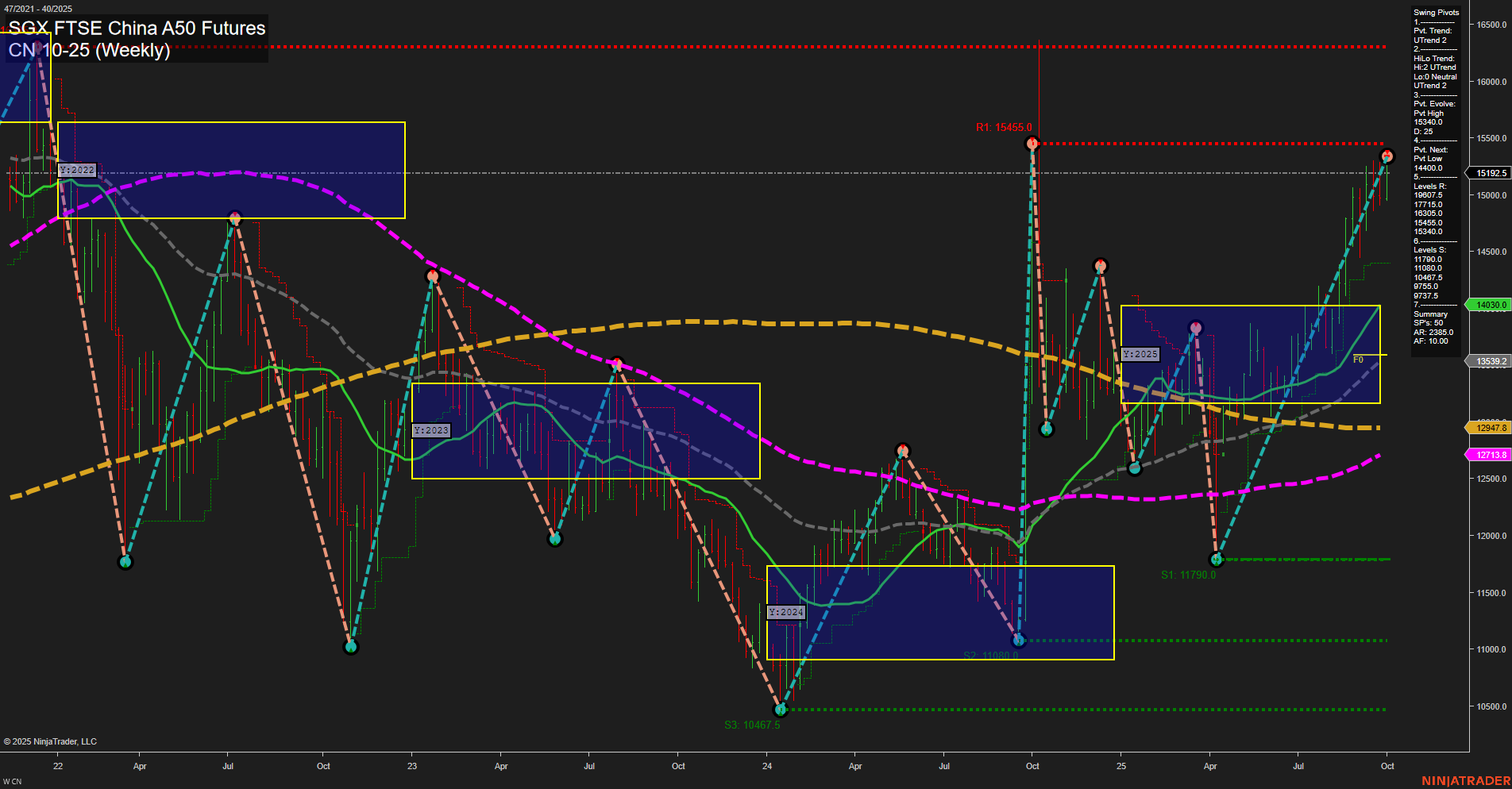

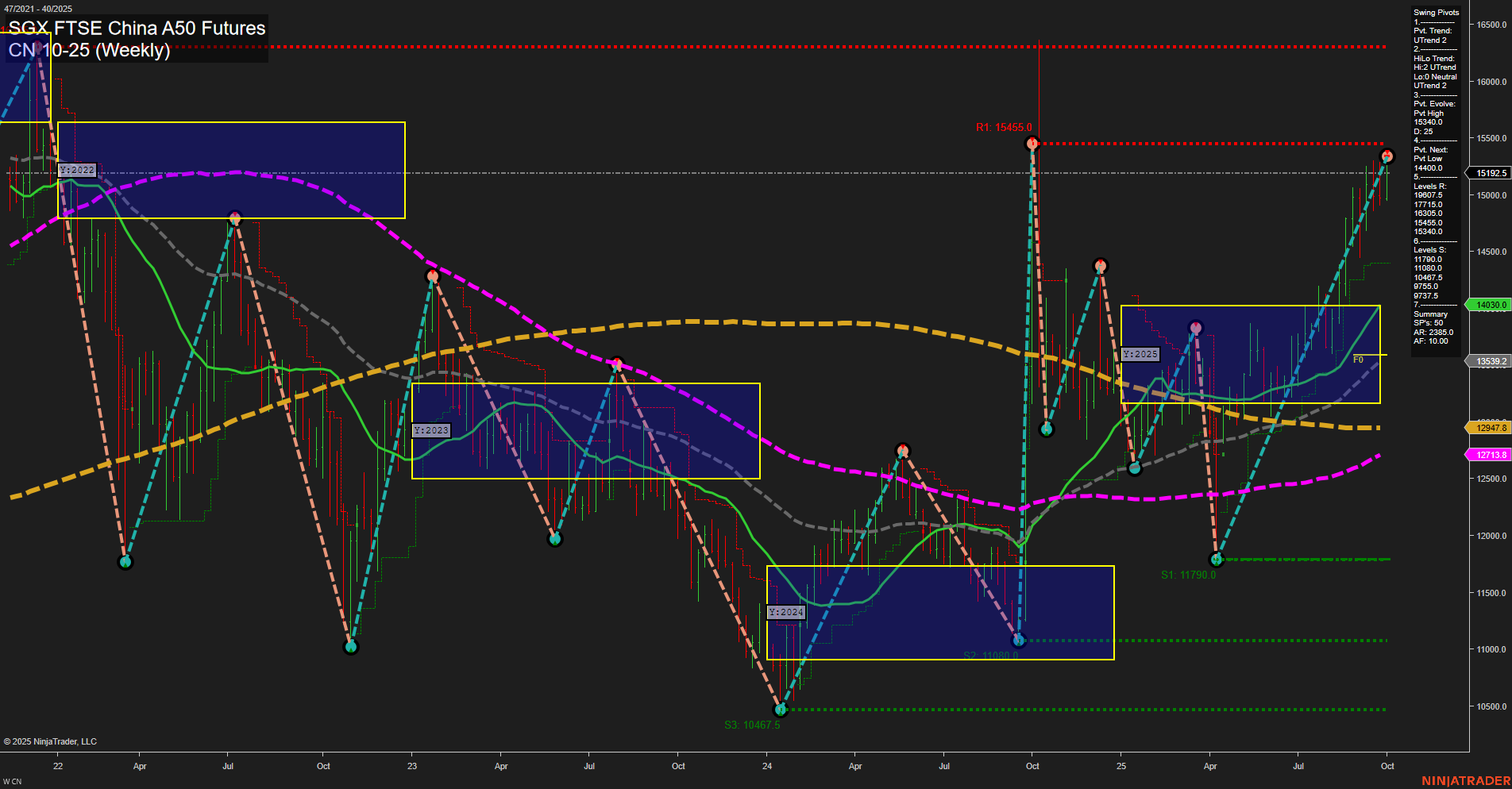

CN SGX FTSE China A50 Futures Weekly Chart Analysis: 2025-Oct-05 18:05 CT

Price Action

- Last: 15192.5,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 15455.0,

- 4. Pvt. Next: Pvt Low 14000.0,

- 5. Levels R: 15455.0, 15192.5, 14000.0,

- 6. Levels S: 11790.0, 10467.5.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 14300.0 Up Trend,

- (Intermediate-Term) 10 Week: 13539.2 Up Trend,

- (Long-Term) 20 Week: 12947.8 Up Trend,

- (Long-Term) 55 Week: 12713.8 Down Trend,

- (Long-Term) 100 Week: 0.0 NA,

- (Long-Term) 200 Week: 0.0 NA.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The CN SGX FTSE China A50 Futures is exhibiting strong bullish momentum, with large weekly bars and a fast pace of price movement. Both short-term and intermediate-term swing pivot trends are in an uptrend, supported by a series of higher highs and higher lows. The price has recently reached a new swing high at 15455.0, with the next significant support at 14000.0 and deeper supports at 11790.0 and 10467.5. All visible moving averages up to the 20-week are trending upward, confirming the strength of the current rally, while the 55-week MA remains in a downtrend, suggesting the longer-term trend is still in transition. The price is trading well above key moving averages, indicating a strong recovery from previous lows. The neutral bias in the session fib grids (WSFG, MSFG, YSFG) suggests the market is not at an extreme, and the current move is not overextended. Overall, the technical structure points to a robust bullish phase in the short and intermediate term, with the long-term outlook awaiting further confirmation as the market continues to recover from its prior downtrend.

Chart Analysis ATS AI Generated: 2025-10-05 18:05 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.