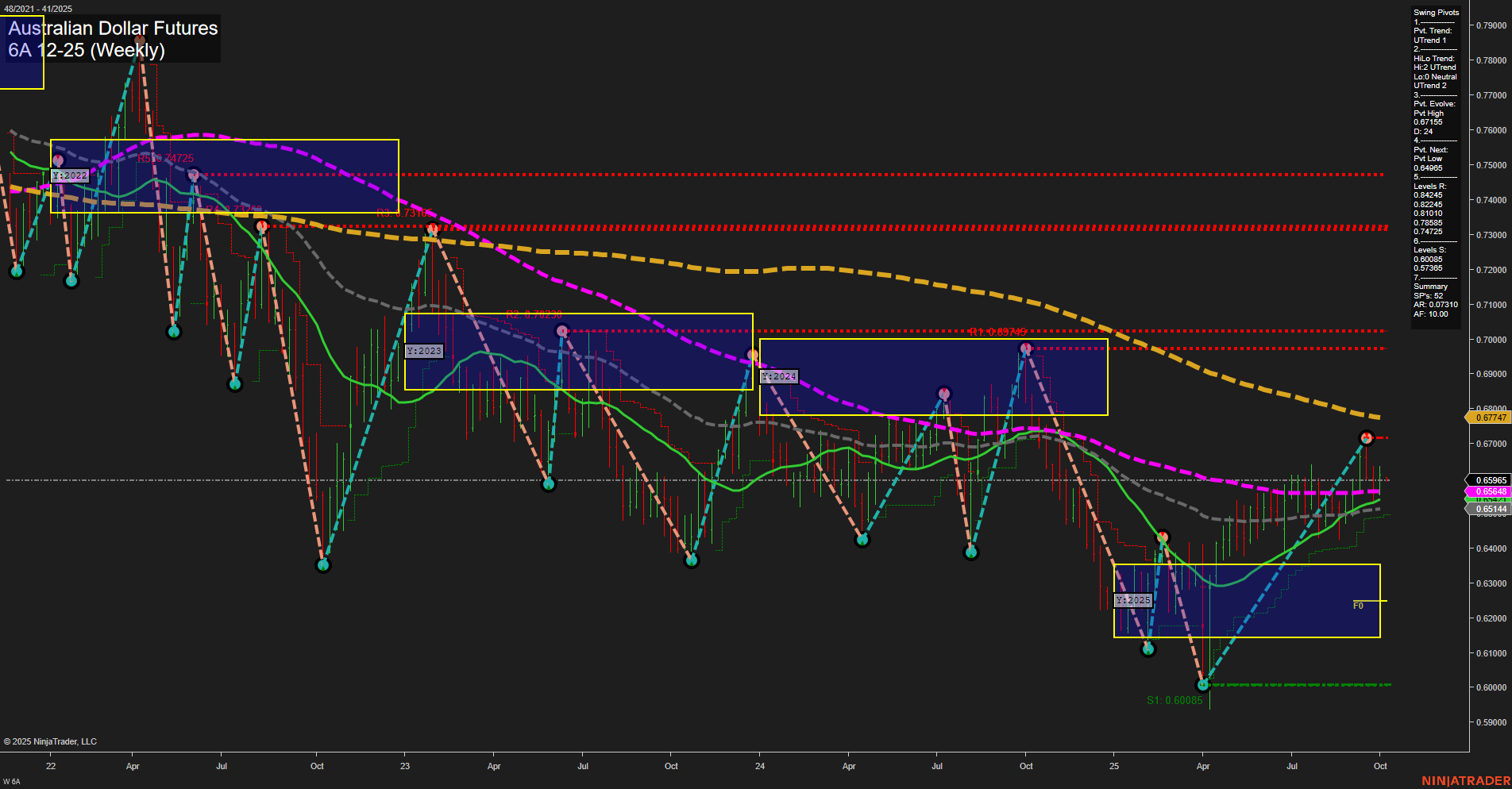

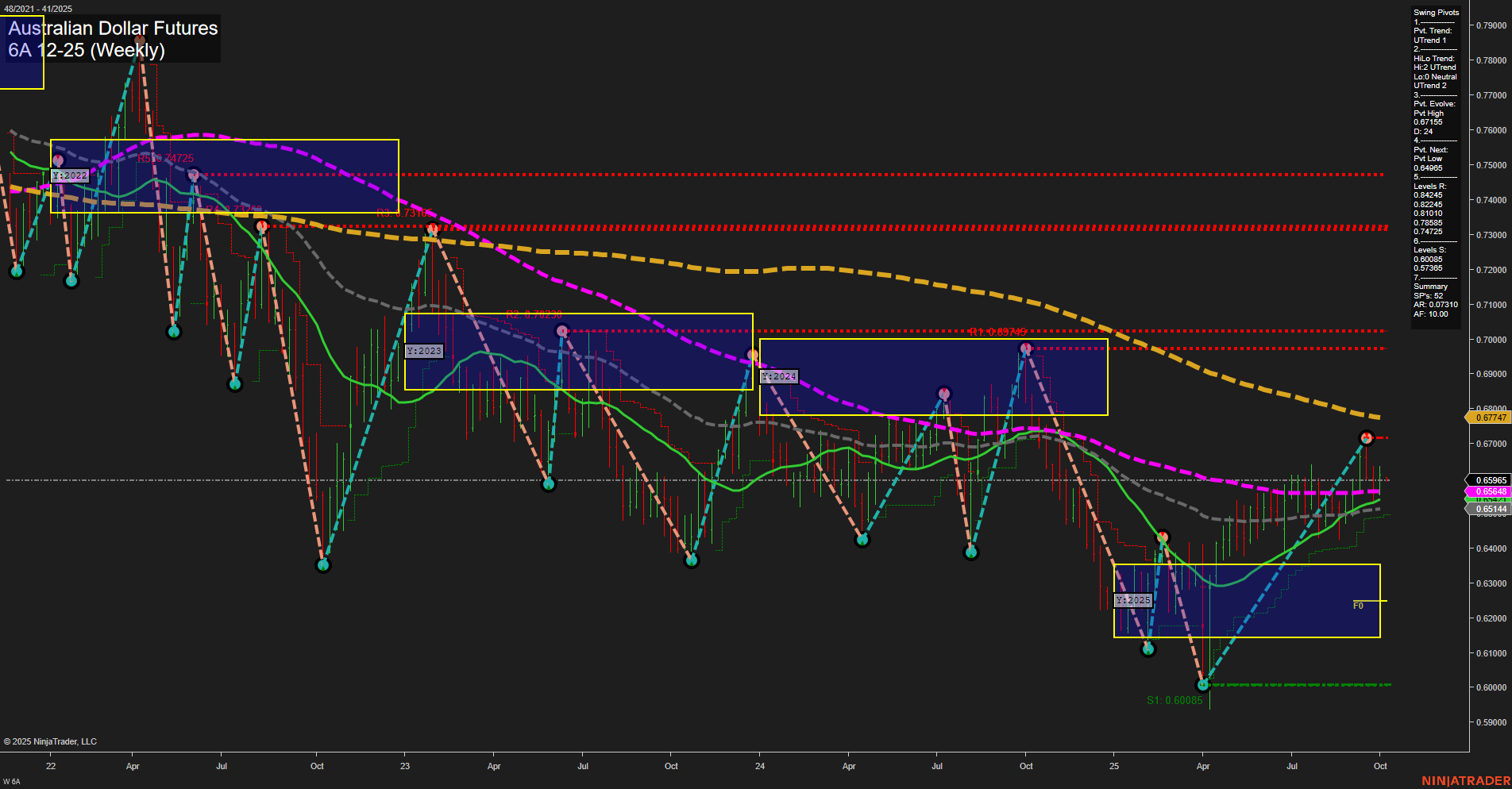

6A Australian Dollar Futures Weekly Chart Analysis: 2025-Oct-05 18:00 CT

Price Action

- Last: 0.66235,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Oct

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 0.67747,

- 4. Pvt. Next: Pvt low 0.60085,

- 5. Levels R: 0.67747, 0.69749, 0.74725,

- 6. Levels S: 0.65545, 0.65144, 0.60085.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 0.65545 Up Trend,

- (Intermediate-Term) 10 Week: 0.65144 Up Trend,

- (Long-Term) 20 Week: 0.65956 Up Trend,

- (Long-Term) 55 Week: 0.65455 Up Trend,

- (Long-Term) 100 Week: 0.65956 Down Trend,

- (Long-Term) 200 Week: 0.67747 Down Trend.

Recent Trade Signals

- 02 Oct 2025: Long 6A 12-25 @ 0.66235 Signals.USAR-MSFG

- 29 Sep 2025: Long 6A 12-25 @ 0.65735 Signals.USAR-WSFG

- 29 Sep 2025: Long 6A 12-25 @ 0.6577 Signals.USAR.TR120

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The 6A Australian Dollar Futures weekly chart shows a notable shift in momentum, with price action currently supported by a series of higher lows and a recent swing high at 0.67747. Both short-term and intermediate-term swing pivot trends are up, confirmed by recent long trade signals and upward-sloping 5, 10, 20, and 55-week moving averages. However, the long-term trend remains neutral, as the 100 and 200-week moving averages are still in a downtrend, indicating that the market is in a transitional phase. Price is consolidating just below major resistance at 0.67747, with support clustered around 0.65545 and 0.65144. The neutral bias across all session fib grids (weekly, monthly, yearly) suggests the market is pausing after a recovery rally, potentially awaiting a catalyst for a breakout or reversal. The overall structure hints at a possible base-building phase, with the potential for further upside if resistance is cleared, but long-term headwinds remain until higher time frame moving averages turn supportive.

Chart Analysis ATS AI Generated: 2025-10-05 18:00 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.