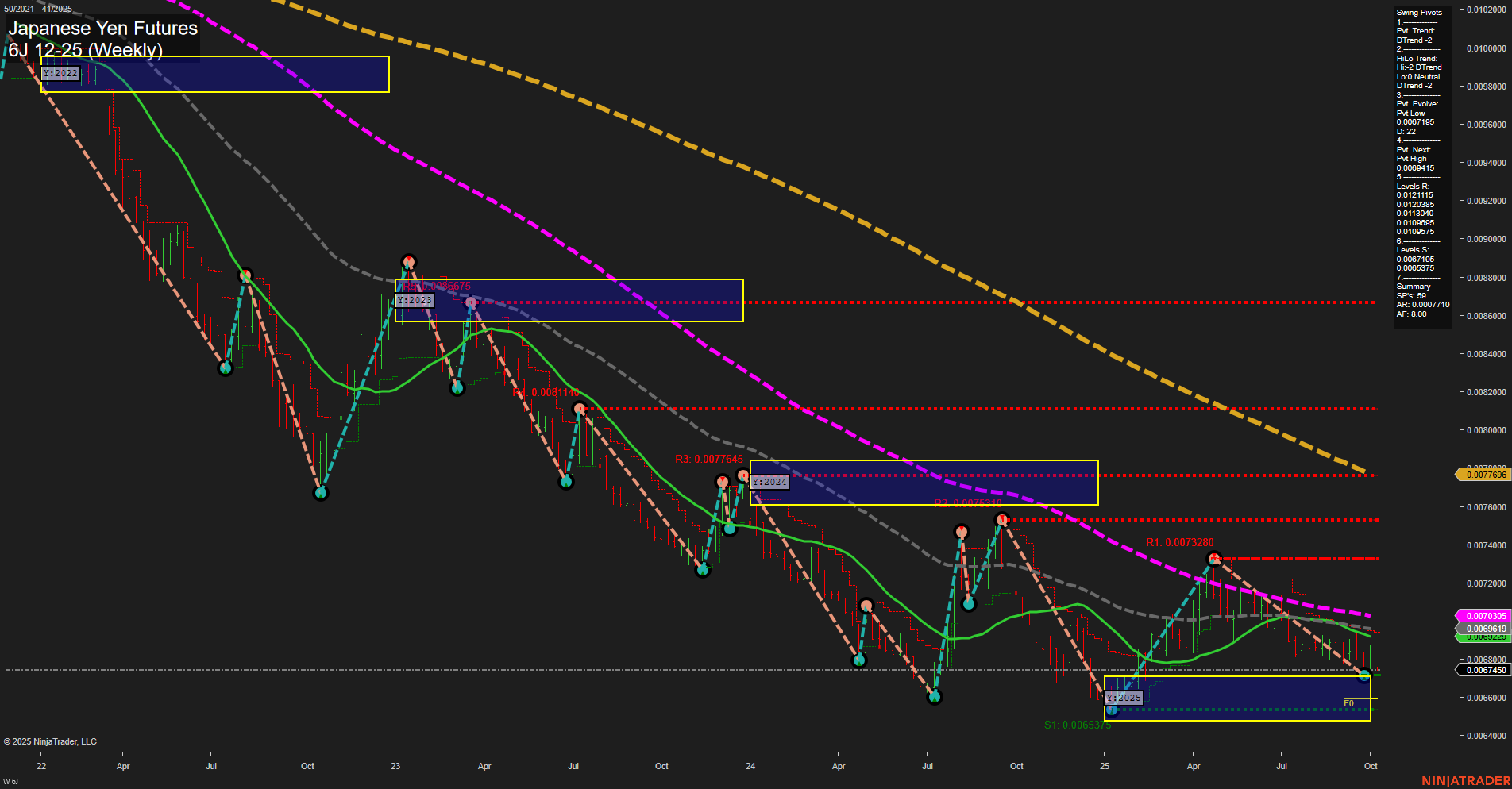

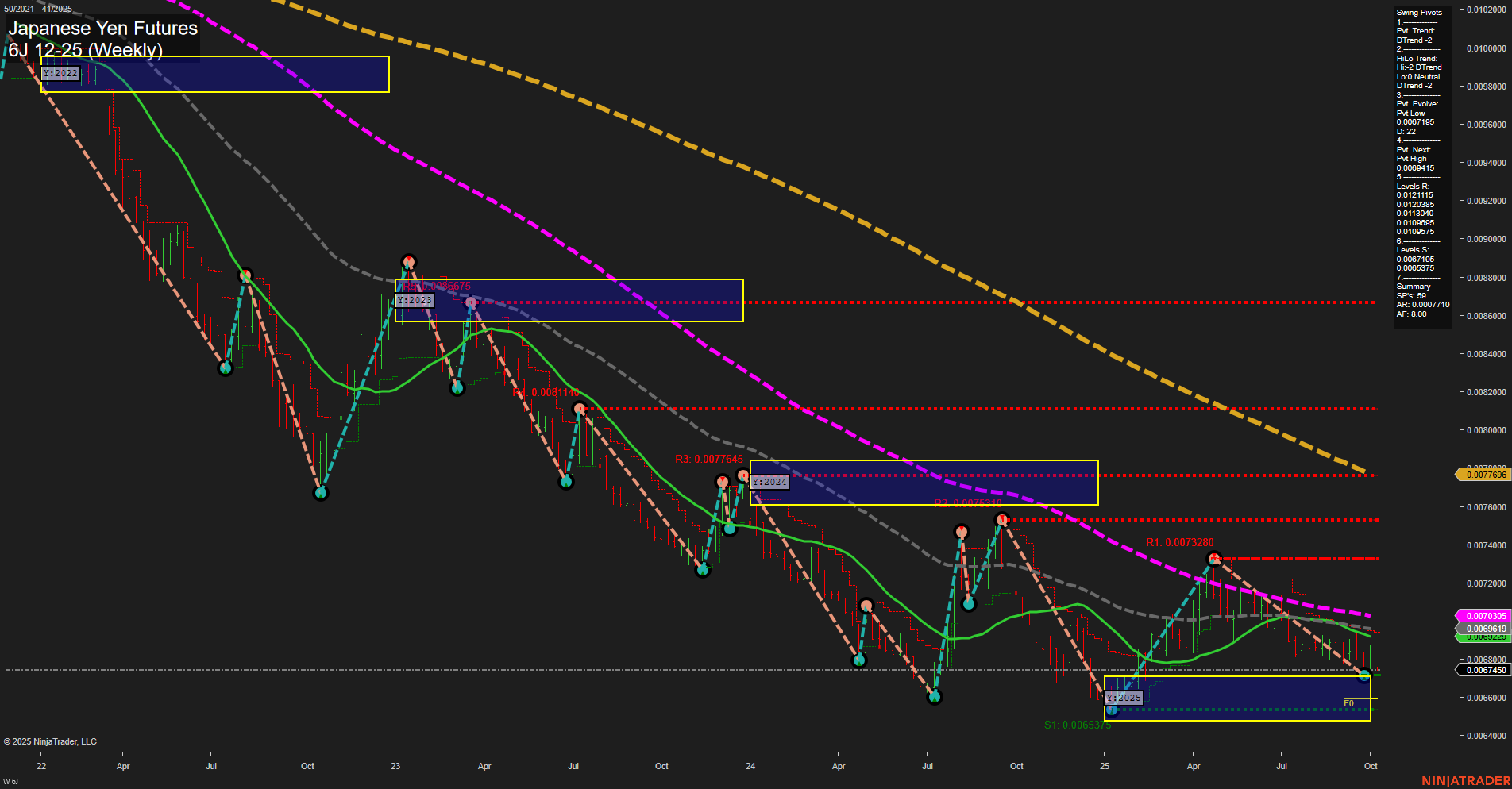

6J Japanese Yen Futures Weekly Chart Analysis: 2025-Oct-05 18:02 CT

Price Action

- Last: 0.006769,

- Bars: Medium,

- Mom: Momentum slow.

WSFG Weekly

- Short-Term

- WSFG Current: -76%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -25%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 13%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt low 0.0063575,

- 4. Pvt. Next: Pvt high 0.0069415,

- 5. Levels R: 0.0102205, 0.0101348, 0.0098965, 0.0092345, 0.0123415, 0.0122115,

- 6. Levels S: 0.0067695, 0.0063575.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.0069619 Down Trend,

- (Intermediate-Term) 10 Week: 0.0070935 Down Trend,

- (Long-Term) 20 Week: 0.0073035 Down Trend,

- (Long-Term) 55 Week: 0.0077645 Down Trend,

- (Long-Term) 100 Week: 0.0081140 Down Trend,

- (Long-Term) 200 Week: 0.0097696 Down Trend.

Recent Trade Signals

- 03 Oct 2025: Long 6J 12-25 @ 0.006843 Signals.USAR-MSFG

- 01 Oct 2025: Long 6J 12-25 @ 0.006846 Signals.USAR.TR720

- 29 Sep 2025: Long 6J 12-25 @ 0.006766 Signals.USAR.TR120

- 29 Sep 2025: Long 6J 12-25 @ 0.006755 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Bearish,

- Long-Term: Neutral.

Key Insights Summary

The 6J Japanese Yen Futures weekly chart shows a market that remains under significant downward pressure in both the short- and intermediate-term timeframes, as indicated by the WSFG and MSFG trends, as well as the swing pivot structure (both in DTrend). Price is currently below the NTZ center on both the weekly and monthly session fib grids, reinforcing the prevailing bearish bias. All benchmark moving averages from 5-week to 200-week are trending down, confirming persistent weakness and a lack of sustained bullish momentum. However, the yearly session fib grid trend has turned up, with price above the yearly NTZ center, suggesting some early signs of long-term stabilization or a potential base forming. Recent trade signals have triggered long entries, indicating possible attempts at a counter-trend bounce or a test of resistance levels, but the overall structure remains dominated by lower highs and lower lows. Key support is at 0.0063575, with resistance levels stacked well above current price, highlighting the challenge for any sustained recovery. The market is in a phase of consolidation near multi-year lows, with volatility likely to persist as it tests the boundaries of the current downtrend and seeks direction into the final quarter of 2025.

Chart Analysis ATS AI Generated: 2025-10-05 18:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.