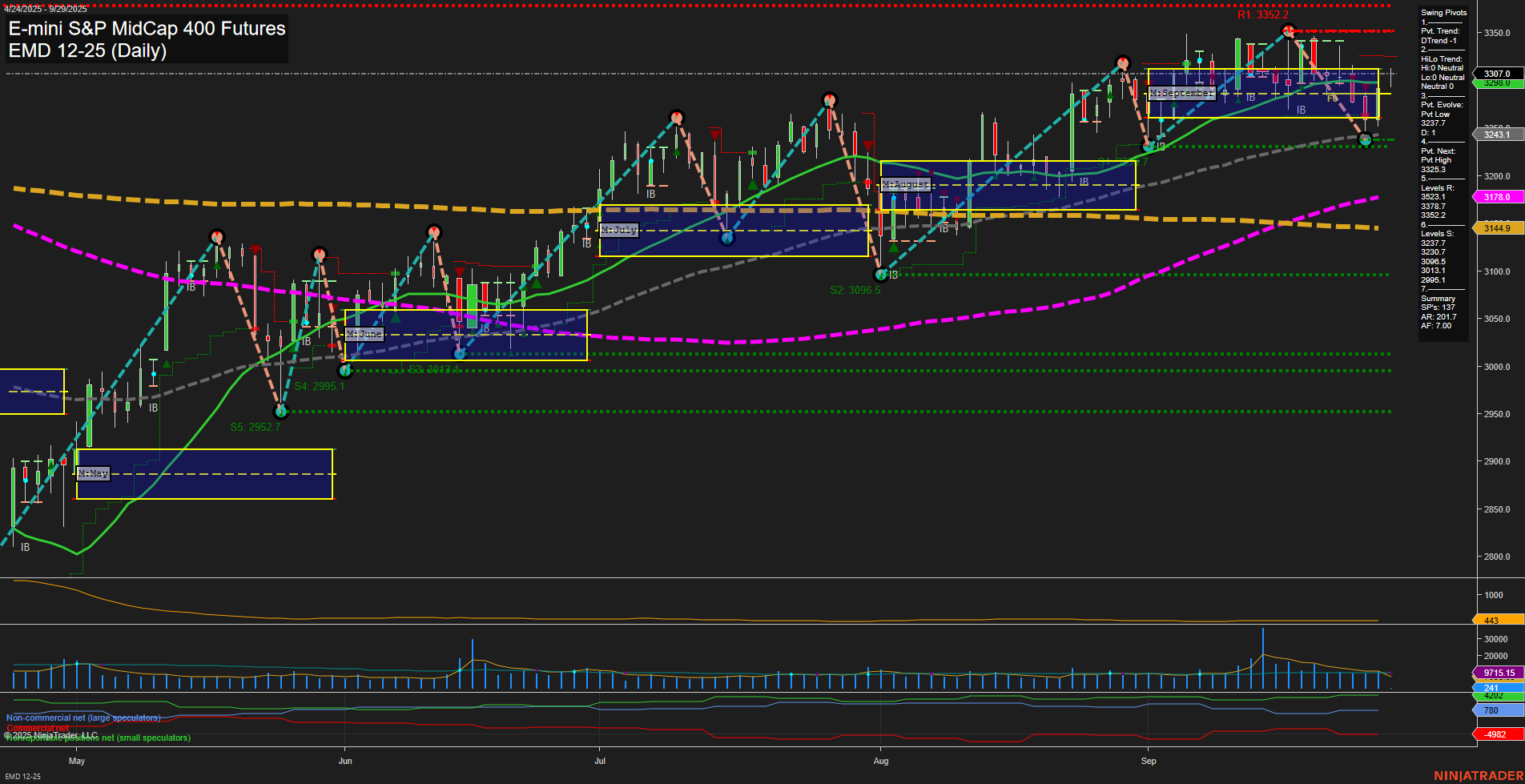

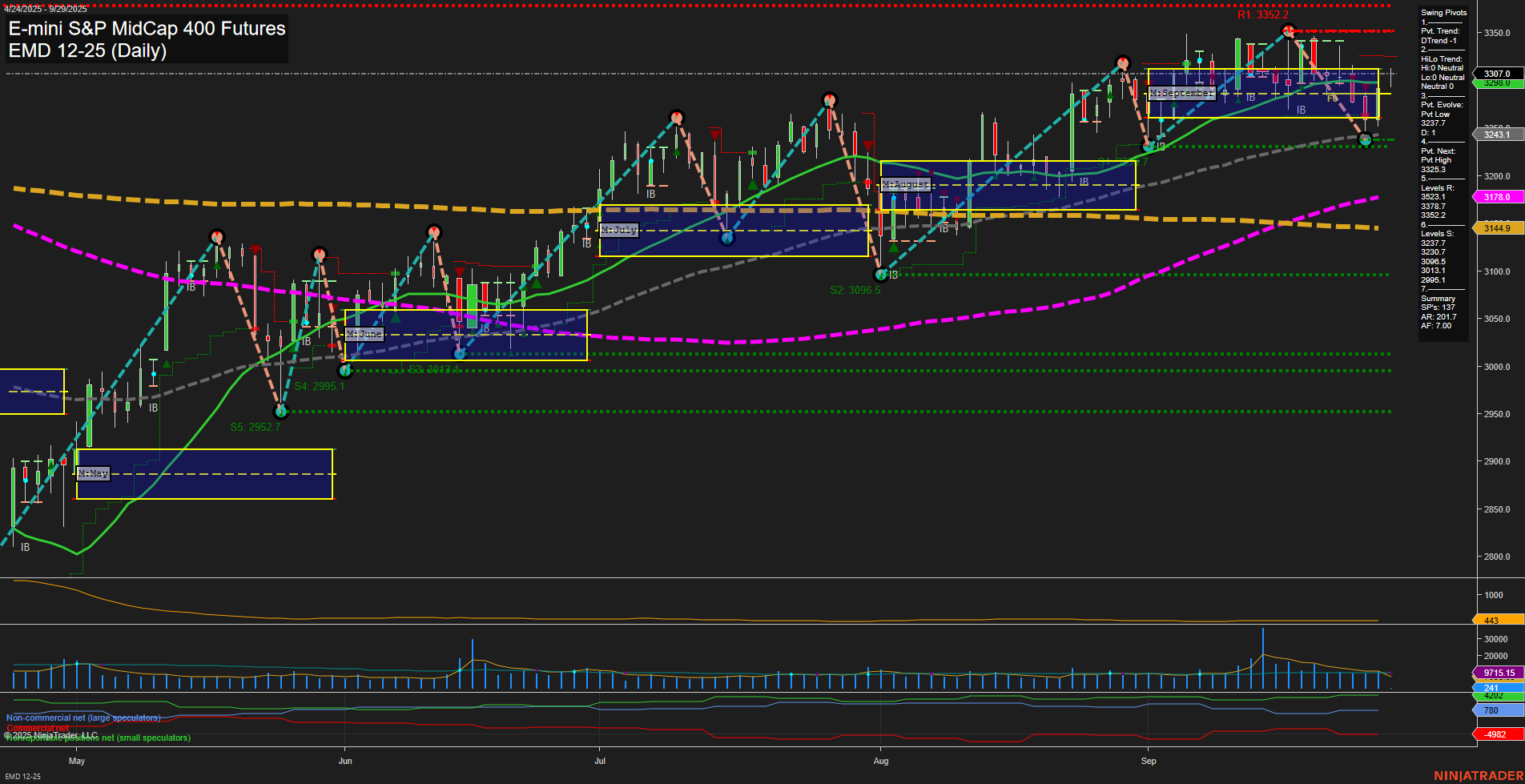

EMD E-mini S&P MidCap 400 Futures Daily Chart Analysis: 2025-Sep-29 07:07 CT

Price Action

- Last: 3307.0,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- MSFG Trend: Up.

YSFG Year 2025

- Long-Term

- YSFG Current: 15%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt Low 3243.1,

- 4. Pvt. Next: Pvt High 3325.3,

- 5. Levels R: 3352.2, 3325.3, 3243.1,

- 6. Levels S: 3237.7, 3096.5, 3011.3, 2995.1, 2952.7.

Daily Benchmarks

- (Short-Term) 5 Day: 3327.7 Down Trend,

- (Short-Term) 10 Day: 3308.6 Down Trend,

- (Intermediate-Term) 20 Day: 3244.2 Up Trend,

- (Intermediate-Term) 55 Day: 3178.0 Up Trend,

- (Long-Term) 100 Day: 3144.9 Up Trend,

- (Long-Term) 200 Day: 3378.2 Down Trend.

Additional Metrics

Recent Trade Signals

- 26 Sep 2025: Long EMD 12-25 @ 3278.1 Signals.USAR.TR120

- 26 Sep 2025: Short EMD 12-25 @ 3255.4 Signals.USAR-MSFG

- 22 Sep 2025: Short EMD 12-25 @ 3298.6 Signals.USAR-WSFG

Overall Rating

- Short-Term: Neutral,

- Intermediate-Term: Bullish,

- Long-Term: Bullish.

Key Insights Summary

The EMD futures daily chart shows a market in a broad uptrend on both intermediate and long-term timeframes, with price holding above key monthly and yearly session fib grid levels. However, short-term momentum has shifted to a downtrend, as indicated by the most recent swing pivot and both the 5-day and 10-day moving averages turning lower. The last price is consolidating just above a recent swing low support (3243.1), with resistance overhead at 3325.3 and 3352.2. Volatility remains moderate (ATR 443), and volume has pulled back from recent spikes. The market has seen mixed short-term trade signals, reflecting a choppy environment with both long and short entries in the past week. Overall, the structure suggests a healthy uptrend on larger timeframes, but with short-term corrective action or consolidation underway. Swing traders may observe for a resolution of this short-term pullback, with attention to whether support at 3243.1 holds or if a new push toward resistance levels develops.

Chart Analysis ATS AI Generated: 2025-09-29 07:07 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.