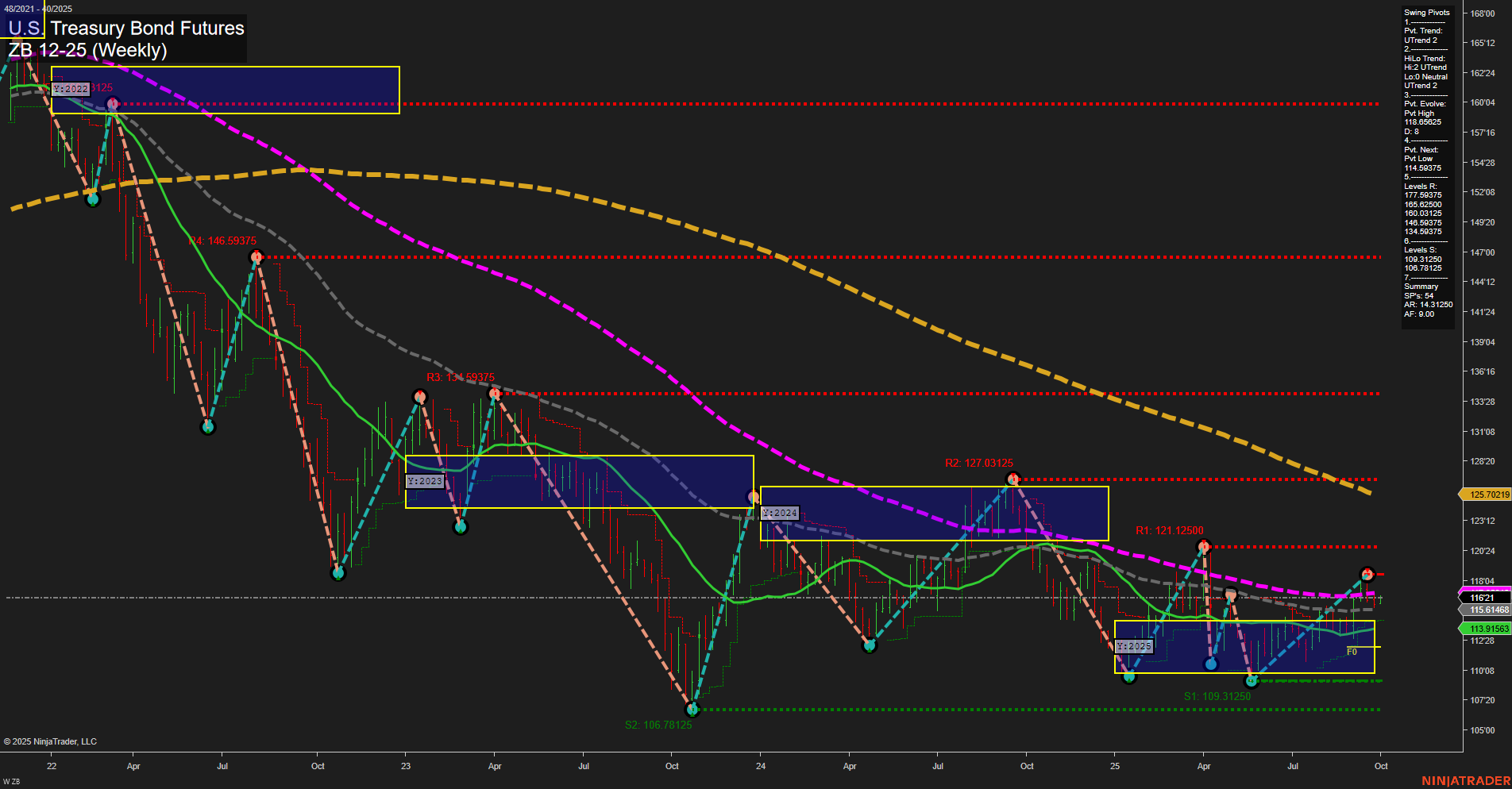

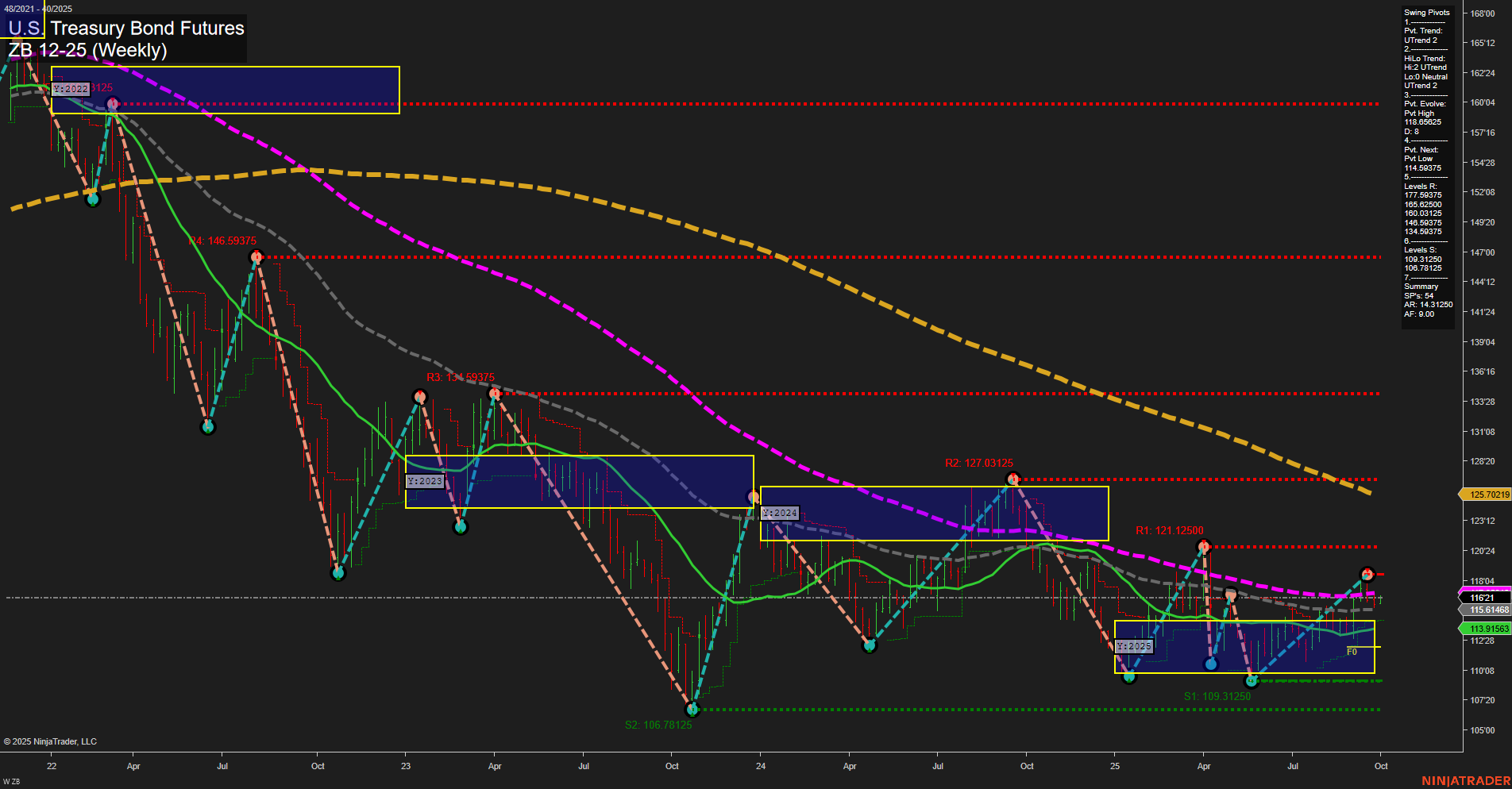

ZB U.S. Treasury Bond Futures Weekly Chart Analysis: 2025-Sep-29 07:22 CT

Price Action

- Last: 125.70219,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend 2,

- (Intermediate-Term) 2. HiLo Trend: UTrend 2,

- 3. Pvt. Evolve: Pvt high 118.09375,

- 4. Pvt. Next: Pvt low 114.09375,

- 5. Levels R: 146.59375, 134.59375, 127.03125, 121.12500,

- 6. Levels S: 109.31250, 106.78125, 100.78125.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 115.61468 Up Trend,

- (Intermediate-Term) 10 Week: 113.91563 Up Trend,

- (Long-Term) 20 Week: 118.094 Lime Green Up Trend,

- (Long-Term) 55 Week: 116.221 Dark Gray Up Trend,

- (Long-Term) 100 Week: 118.094 Magenta Down Trend,

- (Long-Term) 200 Week: 146.59375 Gold Down Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Neutral.

Key Insights Summary

The ZB U.S. Treasury Bond Futures weekly chart shows a notable shift in momentum, with both short-term and intermediate-term swing pivot trends now in an uptrend, supported by a series of higher lows and a recent pivot high at 118.09375. Price action has moved above key intermediate and long-term moving averages (5, 10, 20, and 55 week), all of which are trending upward, indicating a strengthening bullish bias in the medium-term. However, the 100 and 200 week moving averages remain in a downtrend, suggesting that the longer-term structure is still neutral and has not fully reversed from the prior bearish cycle. Resistance levels are stacked above at 121.12500, 127.03125, 134.59375, and 146.59375, while support is established at 109.31250 and 106.78125. The price is currently consolidating near the upper boundary of the NTZ (neutral zone), with no clear breakout yet, reflecting a market in transition. The overall environment is characterized by a recovery from previous lows, with the potential for further upside if resistance levels are breached, but the long-term trend remains cautious until a decisive move above the 100 and 200 week benchmarks occurs.

Chart Analysis ATS AI Generated: 2025-09-29 07:22 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.