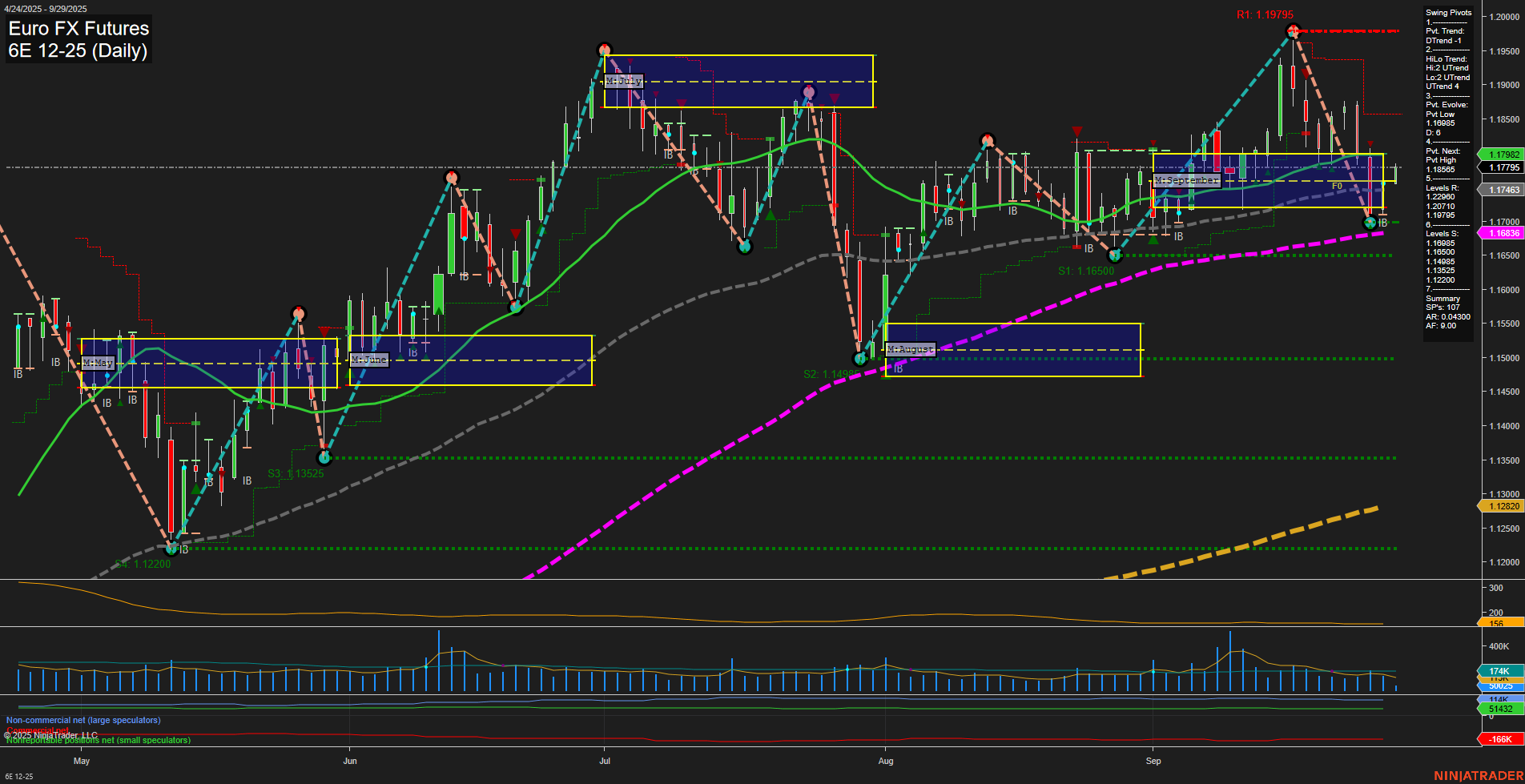

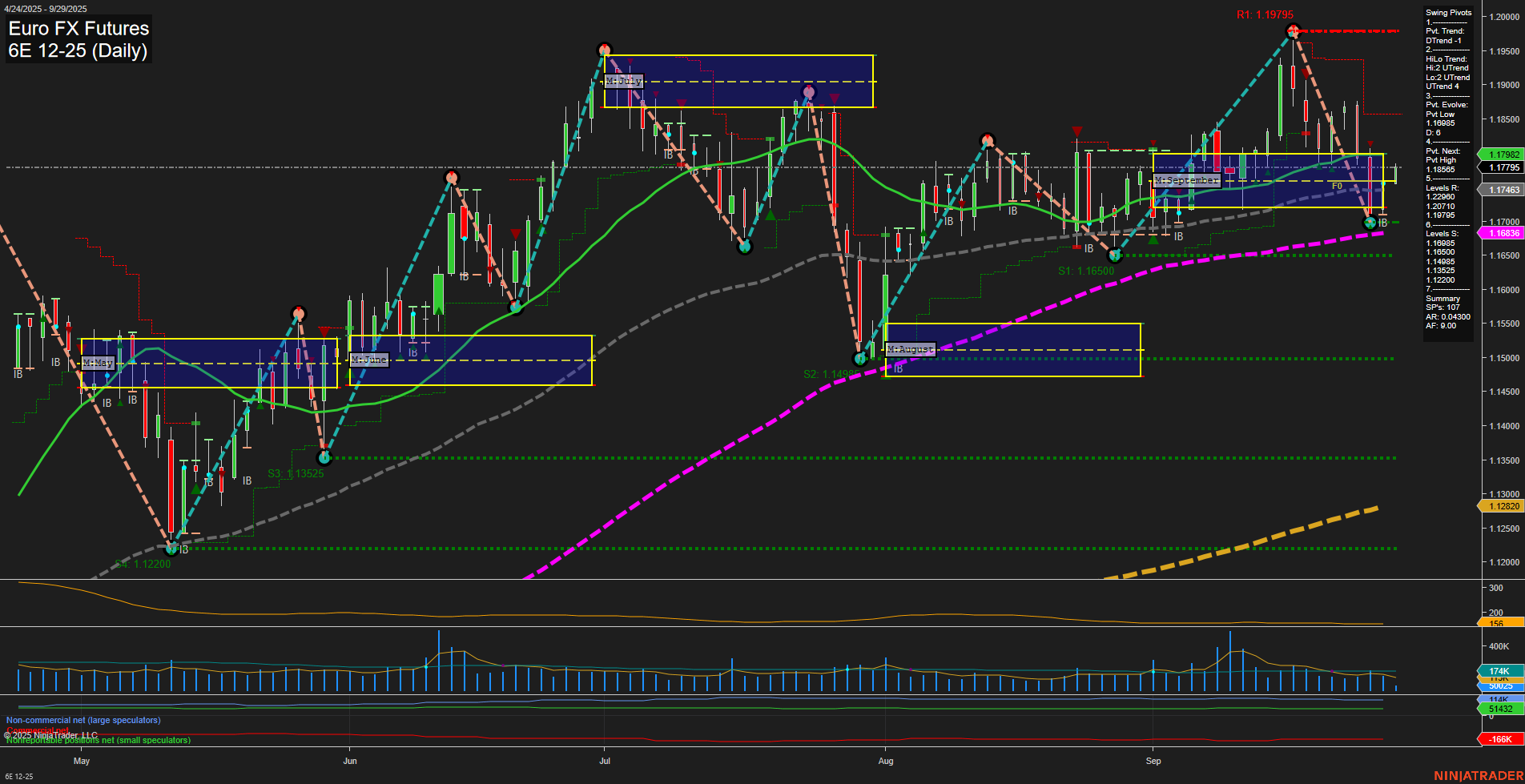

6E Euro FX Futures Daily Chart Analysis: 2025-Sep-29 07:02 CT

Price Action

- Last: 1.17795,

- Bars: Medium,

- Mom: Average.

WSFG Weekly

- Short-Term

- WSFG Current: 16%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: 0%

- F0%/NTZ' Bias: Price Neutral,

- MSFG Trend: Neutral.

YSFG Year 2025

- Long-Term

- YSFG Current: 89%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: DTrend,

- (Intermediate-Term) 2. HiLo Trend: UTrend,

- 3. Pvt. Evolve: Pvt high 1.19795,

- 4. Pvt. Next: Pvt low 1.1686,

- 5. Levels R: 1.19795, 1.18865, 1.18210, 1.17945, 1.17463,

- 6. Levels S: 1.1686, 1.16505, 1.15325, 1.1495, 1.13225, 1.1220.

Daily Benchmarks

- (Short-Term) 5 Day: 1.17932 Down Trend,

- (Short-Term) 10 Day: 1.18565 Down Trend,

- (Intermediate-Term) 20 Day: 1.17463 Up Trend,

- (Intermediate-Term) 55 Day: 1.16636 Up Trend,

- (Long-Term) 100 Day: 1.15325 Up Trend,

- (Long-Term) 200 Day: 1.12820 Up Trend.

Additional Metrics

Recent Trade Signals

- 29 Sep 2025: Long 6E 12-25 @ 1.1772 Signals.USAR-WSFG

- 29 Sep 2025: Long 6E 12-25 @ 1.17745 Signals.USAR.TR120

- 26 Sep 2025: Short 6E 12-25 @ 1.1729 Signals.USAR-MSFG

- 25 Sep 2025: Short 6E 12-25 @ 1.1726 Signals.USAR.TR720

Overall Rating

- Short-Term: Neutral

- Intermediate-Term: Bullish

- Long-Term: Bullish

Key Insights Summary

The 6E Euro FX Futures daily chart shows a market in transition. Price action is currently consolidating near 1.178, with medium-sized bars and average momentum, reflecting a pause after a recent swing high at 1.19795. The short-term trend has shifted to a downtrend, as indicated by the latest swing pivot and both the 5-day and 10-day moving averages turning down. However, the intermediate and long-term trends remain bullish, supported by the 20, 55, 100, and 200-day moving averages all trending higher and price holding above key yearly and weekly session fib grid levels.

Swing structure highlights a recent pivot high, with the next key support at 1.1686 and resistance at 1.17945 and above. The market is currently testing the lower boundary of the monthly session fib grid, suggesting a neutral stance for the month, but the broader context remains constructive. Recent trade signals show mixed short-term direction but a bias toward long entries at current levels, reflecting the underlying strength in the higher timeframes.

Volatility (ATR) and volume (VOLMA) are moderate, indicating a balanced environment without excessive froth or panic. The overall setup suggests the market is digesting gains from the recent rally, with potential for further upside if support holds and momentum returns. The structure favors watching for a resolution of this consolidation, with the long-term uptrend still intact.

Chart Analysis ATS AI Generated: 2025-09-29 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.