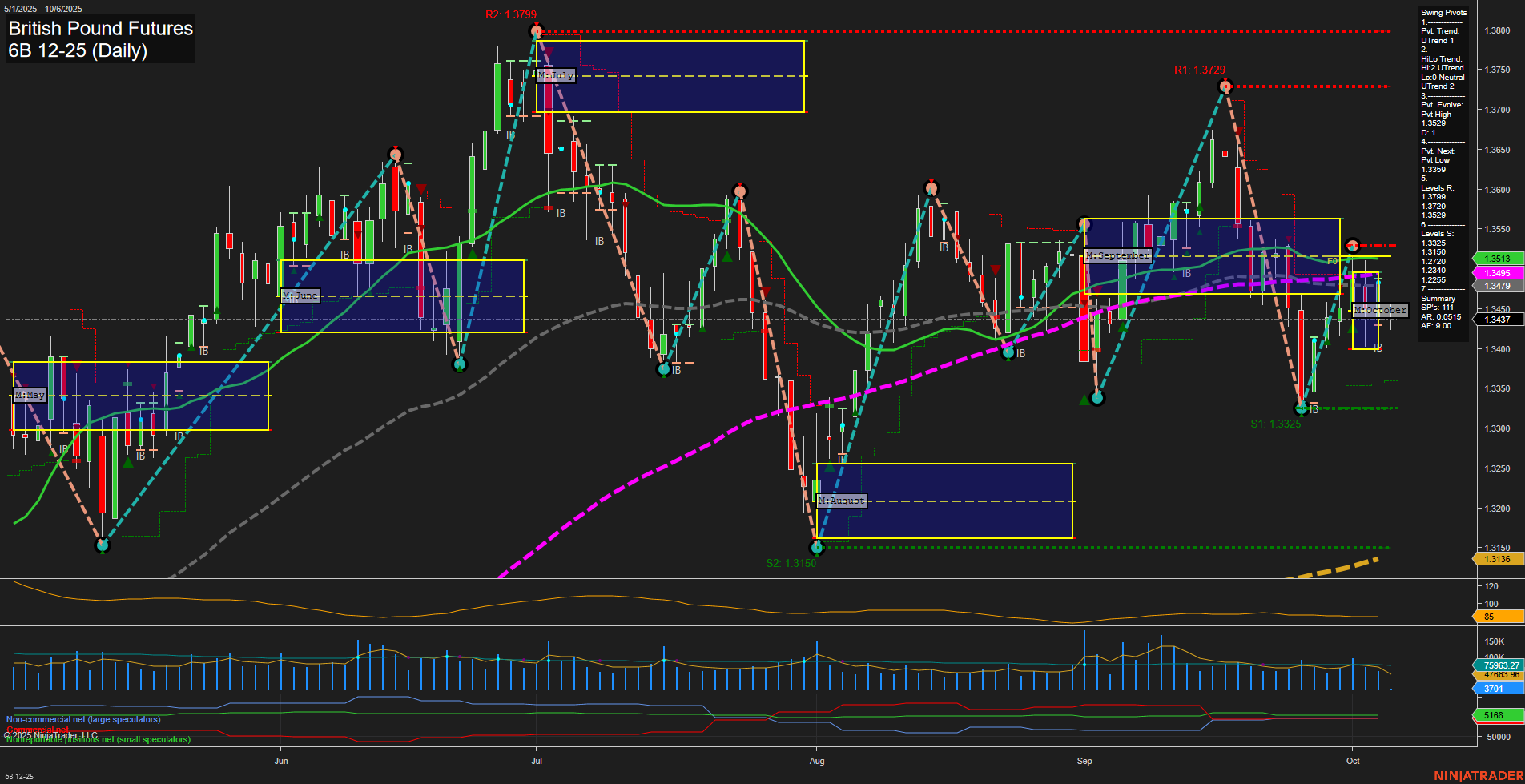

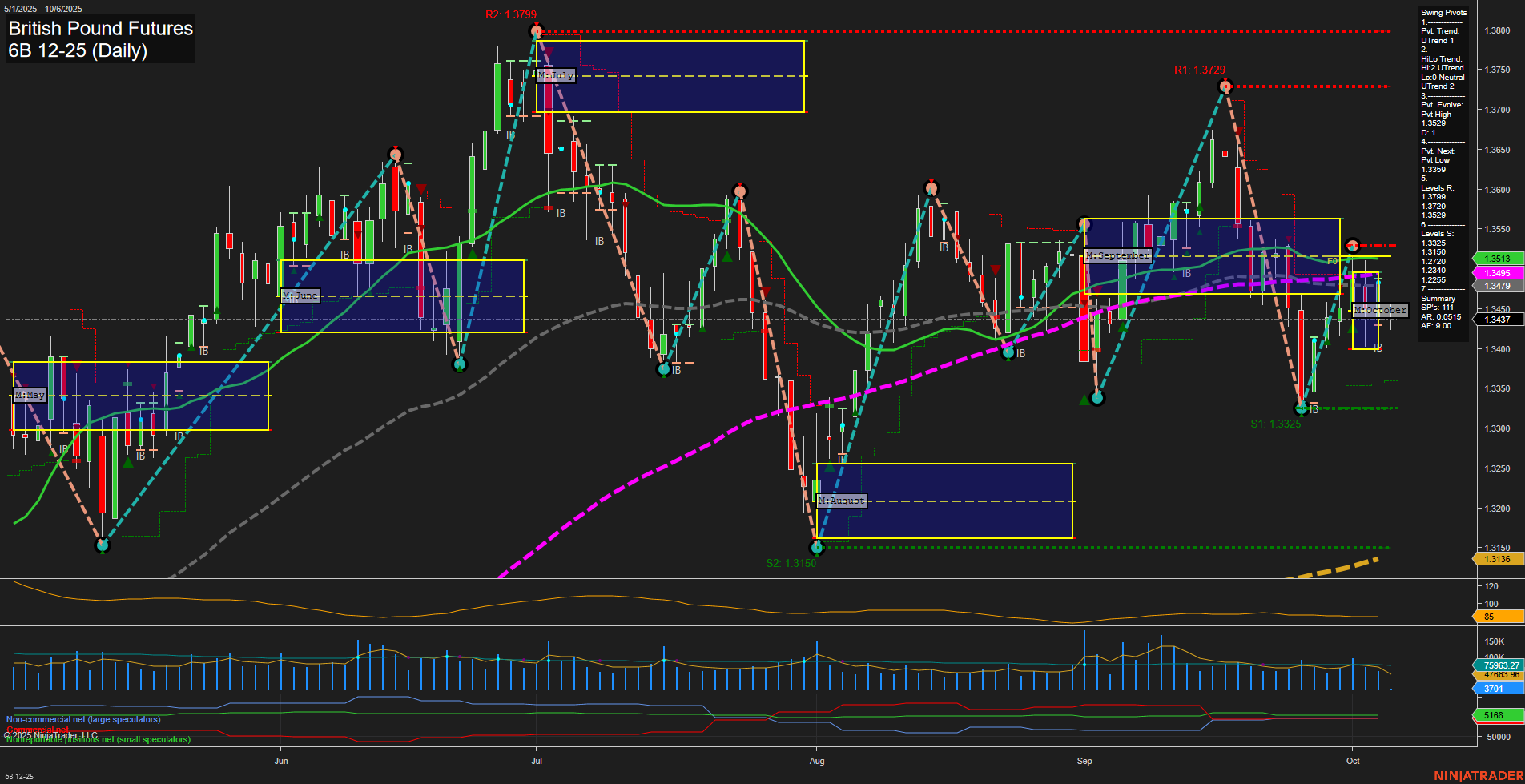

6B British Pound Futures Daily Chart Analysis: 2025-Oct-05 18:00 CT

Price Action

- Last: 1.3437,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: -28%

- F0%/NTZ' Bias: Price Below,

- WSFG Trend: Down.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: -1%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 48%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt High 1.3624,

- 4. Pvt. Next: Pvt Low 1.3325,

- 5. Levels R: 1.3624, 1.3539, 1.3479, 1.3449, 1.3372, 1.3240,

- 6. Levels S: 1.3325, 1.3136.

Daily Benchmarks

- (Short-Term) 5 Day: 1.3479 Down Trend,

- (Short-Term) 10 Day: 1.3449 Down Trend,

- (Intermediate-Term) 20 Day: 1.3513 Down Trend,

- (Intermediate-Term) 55 Day: 1.3495 Down Trend,

- (Long-Term) 100 Day: 1.3479 Down Trend,

- (Long-Term) 200 Day: 1.3437 Down Trend.

Additional Metrics

Recent Trade Signals

- 02 Oct 2025: Short 6B 12-25 @ 1.3422 Signals.USAR.TR120

- 02 Oct 2025: Long 6B 12-25 @ 1.3496 Signals.USAR-MSFG

- 01 Oct 2025: Long 6B 12-25 @ 1.3444 Signals.USAR-WSFG

Overall Rating

- Short-Term: Bearish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) daily chart shows a market in transition. Short-term price action is under pressure, with the last price at 1.3437 and all short-term and intermediate-term moving averages trending down, confirming a bearish short-term environment. The WSFG and MSFG both indicate price is below their respective NTZ/F0% levels, reinforcing the downward bias for the week and month. However, the intermediate-term HiLo Trend remains in an uptrend, suggesting underlying support and the potential for a reversal if buyers step in. The long-term YSFG trend is up, with price still above the annual NTZ, indicating the broader bullish structure remains intact. Swing pivots highlight a recent pivot high at 1.3624 and a next potential pivot low at 1.3325, with key resistance levels stacked above and support at 1.3325 and 1.3136. Volatility (ATR) and volume (VOLMA) are moderate, reflecting a market that is active but not extreme. Recent trade signals show mixed short and long entries, consistent with a choppy, corrective phase. Overall, the market is bearish short-term, neutral intermediate-term, and bullish long-term, with the potential for further downside testing before any sustained recovery.

Chart Analysis ATS AI Generated: 2025-10-05 18:01 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.