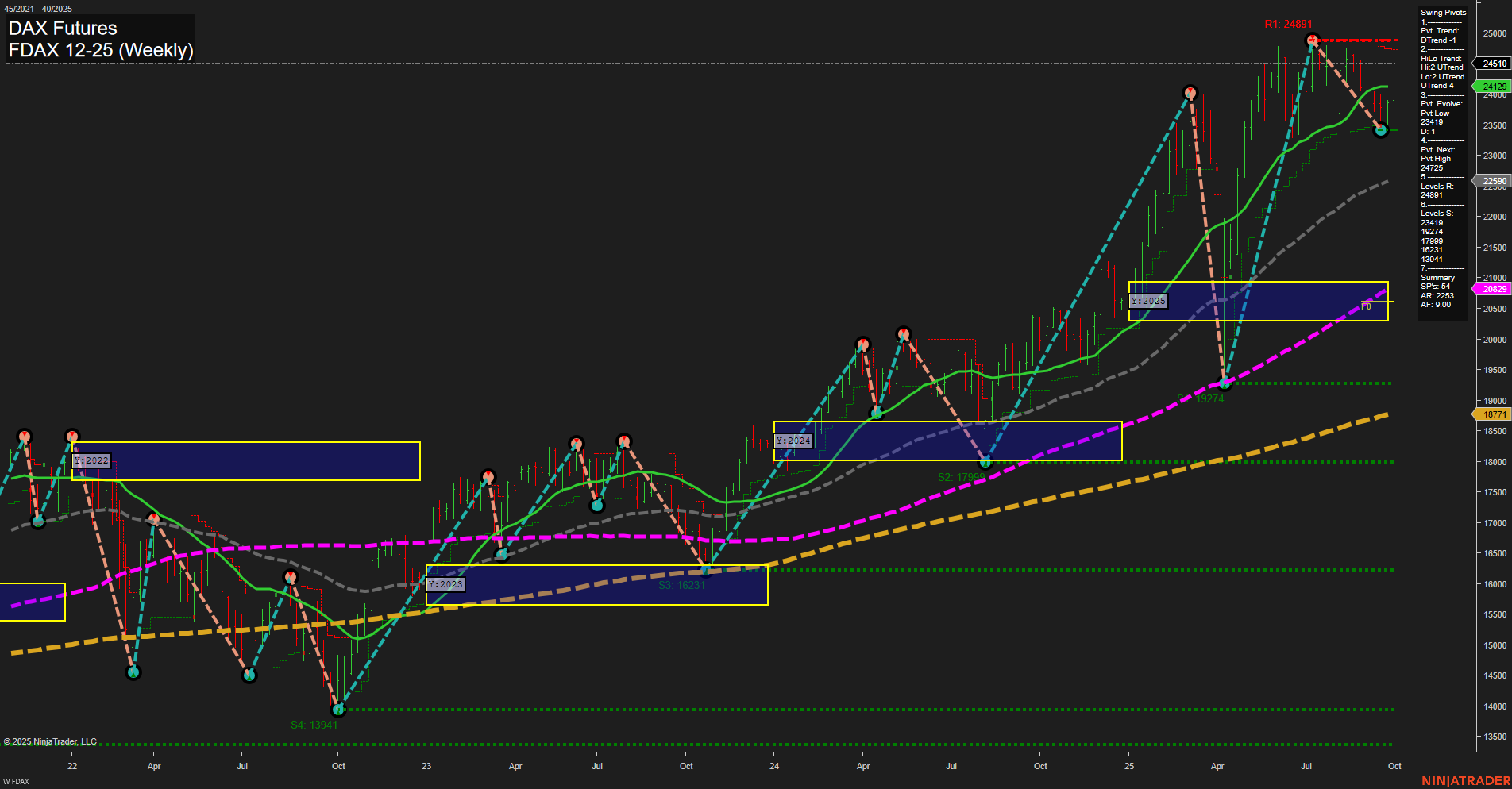

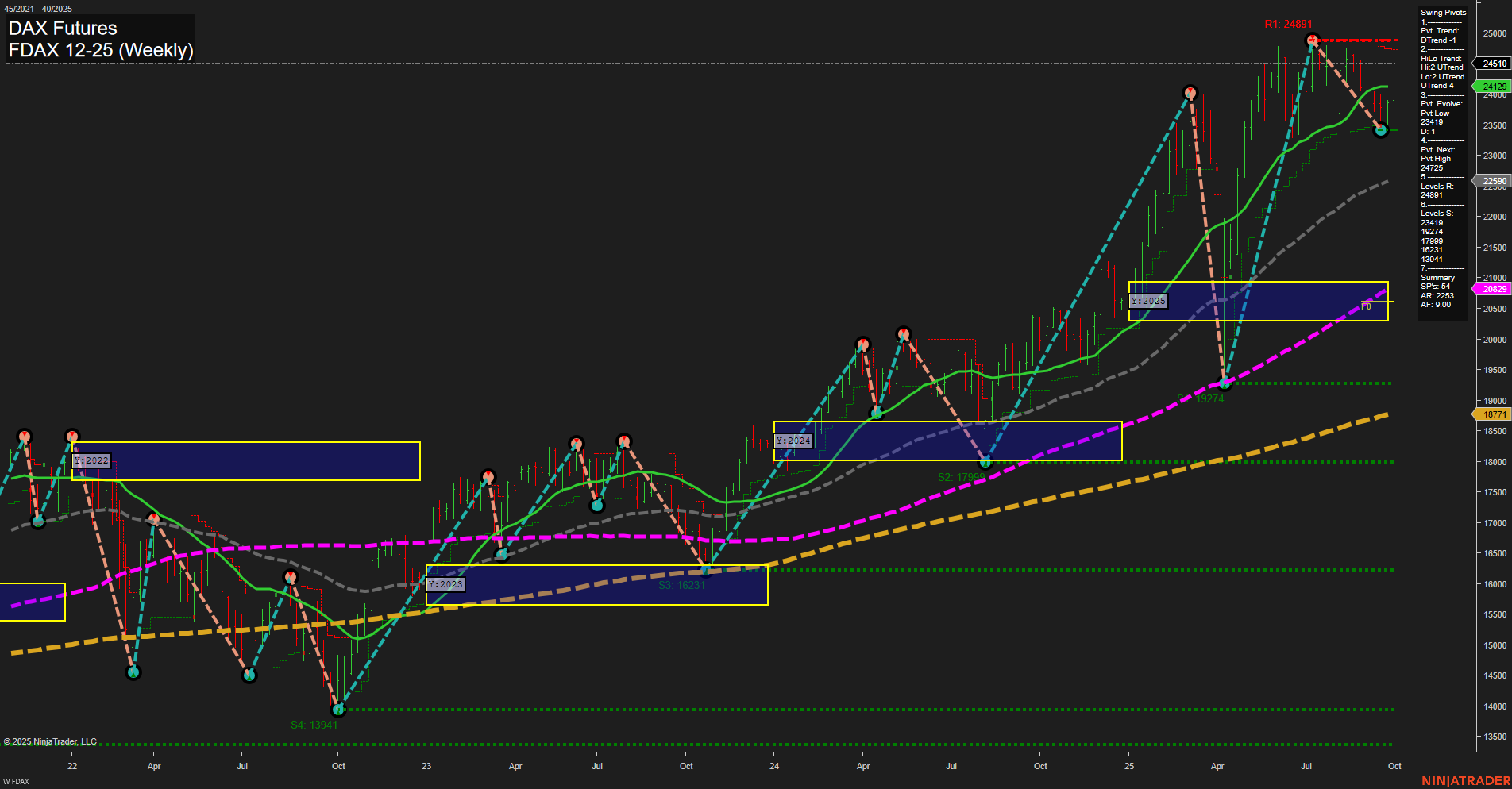

FDAX DAX Futures Weekly Chart Analysis: 2025-Oct-05 18:08 CT

Price Action

- Last: 24,129,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 141%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: 42%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 121%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 23,419,

- 4. Pvt. Next: Pvt High 24,891,

- 5. Levels R: 24,891,

- 6. Levels S: 23,419, 19,274, 17,904, 16,231, 13,941.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 24,175 Up Trend,

- (Intermediate-Term) 10 Week: 23,653 Up Trend,

- (Long-Term) 20 Week: 22,950 Up Trend,

- (Long-Term) 55 Week: 20,829 Up Trend,

- (Long-Term) 100 Week: 19,209 Up Trend,

- (Long-Term) 200 Week: 18,711 Up Trend.

Recent Trade Signals

- 01 Oct 2025: Long FDAX 12-25 @ 24,204 Signals.USAR-MSFG

- 30 Sep 2025: Long FDAX 12-25 @ 23,961 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The FDAX DAX Futures weekly chart shows a market in a strong long-term and intermediate-term uptrend, supported by all major moving averages trending higher and price action consistently above key Fibonacci grid levels. The most recent swing pivot indicates a short-term corrective move (DTrend), but the intermediate-term HiLo trend remains upward, suggesting that the broader bullish structure is intact. Price is currently consolidating just below the recent swing high resistance at 24,891, with support levels well-defined at 23,419 and further below. Recent trade signals confirm ongoing bullish momentum, with new long entries aligning with the prevailing trend. The market is experiencing an average momentum phase, with medium-sized bars indicating neither excessive volatility nor stagnation. Overall, the technical landscape favors trend continuation, though the short-term may see further consolidation or minor pullbacks before any potential breakout above resistance.

Chart Analysis ATS AI Generated: 2025-10-05 18:08 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.