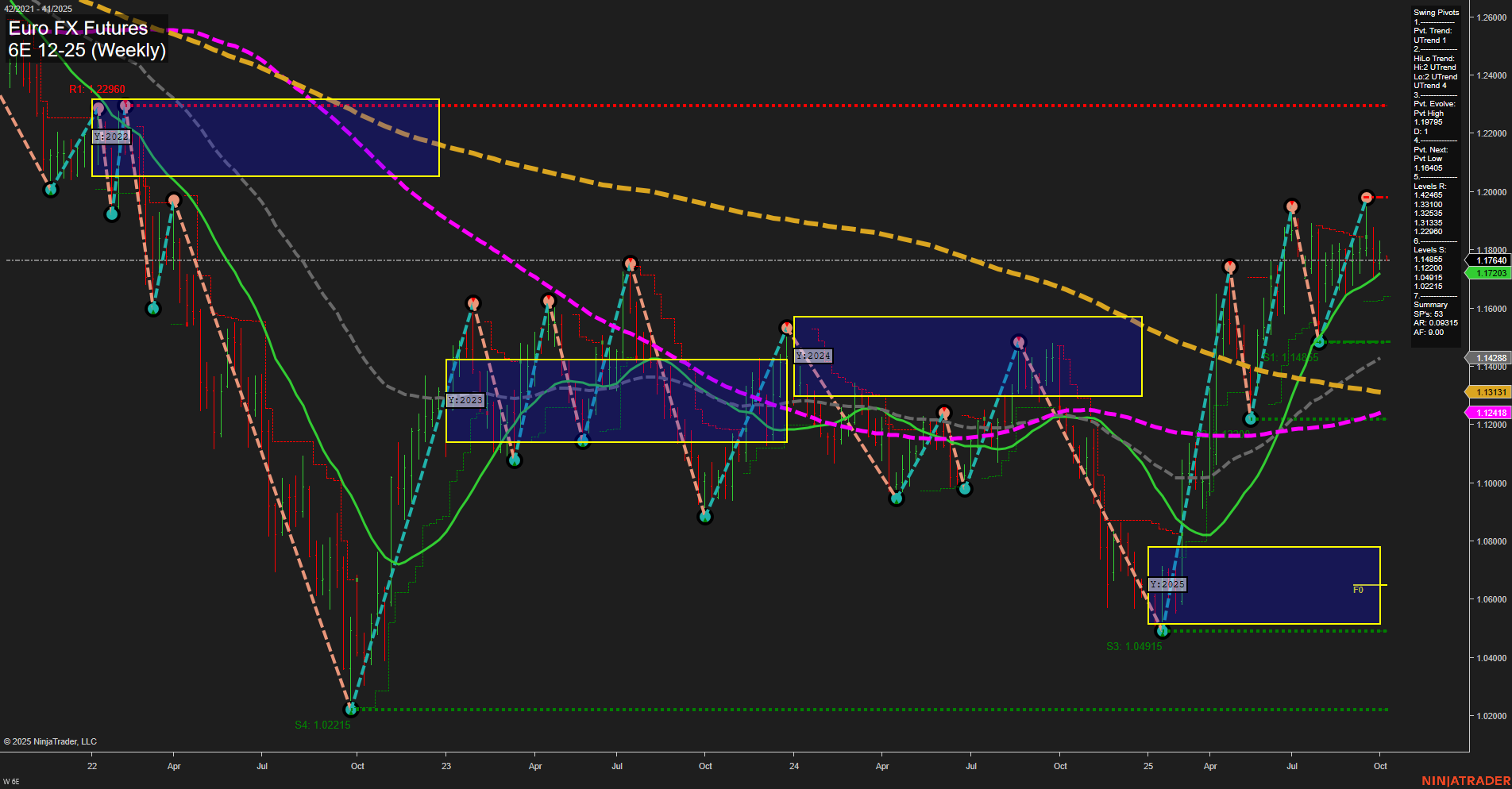

The Euro FX Futures weekly chart shows a market in transition. Price action is currently consolidating near 1.17203, with medium-sized bars and average momentum, reflecting a pause after recent directional moves. Short-term and intermediate-term Fib grid trends (WSFG and MSFG) are both down, with price below their respective NTZ/F0% levels, indicating recent weakness. However, both the short-term and intermediate-term swing pivot trends are up, suggesting a possible emerging recovery or at least a corrective bounce within a broader range. Long-term structure remains bullish, as the yearly session Fib grid (YSFG) is strongly up with price well above its NTZ/F0% level, and most weekly benchmarks (5, 10, 20, 55 week MAs) are in uptrends, except for the 100 and 200 week MAs, which are still lagging and in downtrends. Resistance is seen at 1.18405 and 1.22960, while support is at 1.11445, 1.04915, and 1.02215, highlighting a wide trading range. Recent trade signals have been mixed, with both long and short entries triggered in early October, reflecting the choppy and indecisive nature of the current environment. Overall, the market is in a consolidation phase short- and intermediate-term, with a bullish long-term backdrop. Price is testing key resistance and support levels, and the interplay between short-term corrective moves and the underlying long-term uptrend will be critical for swing traders to monitor. The environment is characterized by volatility, range-bound action, and potential for both trend continuation and sharp reversals.