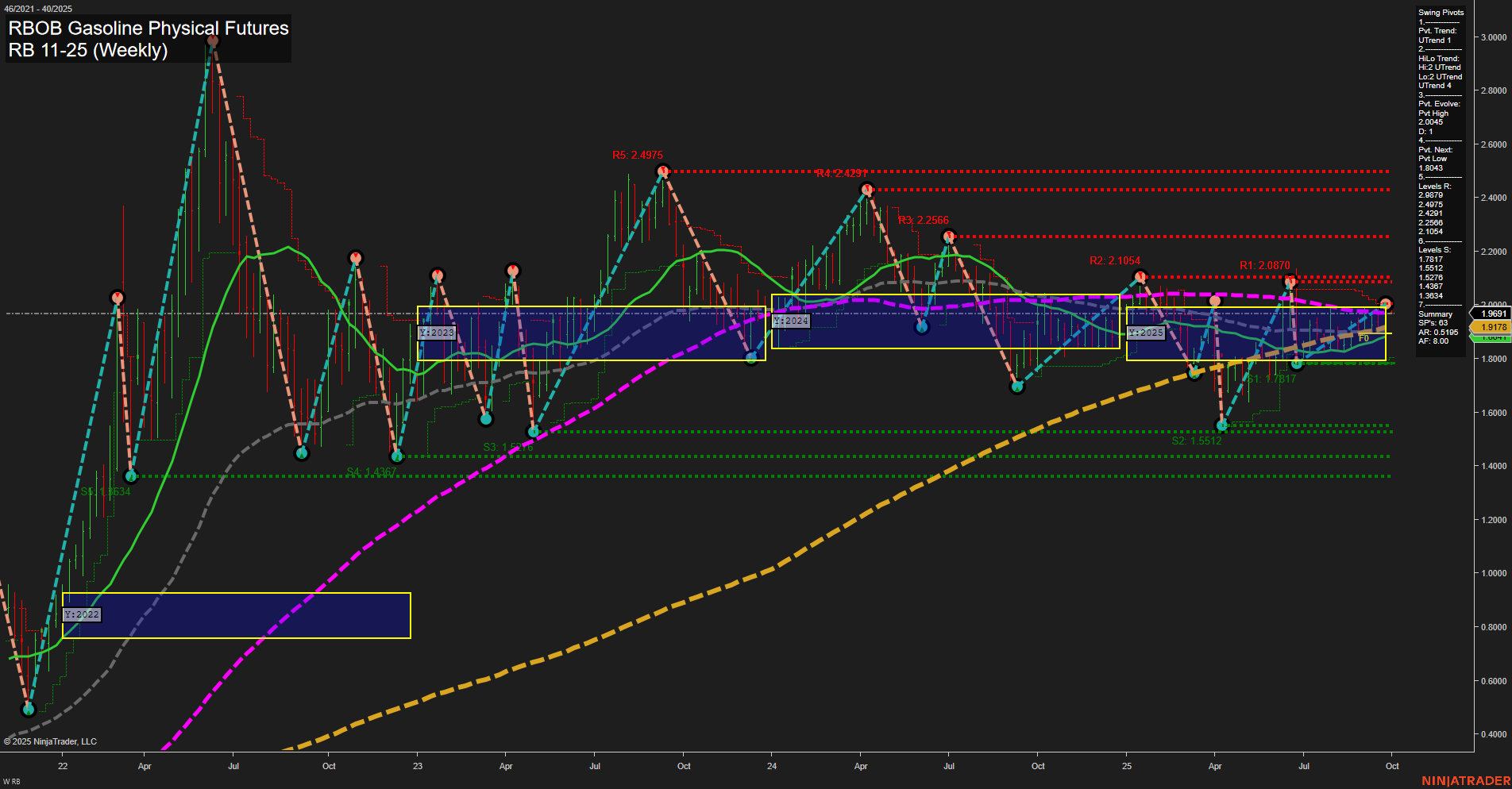

The RBOB Gasoline Physical Futures weekly chart shows a market in transition. Price action is currently near the 2.00 level, with medium-sized bars and average momentum, indicating neither strong acceleration nor significant weakness. The short-term WSFG trend is down, with price just below the NTZ center, suggesting some recent pressure or consolidation. However, both the intermediate (MSFG) and long-term (YSFG) session fib grid trends are up, with price above their respective NTZ centers, reflecting underlying bullish structure. Swing pivot analysis confirms an uptrend in both short- and intermediate-term metrics, with the most recent pivot high at 2.0451 and the next key support at 1.8043. Resistance levels are stacked above, with the nearest at 2.0870 and 2.1054, while support is well-defined below. All benchmark moving averages (from 5 to 200 weeks) are aligned in an uptrend and clustered near the current price, reinforcing a strong underlying trend and suggesting a period of consolidation or base-building. Recent trade signals have triggered long entries, aligning with the intermediate and long-term bullish bias. Overall, the short-term outlook is neutral due to the recent WSFG downtrend and price just below the NTZ, but the intermediate and long-term perspectives remain bullish, supported by trend structure, moving averages, and swing pivots. The market appears to be in a consolidation phase within a broader uptrend, with potential for renewed upside if resistance levels are overcome.