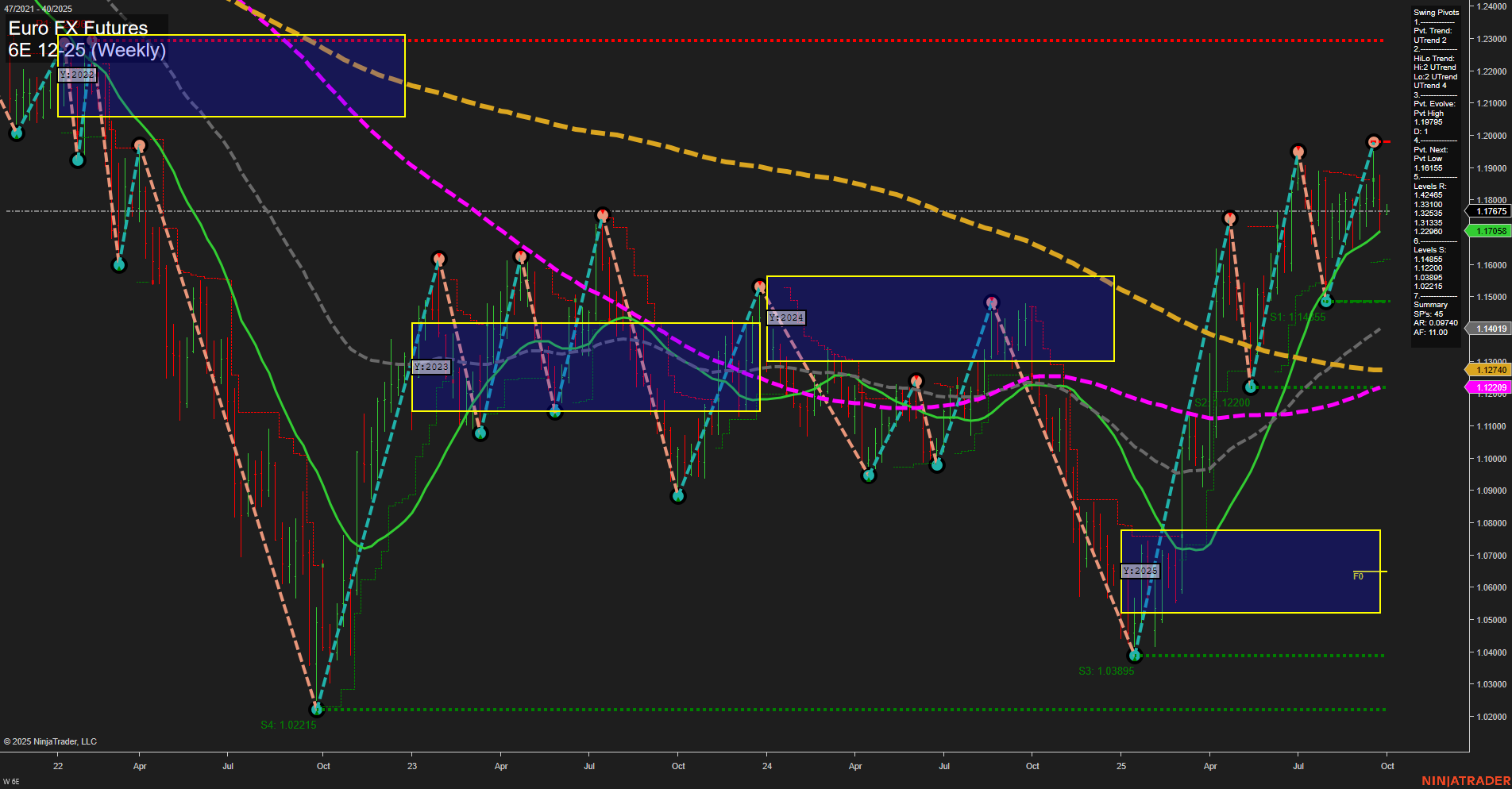

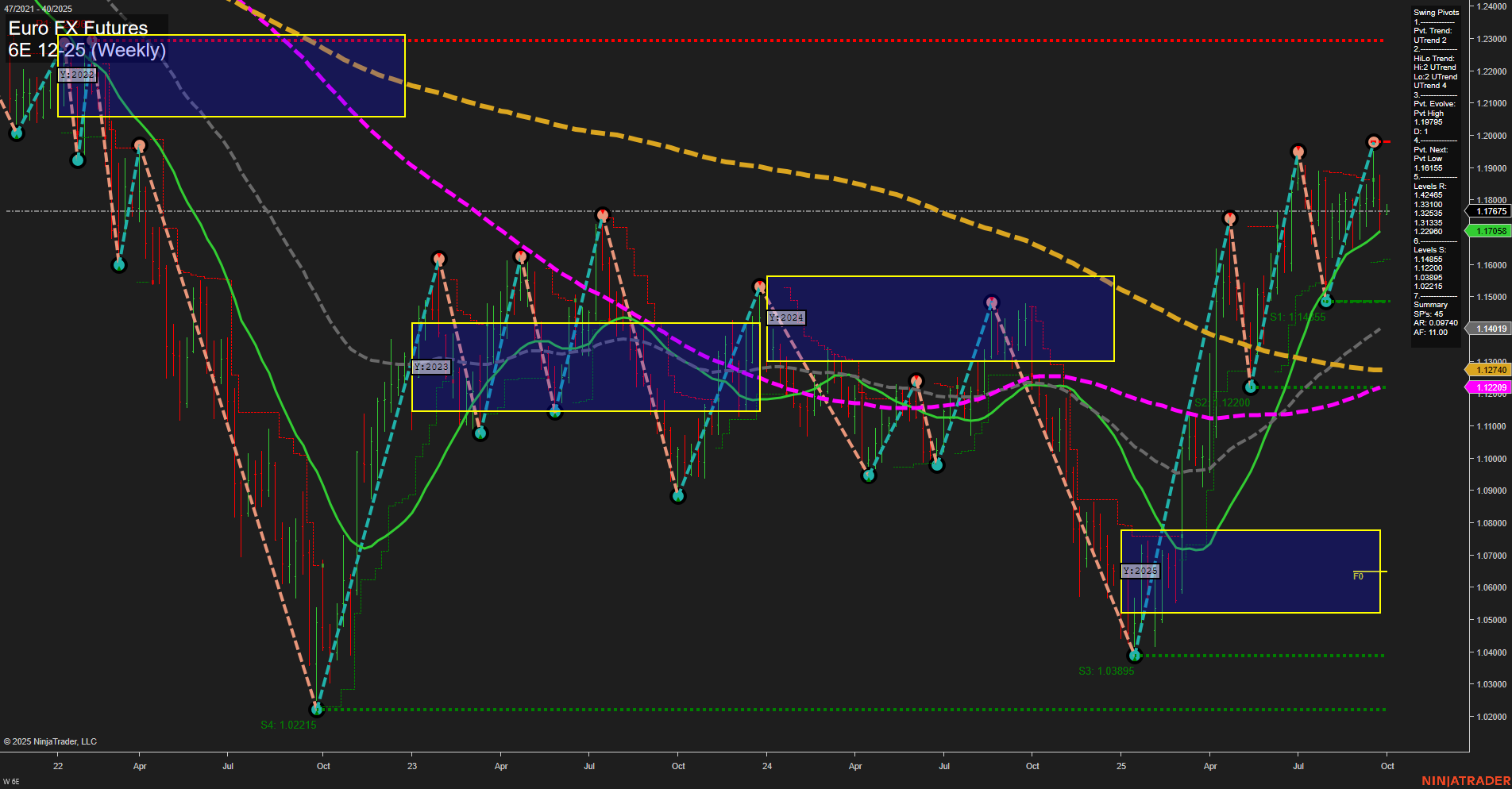

6E Euro FX Futures Weekly Chart Analysis: 2025-Sep-29 07:02 CT

Price Action

- Last: 1.17765,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: 89%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1.19155,

- 4. Pvt. Next: Pvt low 1.11455,

- 5. Levels R: 1.19155, 1.18825, 1.13285,

- 6. Levels S: 1.11455, 1.03895, 1.02215.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.17058 Up Trend,

- (Intermediate-Term) 10 Week: 1.15705 Up Trend,

- (Long-Term) 20 Week: 1.15019 Up Trend,

- (Long-Term) 55 Week: 1.12740 Up Trend,

- (Long-Term) 100 Week: 1.12920 Down Trend,

- (Long-Term) 200 Week: 1.17290 Down Trend.

Recent Trade Signals

- 29 Sep 2025: Long 6E 12-25 @ 1.1772 Signals.USAR-WSFG

- 29 Sep 2025: Long 6E 12-25 @ 1.17745 Signals.USAR.TR120

- 26 Sep 2025: Short 6E 12-25 @ 1.1729 Signals.USAR-MSFG

- 25 Sep 2025: Short 6E 12-25 @ 1.1726 Signals.USAR.TR720

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Neutral,

- Long-Term: Bullish.

Key Insights Summary

The 6E Euro FX Futures weekly chart shows a constructive technical structure, with price action currently above key short- and long-term Fibonacci grid levels. The short-term trend is bullish, supported by upward momentum and recent long signals, while the intermediate-term trend is neutral, reflecting some consolidation and mixed signals. Long-term structure remains bullish, with price above the yearly NTZ and most major moving averages trending up, except for the 100- and 200-week MAs, which are still lagging. Swing pivots confirm an uptrend with higher highs and higher lows, and resistance is seen near 1.19155, with support at 1.11455. The market has recently bounced from a significant low, showing a V-shaped recovery and continuation pattern, with the potential for further upside if resistance levels are cleared. Overall, the chart reflects a market in transition from consolidation to a possible sustained uptrend, with volatility and pullbacks likely as it tests overhead resistance.

Chart Analysis ATS AI Generated: 2025-09-29 07:03 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.