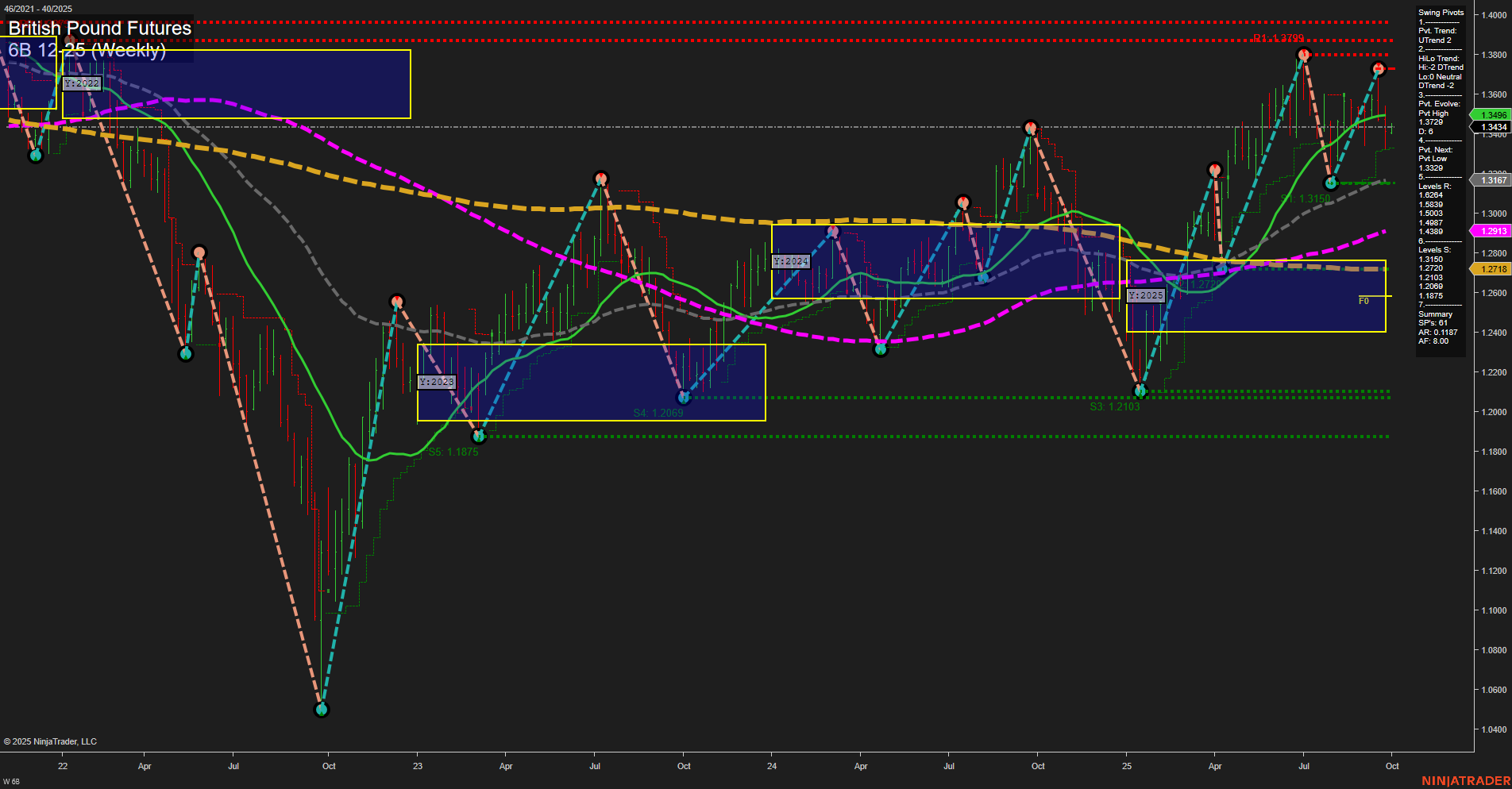

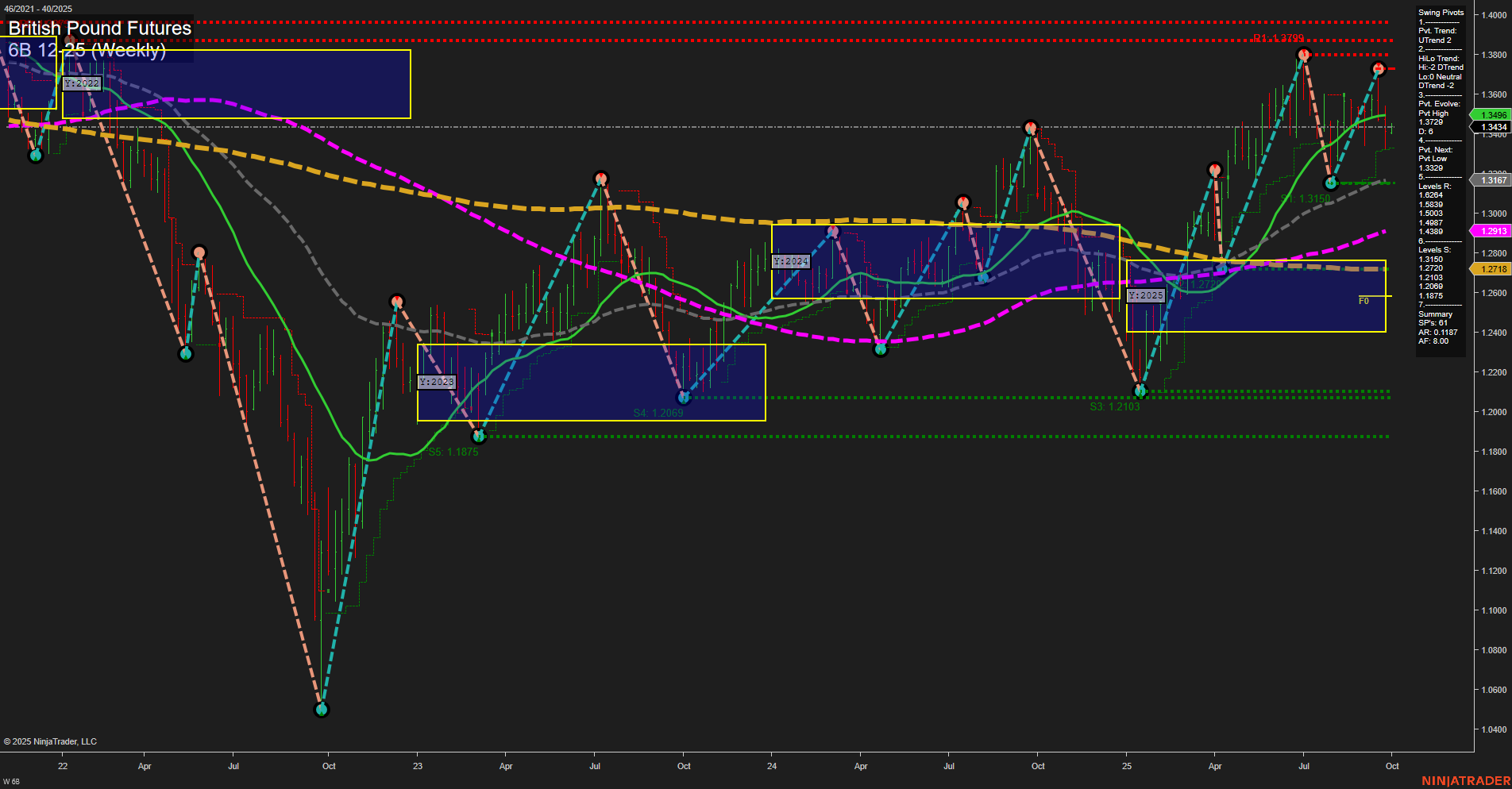

6B British Pound Futures Weekly Chart Analysis: 2025-Sep-29 07:01 CT

Price Action

- Last: 1.3443,

- Bars: Medium,

- Mom: Momentum average.

WSFG Weekly

- Short-Term

- WSFG Current: 22%

- F0%/NTZ' Bias: Price Above,

- WSFG Trend: Up.

MSFG Month Sep

- Intermediate-Term

- MSFG Current: -16%

- F0%/NTZ' Bias: Price Below,

- MSFG Trend: Down.

YSFG Year 2025

- Long-Term

- YSFG Current: 48%

- F0%/NTZ' Bias: Price Above,

- YSFG Trend: Up.

Swing Pivots

- (Short-Term) 1. Pvt. Trend: UTrend,

- (Intermediate-Term) 2. HiLo Trend: DTrend,

- 3. Pvt. Evolve: Pvt high 1.3784,

- 4. Pvt. Next: Pvt low 1.3234,

- 5. Levels R: 1.3784, 1.3799,

- 6. Levels S: 1.3234, 1.3159, 1.2069, 1.2103, 1.1875.

Weekly Benchmarks

- (Intermediate-Term) 5 Week: 1.3317 Up Trend,

- (Intermediate-Term) 10 Week: 1.3191 Up Trend,

- (Long-Term) 20 Week: 1.3090 Up Trend,

- (Long-Term) 55 Week: 1.2718 Up Trend,

- (Long-Term) 100 Week: 1.2975 Up Trend,

- (Long-Term) 200 Week: 1.2718 Up Trend.

Recent Trade Signals

- 26 Sep 2025: Long 6B 12-25 @ 1.3407 Signals.USAR.TR120

- 25 Sep 2025: Short 6B 12-25 @ 1.344 Signals.USAR-WSFG

- 25 Sep 2025: Short 6B 12-25 @ 1.3456 Signals.USAR-MSFG

Overall Rating

- Short-Term: Bullish,

- Intermediate-Term: Bearish,

- Long-Term: Bullish.

Key Insights Summary

The British Pound Futures (6B) weekly chart shows a market in transition, with mixed signals across timeframes. Price action is currently above key short- and long-term Fibonacci grid levels, supported by a series of higher lows and an average momentum profile. The short-term trend is bullish, as confirmed by the upward WSFG and recent long signal, while the intermediate-term trend remains bearish, with the MSFG and HiLo swing pivot trends pointing down and recent short signals reflecting this. Long-term structure is constructive, with the YSFG trend up and all major moving averages trending higher, indicating underlying strength. Resistance is clustered near 1.3784–1.3799, while support is layered at 1.3234 and below, suggesting a broad trading range. The market is currently navigating a pullback within a larger uptrend, with potential for further consolidation or a retest of recent highs if buyers maintain control. Volatility remains moderate, and the interplay between short-term bullishness and intermediate-term weakness will be key for swing traders monitoring for trend continuation or reversal setups.

Chart Analysis ATS AI Generated: 2025-09-29 07:02 for Informational use only, not trading advice. Terms and Risk Disclosure Copyright © 2025. Algo Trading Systems LLC.