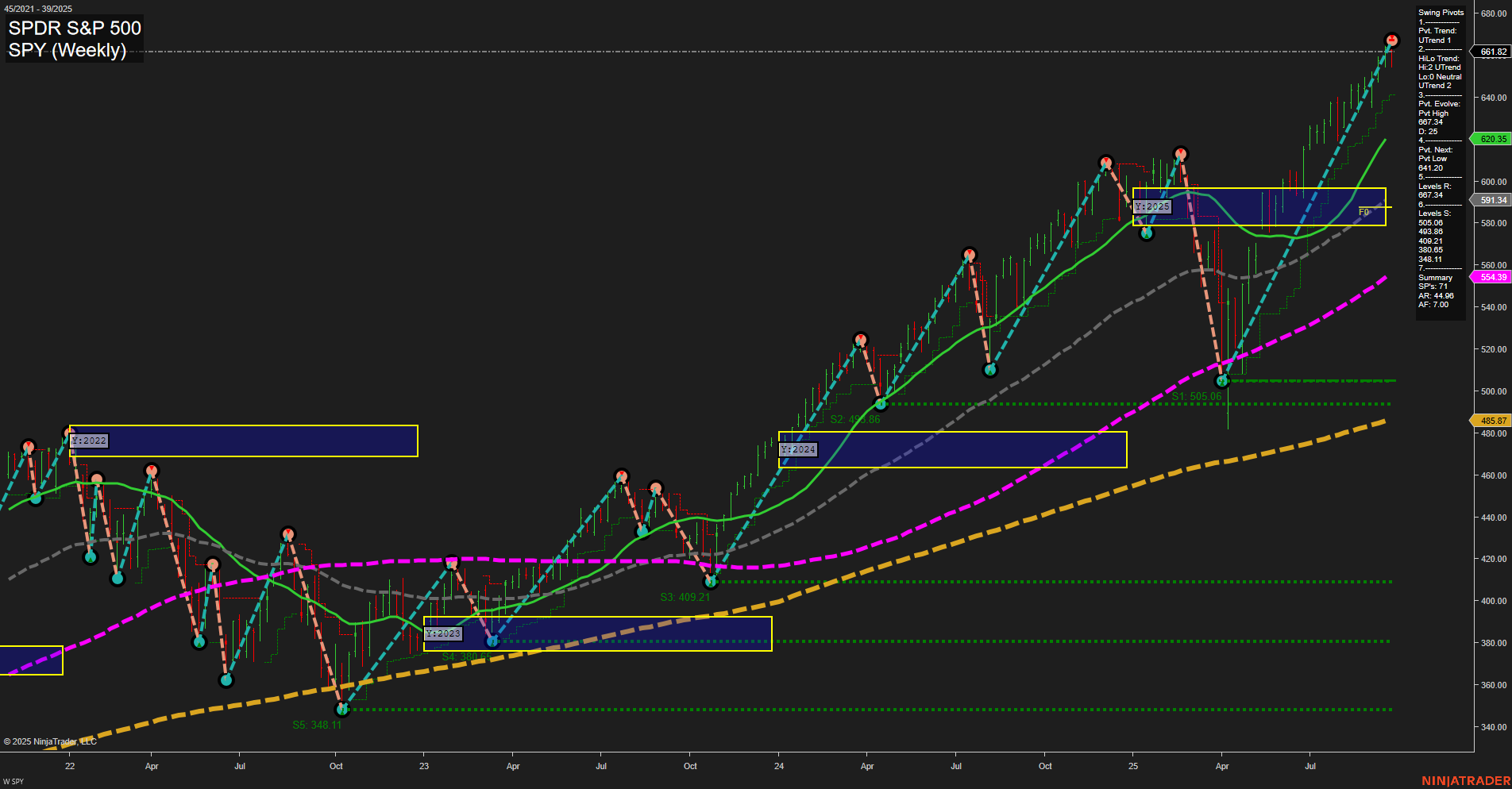

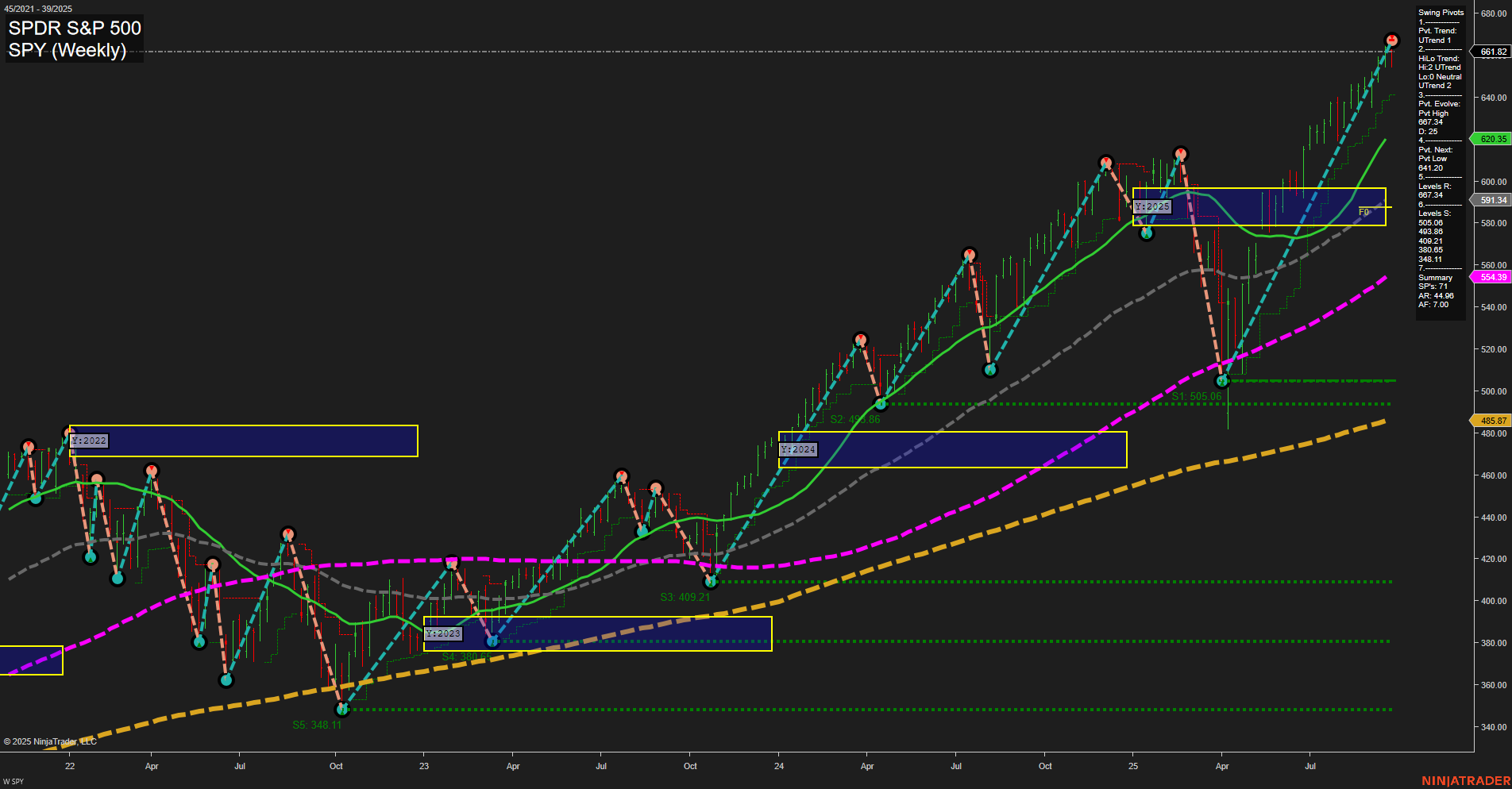

SPY SPDR S&P 500 Weekly Chart Analysis: 2025-Sep-29 07:19 CT

Price Action

- Last: 661.82,

- Bars: Large,

- Mom: Momentum fast.

WSFG Weekly

- Short-Term

- WSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- WSFG Trend: Neutral.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: NA%

- F0%/NTZ' Bias: Price Neutral,

- YSFG Trend: Neutral.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 661.82,

- 4. Pvt. Next: Pvt low 620.35,

- 5. Levels R: 661.82, 591.34, 567.41,

- 6. Levels S: 505.06, 409.21, 386.81, 380.25, 348.11.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: Not shown Up Trend,

- (Intermediate-Term) 10 Week: Not shown Up Trend,

- (Long-Term) 20 Week: 620.35 Up Trend,

- (Long-Term) 55 Week: 554.39 Up Trend,

- (Long-Term) 100 Week: 485.87 Up Trend,

- (Long-Term) 200 Week: 348.11 Up Trend.

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The SPY weekly chart is displaying a strong bullish structure across all timeframes, with price at new highs (661.82) and large, fast momentum bars confirming aggressive buying. All major swing pivot trends (short and intermediate) are in uptrends, and the most recent pivot is a new high, with the next key support at 620.35. Resistance levels are being set at new highs, while support levels remain well below current price, indicating a strong cushion for any pullbacks. All long-term moving averages (20, 55, 100, 200 week) are trending upward and well below price, reinforcing the dominant uptrend. The chart shows no immediate signs of reversal or exhaustion, and the price remains above all key benchmarks. The neutral bias in the Fib grids suggests price is not currently at a major inflection zone, allowing the trend to persist. Overall, the technical landscape is supportive of continued bullish momentum, with any retracements likely to be viewed as opportunities for trend continuation rather than reversal.

Chart Analysis ATS AI Generated: 2025-09-29 07:20 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.