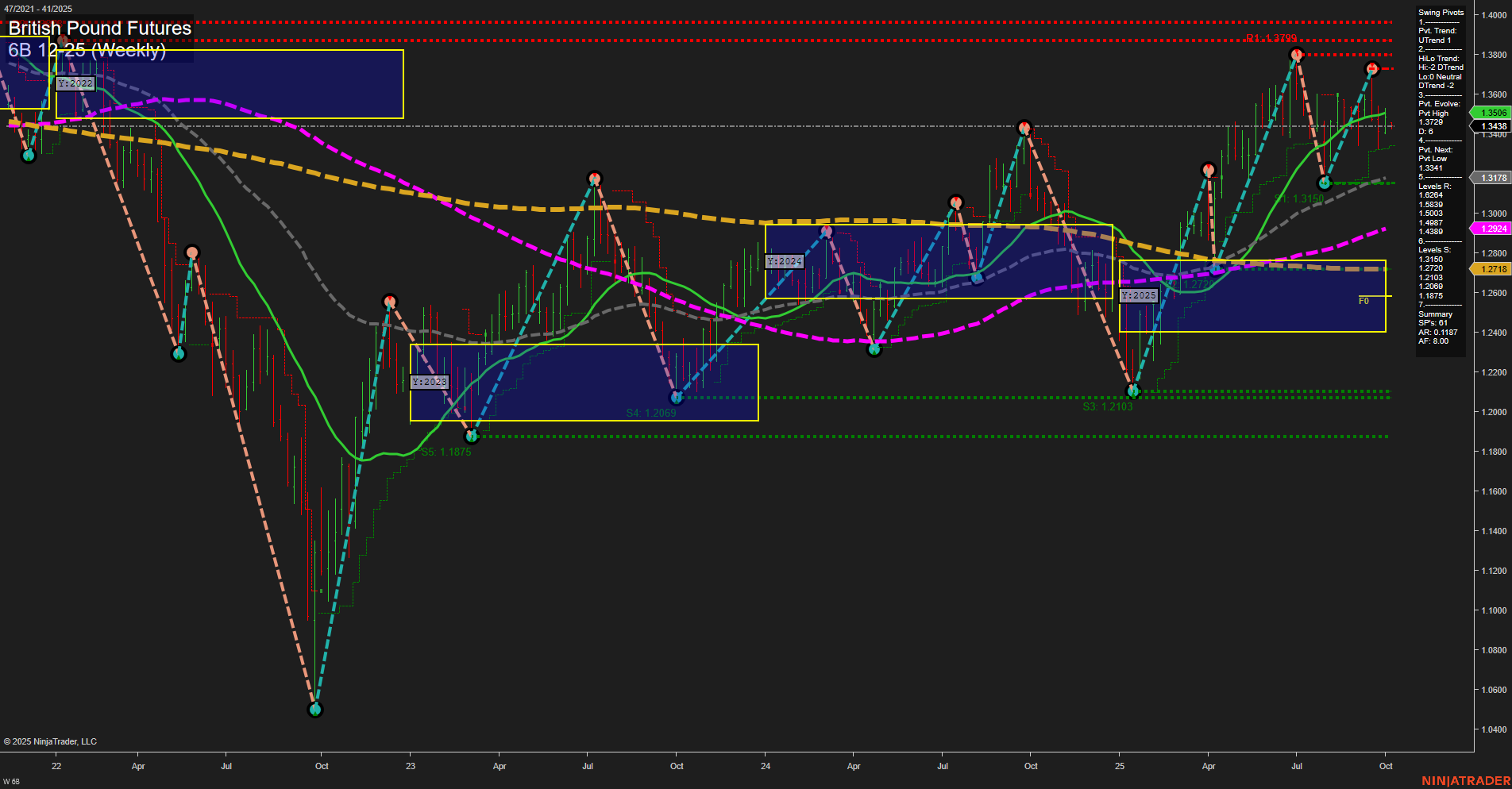

The British Pound Futures (6B) weekly chart shows a market in transition. Price action is currently near 1.35 with medium-sized bars and average momentum, indicating neither strong acceleration nor significant stalling. Short-term and intermediate-term Fib grid trends (WSFG, MSFG) are both down, with price below their respective NTZ/F0% levels, suggesting recent weakness and a lack of short-term bullish conviction. However, the long-term yearly grid (YSFG) remains up, with price well above its F0% level, reflecting a broader bullish structure. Swing pivots highlight a short-term uptrend but an intermediate-term downtrend, with the most recent pivot high at 1.3748 and next support at 1.3434. Resistance levels cluster above, while support levels are spaced further below, indicating potential for volatility if key levels are breached. All benchmark moving averages (from 5 to 200 weeks) are trending up, reinforcing the underlying long-term bullish bias despite recent pullbacks. Recent trade signals show mixed activity, with both short and long entries triggered in early October, reflecting the choppy, range-bound nature of the current market. Overall, the short-term outlook is neutral due to conflicting signals, the intermediate-term is bearish given the prevailing downtrend, while the long-term remains bullish as supported by the moving averages and yearly grid. The market appears to be consolidating after a strong rally, with potential for either a deeper retracement or a resumption of the uptrend depending on how price reacts to nearby support and resistance levels.